MF on MQ. Interesting arms dealer. Need to read up on it. Given that it IPO’ed in June this year, shouldn’t you wait 6 months for all the lockups to expire first?

That was my concern too when I first looked at it not long after their IPO. But then it just went on ripping 10x so who’s the fool now?

![]()

That’s my difficulty with investing in arms dealers. I really have no visibility how good they really are, and it seems to a layman like myself it wouldn’t be that hard to swap out one arms dealer in favor of another one. Aren’t they all sorta fungible? Of course there are customer relationships, training costs etc that make it not as easy to swap in practice. Still I don’t have any insight distinguishing one AI-enabled lending system from another.

I did bring it up!

I knew about UPST. I just wasn’t convinced they could be that good. Oh well.

TBH, I wasn’t convinced either. Every day I feel like taking some profits off the table but it keeps going higher. I should stop thinking and just stay put!

What do people think about Lightspeed? $LSPD. I can’t decide but I am of the opinion the fintech tide is rising and lifts all boats?

yes, fundamentals don’t matter. I view USPT as a meme stock.

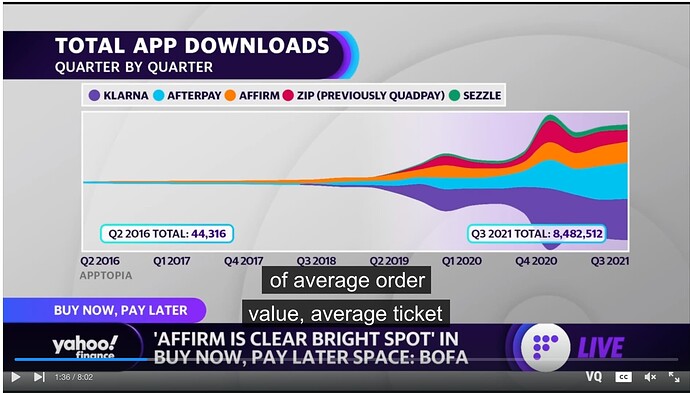

BAC favors AFRM over other fin techs.

But the guy’s own slide clearly shows Afterpay has bigger share than Affirm? At least in terms of app downloads.

And Square just bought Afterpay:

Square plans to integrate Afterpay into its existing Seller and Cash App business units, so that even “the smallest of merchants” can offer buy now, pay later at checkout. The integration will also give Afterpay consumers the ability to manage their installment payments directly in Cash App. Cash App customers will be able to find merchants and buy now, pay later (BNPL) offers directly within the app.

Square will come at this from both the merchant side and the consumer side. Customers don’t need to download and set up yet another app. Cash App is the financial super app. Plus, because Square has visibility to all of the consumer’s financial data they can handle the credit risks better than one-trick ponies like Affirm.

Square to $1T !!

![]()

Every hot stocks have market cap of $1T? In no time, market caps of all hot stocks would be larger than GDP of the world. Wake me up when FB is $1T.

Bitcoin is already over 1T. And it does nothing.

The market is full of this shit. Doesn’t anyone recognize a top?. A top is when people buy shit only because of FOMO. Fundamentals?. Who cares. Profits? who cares… crash coming? … who cares. Government spending run amok who cares. Senile clueless President whose only concern is climate change… WHO CARES…. Yeah things are just peachy… who cares

Plaid another fintech growing

Oh I didn’t know it was him. I even have one of his books.

.

I don’t know him until now as in associate face with name. Other than still don’t know who is he. You really follow a lot of dudes. Frankly, there is no need to know what the ticker represents if you’re trading. There are traders making huge fortunes without knowing what the company is or its financial performance, purely using moving averages. If you have a good AI algorithm to identify patterns and a system for trading, it will work. Having said that, if you are going on a TV, should take some effort to know what the company does. Is not that difficult, just use buzz words,

An AI powered system to democratize… in this case, use “lending”. Done.

.

Scanning through the web, he makes $$$ from selling his trading book. Are you an outstanding trader now? I have a formula for you how to be a buy n hold investor that make 1000x over 20 years… Just identify an outstanding CEO-founder, all-in into this one stock, watch TV serials and Tiktoks, you would be a multi-millionaire in no time.

Setting the bar so low nowadays?