Even without 5G, AAPL Revenue & Profits are skyhigh. AAPL will be introducing 5g soon…rest I will leave it…

Lol

.

.

.

10 Robinhood Stocks Investors Are Buying in August

FB and GOOG are no longer cool  to millennials

to millennials

Now only TAMAN

Since then TSLA underperforms till Covid-19 strikes and suddenly is a hot stock! Who would have guessed that TSLA cars become popular during pandemic.

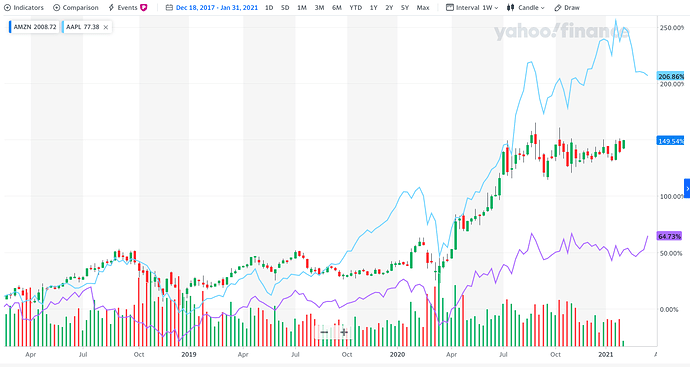

Coincidentally, four of them have similar gains, AAPL AMZN NFLX NVDA. @Jil takes note. Investing in any of these fours are good choices. For whatever reason, they go sideways from Jul while TSLA continues to explode. So you are suffering from recency biased to claim that TSLA is a good choice in 2017 - in fact was bad decision. Is an outstanding choice if you somehow spot the relationship of Covid-19 and TSLA - I can’t.

FB, @manch said would overtake AAPL in market cap, performs only better than BABA and BIDU, third LAST.

Upon first case of Covid-19 (Jan 20), the best stocks to buy then are TSLA MRNA ZM ![]()

Hmmmmm, you missed great MSFT !

Buy only at dip, see TSLA I bought at $330 !

I bought after you ![]() mentioned it at $330 too. Sold though

mentioned it at $330 too. Sold though ![]()

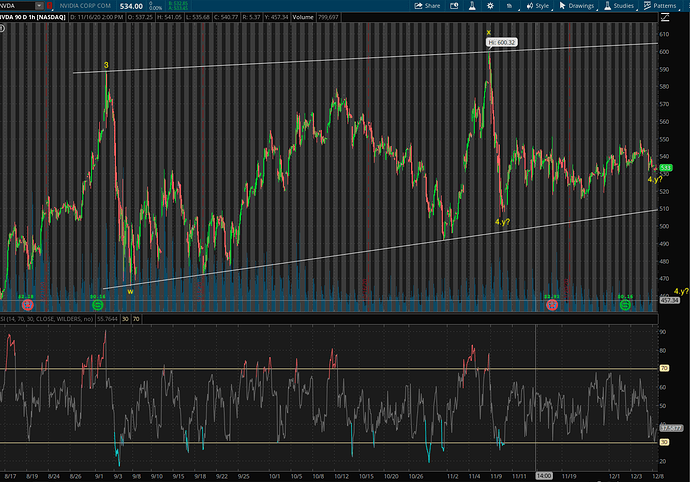

FAANMG starting to roll over… ominous… may not have last hurray… we’ll see…

When would market cap of AMZN and FB overtake AAPL?

AAPL $2.01T

AMZN $1.55T

GOOG $1.37T

FB $826B

Little known fact: When GOOG IPO on Aug 19, 2004, its market cap is about 10-20% higher than AAPL. I recalled a few bloggers advise to sell AAPL to buy GOOG, GOOG is the future! I stick to my bird in hand

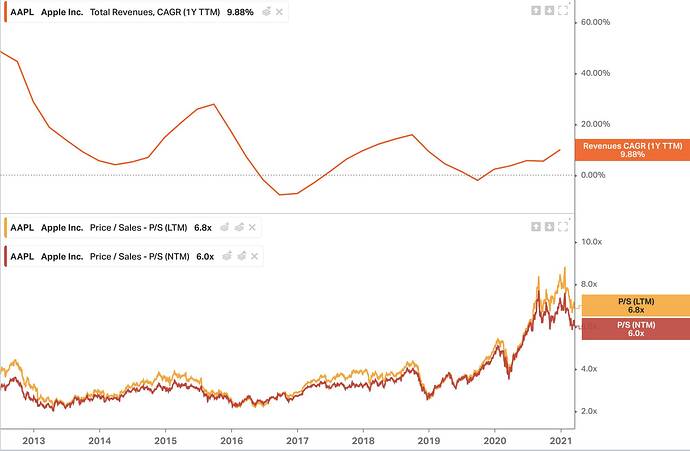

Did I say in 5 years last year? Forgot. Anyway, things come in rotations, and AAPL can’t be king forever. Its revenue growth is weak, but its duopoly on smart phones is a cash cow which allows it to engage in financial engineering aka stock buyback.

Reduces market cap. If no buyback, AAPL market cap is even HIGHER.

Your memory failed you. More than 3 years already.

.

Market cap comparison: AAPL is 29.7% higher.

Price comparison: 38.3% higher.

I recalled you sold your AAPL to buy AMZN around that time. You’re happy about your decision for about 1.5 years. Told you tortoise (AAPL) vs hare (AMZN)… we know who won. You may have sold AAPL to buy FB too.

.

You may want to reconsider using P/S for comparison… those are for comparing high growth no profit new companies. You may want to consider using P/E. Also don’t read too many articles like the one below. Every article always recommend AMZN is better stock than AAPL… the truth is, you know.

Well I still have about two years left. Don’t be so sure. Remind yourself how the race between the hare and tortoise turns out.

Meanwhile Facebook is cooking something big.

https://twitter.com/firstadopter/status/1372660119553642507?s=21

Apple’s app tax needs to be reined in. Highly anti competitive.

Want us to sell our souls for free yet don’t want to pay for plumbing?

FIFY

Apple’s heavy exposure to China is a huge plus on the way up. But the tide could easily turn and become a huge liability on the way down.

And the tide is turning.

That has been said for as long as you heard that hyperinflation is coming.

Btw, TSLA is also heavily dependent on China, how come you are so bullish?

TSLA is not as dependent on China as Apple. Besides, I am only bullish on TSLA if it came down to $400 or so.