Already posted by @manch:

We need fiscal policy. How does zero rate help a restaurant owner with zero customers? I’d like to eat out more but wife doesn’t allow…

Take out?

We need more masks, not more QE. The government is still clueless. This might spook the market again like last time after the initial spike. Meet again next week for rates to go negative.

Futures are tanking so far.

ES and NQ both down >3%.

Maybe I’ll just sneak out by myself instead. ![]()

LIMIT DOWN!

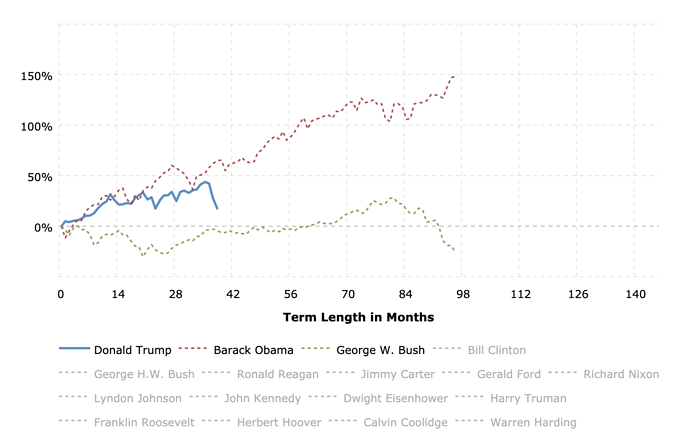

This interactive chart shows the running percentage gain in the Dow Jones Industrial Average by Presidential term. Each series begins in the month of inauguration and runs to the end of the term. The y-axis shows the total percentage increase or decrease in the DJIA and the x-axis shows the term length in months.

https://www.macrotrends.net/2481/stock-market-performance-by-president

![]()

Future is still dead. No bids.

QE of facemasks instead of money will reverse the downtrend

Postponing taxes until the end of the year will help a lot. Emergency SMB loans to small businesses too. Cutting rates and QE will help calm the financial market, yes that’s super important, but it won’t help Main Street much.

The Fed wants you to use the QE money as toilet paper.

But it’s not soft as Charmin. It will hurt my butt

Futures have been limit down the whole day. No bids at all. This is looking really scary. Another wild ride on Monday folks!

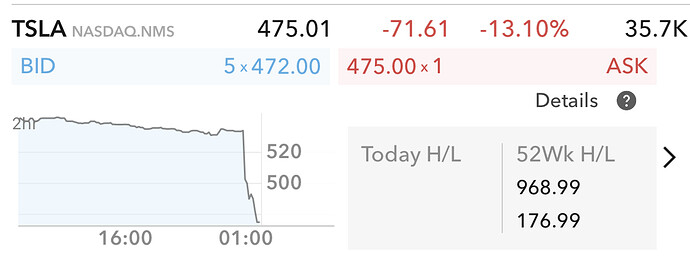

Heading to $420. It’s already 50% lower from all time high.

I have a feeling robinhood might crap out again tomorrow.

Didn’t @jil said it won’t happen? Anyhoo being wrong is not a sin or to be shameful of. Better to be lucky than to be correct. @jil is a swing trader so he doesn’t get attached to a stock, his FA is really just short term FA. I am wondering what happen to those few diehard long term investors, remain diehard?

If you read my statements, I would have mentioned “Unless Recession hits”. All FA/TA are thrown to dustbin when recession happen as no one knows what will be the revenue/profit during recession period.

This is common to any stock as entire economy tanks.

I sold 20% of my portfolio in December. The problem is where do you put your liquid assets

in an economic collapse?

Park with me.