Another Fintwit?

Wall st West?

Fintech Startup Bolt Sees Valuation Surge to $6 Billion

Company says it’s building a universal checkout login that will help retailers compete with Amazon’s speed. European expansion is next.

A startup that’s trying to bring Amazon’s speedy one-click checkout to the rest of the internet saw its valuation jump to $6 billion.

Bolt Financial Inc., founded in 2014, raised $393 million in its latest round to bring total funding to $600 million, the company said. In December, the company was valued at $850 million, according to researcher PitchBook. Earlier this year, Bloomberg reported the company was eyeing a $4 billion valuation.

The company, based in San Francisco, has 10 million shoppers signed up. And that number has the potential to hit 100 million once all the deals Bolt has signed are fully activated, according 27-year-old founder Ryan Breslow.

…

Bolt, which makes money by getting a 2% cut of purchases made through its one-click checkout, will use the funding to expand overseas, add more features and boost brand advertising.

2% cut, pretty good cut.

They reached out to me (as I am sure they did many others) a few years ago for engineering roles. I didn’t see the appeal of the product. Will be interesting to see what other features they add.

So many FOMO purchasing of AFRM. Scary, right?

.

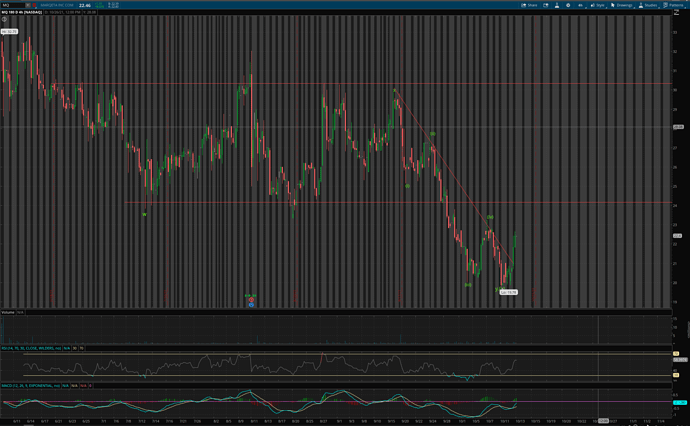

If you have some money that you can lose them all without blinking, try MQ ![]() I YOLO 800 shares ~$16k…

I YOLO 800 shares ~$16k…

Why MQ in specific?

Never heard of it. Kinda suspicious of Oakland tech. Should at least be based in Berkeley.

Anyway, I was thinking how come I missed USPT. My conclusion is that, UPST is like Stripe and Affirm. They are like the arms dealer in fintech. They give tools to existing financial firms to haul their crap to the 21st century. As arms dealer they can scale revenue super fast because the existing dinosaur firms serve as distribution channels for their ware.

In contrast firms like SoFi, Lemonade and to a certain extent Square capture all the revenue on their own sites and apps. Lemonade is not licensing their software to other insurance firms. They capture more of the upside but they can’t scale as fast as the arms dealers. They are the warloads who make their own weapons for their own troops.

I was too much into the warloads and not paying enough attention to the arms dealers.

In another word, UPST is the AWS of the loan, insurance or etc.

.

MQ is an arms dealers, HQ in Oakland is expected.

Buying UPST and AFRM still offer good return just regrettably missed the early monster rally.

granted, I am a fuddy duddy but i don’t get UPST. Is their “new” credit risk methodology that much better? or are they just setting themselves up for a ton of defaults in the next few years?

- disclaimer - i am a fuddy duddy who doesn’t get “vision” for many companies so I am sure i am missing this.

Similarly - i am such a scrooge about AFRM and all the BNPL companies. Seems like subprime waiting to happen all over (and is already starting, have seen articles as such)

I have not studied their business model. They might be OK if they keep their lending small, and do not lend again to defaulters. Using the terminology from Insurance industry - keep risks fewer and smaller.

Remember rent-a-center or other rent-to-own businesses? All they’re doing is bringing back that business model with a new name.

right? that is why I am not excited about this. and yes, I am old enough to remember lay away at Kmart - I was kid when Kmart was in its heyday!

Layaway is different. There’s lower risk, since the customer doesn’t get the item until they’ve fully paid for it. Rent-to-own is riskier, since the customer takes home the item before fully paying for it. Those items instantly depreciate to a small fraction of original value once they are purchased. It’s much riskier than a car loan, so the idea of charging low interest rates is insane. It’s closer to credit card risk, so offering it at a much lower interest rate is crazy. Those companies will all collapse when there’s a recession.

Look like I am wrong about Group 1. UPST shot up 10% today.