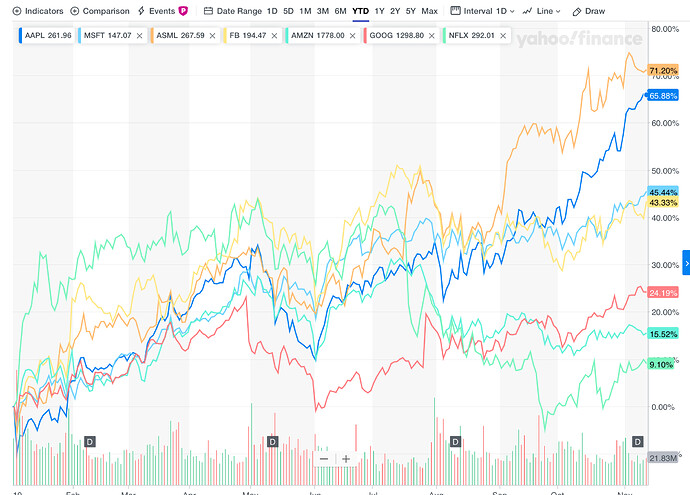

@manch favorite $1T potentials, AMZN and FB, are not anywhere close ![]()

That’s why now is a good time investing in those two. Ride the  on their way up.

on their way up.

Do not tell him the secret !!

Since Aug 28, 2017,

AMZN +88.78%

NFLX +74.47%

AAPL +61.11%

GOOG +43.51%

FB +14.11%

FAANG +56.21%

Last Nov 2018,

Why is CNBC repeating what I have said? And post the same graph too!

Jim said buy MSFT, BABA and WDAY. I have 400 BABAs and 10 WDAY.

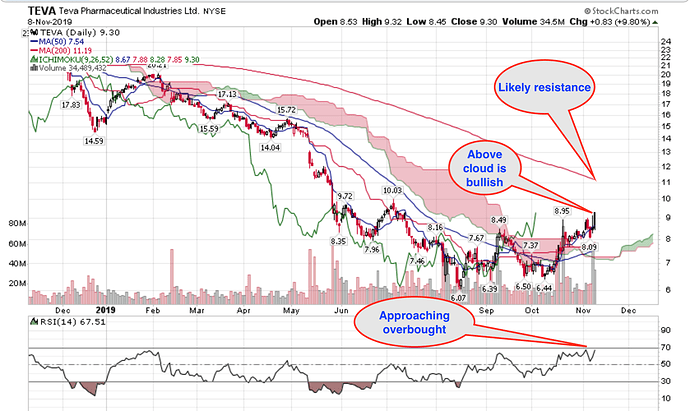

Offline conversation: Look out TEVA bottomed, buy some tiny and hold long, if you are comfortable.

Why Bezos is the richest person in the world. Watch the video in the tweet.

Ytd gain of old tech AAPL MSFT ASML beats gains of FANG.

Should You Buy or Sell the 5 FAANG Stocks?

BUY: FB, AAPL, AMZN

Hold: GOOG

Sell: NFLX

Since Aug 28, 2017,

AMZN +83.87%

NFLX +76.54%

AAPL +64.59%

GOOG +46.08%

FB +16.66%

FAANG +57.39%

That’s when 10x stocks were picked.

VEEV 253%

NTNX 147%

SHOP 316%

UI 323%

I need to do that screen again for new ideas.

Deserve an update ![]()

Since Aug 28, 2017,

NFLX +103.25%

AAPL +97.39% Finally ahead of AMZN ![]()

AMZN +97.11%

GOOG +62.00%

FB +32.83%

FAANG +78.46%

So far, investing in FAANG since Aug 28 2017 (is not a cherry picked date) is inferior to the few 10x stocks that @marcus335 chose.

.

Excellent choices…

My Qn is what is the combined Beta on those stocks as compared to FAANG?

Their beta should be higher since the market is up, and they are up by a much higher percentage. They’re also up by a higher percentage than FAANG. You want high beta in a bull market.

High Beta can lead to ![]() .

.

That is true but the market has far more up years than down years. There are ways to hedge yourself.

Diversification?

These aren’t ranked in order of preference:

-

Buy puts. I’m not a huge fan since your timing has to be really good. If you’re regularly buying then, you’ll offset most of your gains.

-

Sell OTM covered calls to finance buying puts. This gives you a range of max profit and max loss for the given time window.

-

Sell OTM covered calls to create yield and that gain can offset future drops. The risk is having to sell and the stick keeps going up. There are always pullbacks to rebuy though if you’re patient.

-

Set a technical indicator as a stop to limit your downside from the high. Let’s face it. None of us are going to exactly time the highs and lows. This removes the emotion.

-

Buy puts in the weaker competition. In theory, the company you own should be doing well at the expense of competitors. If it’s an economic or industry cause of stock decline, then weaker companies competitors should decline even more. That gives you more insurance for less.

I honestly think diversification is hard unless you have a ton of time to dedicate to it. My goal is to own a max of 5 stocks and work positions around them. That makes up about 80%. The other 20% I do technical based options trading. Right now, I size call positions 2x as big as puts and try to have 2x as many call trades as puts. That makes me net 80% long. I prefer options with 3x leverage so that’s more like 240% long and a 60% hedge.

Diversification refers to portfolio level like a stock portfolio or total asset. Idea is to hold stocks or assets that don’t have positive correlation, if possibly negative correlation.

Btw, I don’t hedge buy n hold position. Prefer to float with the tide.

Do trading on and off, so have yet to develop a structured trading plan ![]()