that’s what was surprising to me about the market reaction today. 75% of the analysts still expected the Fed to raise rates today. It was not a surprise. They also expected the Fed to be more dovish for the future. Again not a surprise. So why tank the market?

2 words: irrational angst.

The CBO currently projects a $973 billion deficit for the current fiscal year, or 4.6% of GDP, climbing as high as 5.4% of GDP in 2022.

Yeah I found the market reaction surprising as well. I think the Fed has turned more dovish of late. The coming 2 hikes will be very data driven. If growth comes down more than they expected they may stop at one instead of going for two.

Rate hike - Increased cost of capital, narrower margin, lower profit, stock down.

Rate stay - Fed acknowledges economic slowdown, stock down.

So it doesn’t matter what Fed does, stock will be down.

For stock prices to go up, sentiments need to change to bullish. Then the Fed’s action will be interpreted like this:

Rate hike - Wow, economy is booming, stock up.

Rate stay - Fed wants economy boom to continue, stock up.

Merrill Lynch:

The Fed hiked rates while signaling a lower path, as we expected. … We think Fed Chair Powell delivered a clear message: when the Fed has reached the neutral target range, there is a need for greater caution and policy to become ever more data dependent. This means that the threshold to bring rates into restrictive territory - above the neutral rate - is high. The Fed would need to see convincing data including a further decline in the unemployment rate, above target inflation with inflation expectations shifting higher and cooperative financial markets.

We are changing our call for the Fed. We now expect the Fed to hike just two more times in 2019 with no additional hikes in 2020. This would leave the terminal rate of the cycle to be 2.75 - 3.0% and shaves 50bp off our previous path of the Fed. The market has already shifted and is not even pricing in a full hike in 2019 with cuts in 2020. In our view, the Fed is too optimistic about the terminal rate but the market is too pessimistic. In addition, consistent with our forecast for fewer Fed hikes, we lower our US interest rate forecasts across the curve, with the 10yr ending at 3%.

That’s only going to get worse as entitlement spending as a percent of GDP grows. We’re less than 15 years from social security, medicare, medicaid, and interest consuming 100% of tax revenue.

Deficit is a simple arithmetic problem. All you need to do is to make sure revenue > spending.

If you are worried about spending too much, then by all means go cut it. GOP controls all 3 branches of government. Fact of the matter is these are popular programs. So we should face the political reality: we will never cut these programs.

The time to spend less on your restaurant meal is before you ordered. You can’t bitch about the bill after you have already eaten.

How do you suggest we afford programs where 90% of people receive more benefits than they pay in taxes for the benefits?

When has the US ever collected over 40% of GDP in tax revenue? That’s what it would take to balance the budget in 15 years.

Countries that collect over 40% of GDP in taxes grow GDP half as fast as countries that collect less than 20%. Do you really want to cut GDP growth in half?

I’m pretty sure the middle class would have an awakening when they realize what middle class taxes are in other countries. You think cutting the program spending would be unpopular. Try telling the middle class they need to pay a 40% effective tax rate vs. 9% for those making $50-100k/yr.

I don’t think. I know.

Otherwise they would have been cut long ago. What’s stopping the GOP?

There are few positives on tax cut:.

Corp Tax cut , short team, increased the profit margin of all companies. This we have seen in 2018 company results and on going with profit margin.

Corp one time repatriation tax benefit, brought offshore dollars to USA, spent in buybacks, dividends and local cash position for future buybacks and investments.

Both are short term and we have witnessed repeatedly.

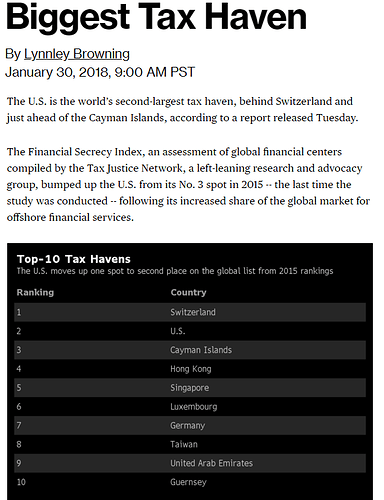

Corp tax cut paved way US as tax haven state. This has long term effect of investors moving money to USA. They will not be visible immediately, but will take longer run to improve US economy. This is slow and steady progress in US economy.

Corporate+Investors are like bees, they will know where the honey is there and definitely take benefit of it.

When you say “Long term”, you can not expect in one year, but 8 to 10 years away.

It took 10-15 years for AAPL to build reserve 200 Billions in Ireland, but took just one year to bring it here.

It depends. I am 59 but I behave like 2 guys at 29 yo. ![]()

Both parties have been kicking the can down the road for decades.

Because despite posturing these programs have wide support.

Try tell a crowd of seniors you want to cut Medicare. Or social security.

The stock market reacts to “suspected” things that may happen in the future. That is, they depend on speculation.

When Twhitler got in, the stock market went crazy on the future “whatever good or bad for we the people” he was going to sign on. Most of it was on the course of cutting expenses, most on the side of the population, never on the side of government where they were and still are living like if we have a monarchy.

ACA was one of them, they failed to kill it. Then they jumped to “entitlements” and they have been working silently to cut them. They just need those tweets every morning to distract you.

Then, the failed promise of a “negotiator” never telling his plans in advance to “the enemy” came in the name of tariffs, a trade war that started to take the stock market down.

Add to it, the government is not erasing the national debt nor attacking the deficit. The tax cuts were a bad idea to begin with when the economy was slowly coming to its own terms, not inflated with unnecessary cuts, at least on the way they did it. They failed, as the TARP program failed, not putting restrictions so the benefited didn’t give their CEOs huge bonuses while deceiving a few employees with a $0.25 increase on their paychecks.

There’s a situation here. This country is relying on the speculation and false narrative that one person, who has been a liar all his time, can fix anything and everything. If he surrounded himself with people with vast knowledge of the economy, and he kept his mouth shut as he screwed all up with the fight with China, perhaps the augmenting of the rate interests wouldn’t have the deadly effect we see now.

I am not an economist, and also I am not a wishful thinking guy trying to fit the actual numbers in a narrative that everything is OK. Nothing is OK as of now folks!

Trying telling people you want them to actually pay the full tax bill for the programs. Tell the middle class their tax bill needs to quadruple. They are popular, because who wouldn’t love to get way more than they paid for? If you could pay for a Corolla and get Tesla model 3, I’m sure you’d be thrilled.

The trump tax cut was unnecessary. Start by getting rid of it. It’s extraordinarily unpopular for a tax cut.

LOL………there is a couple of guys here whom are in that river in Egypt, denial.

Read them, they live in La La Land.

Government is not giving free. They deduct it every paycheck like 401k/IRA. They take responsibility to provide it, but not meeting their assurance. They have to straighten their process or print money so that they do not default.

Trump tax cut (I mean corp tax cut, not individual tax cut) is major overhaul in tax system.

True, It is extraordinarily tax reform in the history of USA.

This makes USA as tax haven state that will benefit in the long run.