So is anyone picking at NIO these days?

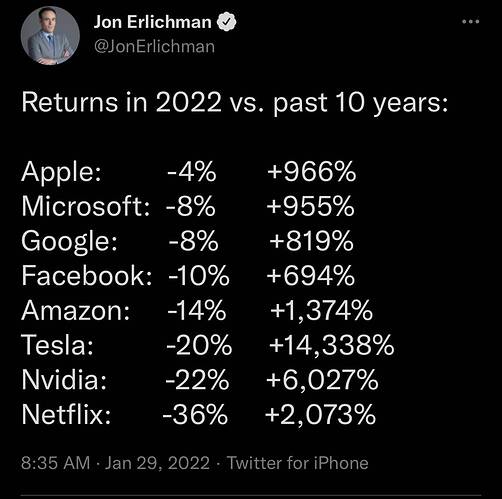

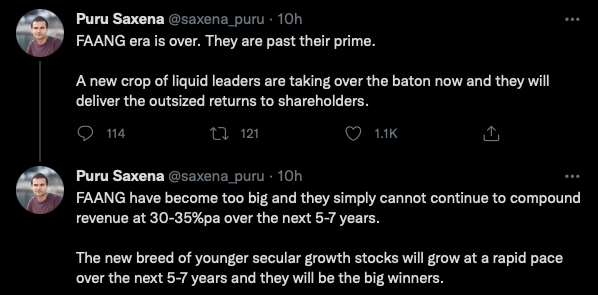

FANGMANT has been grinding down for many months… if tax hikes become reality, expect FANGMANT to crash…

Definition of crash: 10% decline over 3 days or 30% decline over 1 month.

New FAANG is SCANT? Actually NT is part of FANGMANT. Of the three new stocks, I have CA, SHOP is still not cheap enough.

love this. My director said about facebook in year 2007 as a weekend term project. ( I am sure he ate humble pie several times after that). FB and Netflix sound so much old age companies (as does paypal - it is really the great grandfather of online payment tech).

Did you notice both GOOG and AAPL own the OS. Amazon indirectly does to with its AWS. Means you own not only the games, but also the casino.

streaming and payment space is too crowded.

Regarding the payment tech. why VISA and MC are doing OK even-though they are so old?

Platform

AAPL MSFT GOOG own platform. Mark tried hard to make FB to be a platform. Now he is throwing $B to build the metaverse platform.

Btw, Mark did consider building a phone.

The well documented wisdom is you need to build hardware if you are serious about software.

Don’t visa and MasterCard own payment platform too? To me looks like everyone else routes their payments through their network

How are ach payments routed?

Even Puru is jealous of the strength and return of FANGMANT.

Very well said! Software is nothing without the underlying hardware. We are learning this lesson in Silicon Valley, which for couple of decades has been software obsessed and has ignored hardware like semiconductors. Hence, most semi manufacturing moved overseas to Asia and got clustered in a few companies. The semi shortage is partly a result of this short sightedness.

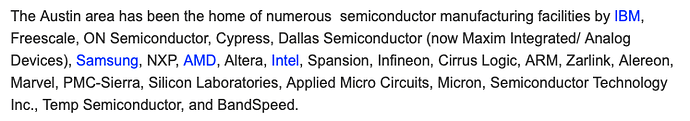

Plenty of semiconductor companies in Austin.

Many “assembly” companies have sprung up in Austin.

Go Austin.

All big software companies (Microsoft, Amazon, Google, Facebook, Apple) are also heavy into hardware design (though not known outside as such) . Oracle actually acquired SUN in 2010. And Intel acquired McAfee in about same time.

Chip Design and Board design are different activities and they have different customer bases.

.

Eventually chip design would migrate to Austin ![]() from Santa Clara.

from Santa Clara.

There are a lot more trained professionals all over the world (austin, bangalore, seattle, hyderabad etc) in the chip design activities today than there were 20 years ago. So, chips can be designed from anywhere. The question is who will manufacture them! That is where the focus is shifting these days. Intel is going to open a huge chip fab in Ohio. Industries are finally returning to rust belt, where the America’s industrial activities once thrived.

Three developments since 1960s have enabled exponential growth of chip design industry. Better device (like transistors and gates) modeling even at smaller nodes (like 5nm and 3 nm), better EDA tools to string these devices together and verify/validate. And manufacturing the design into silicon. Improvement into these area means less risk in design and development.

Market cap

FB $620B

AAPL $2.8T

AMZN $1.6T

NFLX $178B

GOOG $1.83T

MSFT $2.26T

NVDA $646B

TSLA 938B

Take note, FB, some1’s favorite to overtake AAPL in market cap is now has market cap lower than NVDA.

AAPL’s market cap = AMZN FB NVDA, all these three are supposed to have overtaken AAPL in market cap

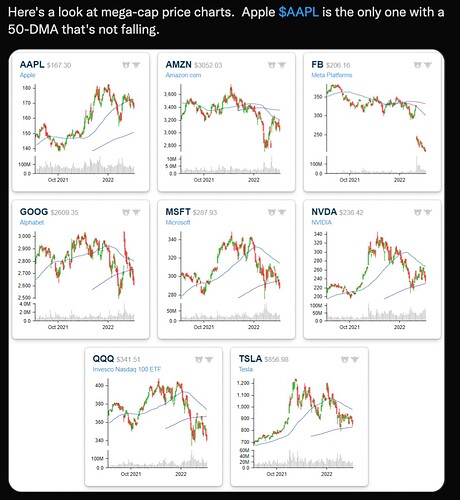

MANT above 200-day SMA, FANG still below 200-day SMA.