That’s for you. I am waiting to be a billionaire by lazing around.

subprime 2.0, here we go.

Don’t worry, Fed would print more money to take care of it. So buy buy buy. No politicians, no Fed members, no governments, … would dare to let the market take care of itself. They would all PROP UP the market and economy rather than let them slides into depression and chaos to punish those speculators and over aggressive investors. Excessive risk taking is encouraged as there is a safety net provided by Fed and the government… millennials all understood this… YOLO.

COIN rocks.

Flirting with so many names nowadays?

That’s good news for my PINS calls and stock.

PYPL is morphing into?

Bought some paypal and short+long dated option calls.

Soros still got it. Legend.

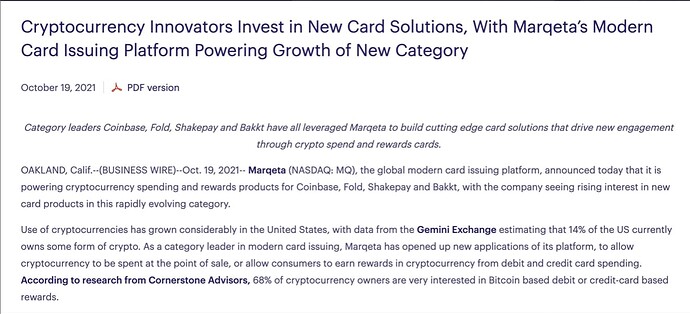

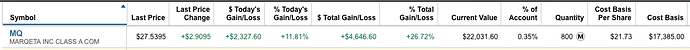

I am sticking to things I at least vaguely understand. MQ is tempting but have to stay focused for now.

.

Other than AAPL, I understand nothing about the stocks I am buying nowadays. Just buy n pray… let some high up decide for me.

Why is every American companies copying TenCent WeChat?

They copied AOL. A huge percent of AOL users thought AOL was the whole internet. They didn’t realize there were other websites out there.

The goal is to become a “super-app” similar to apps like WeChat and Alipay, which have become dominant in Asia by bundling financial services along with features like messaging, social media, and food delivery.

The financial-technology company has been expanding beyond payments and into other areas of financial services and commerce, driven by a revamp of its app to emphasize features like crypto purchasing and savings accounts, as well as recent acquisitions, including of the deals platform Honey.

PayPal PYPL, -4.98%isn’t the only fintech company with super-app aims—Affirm Holdings Inc. AFRM,-4.93% has expressly stated its ambitions here, and Square Inc. SQ, 0.38% has been beefing up its business through acquisitions—but so far the parties don’t seem to be branching too far outside of financial services and commerce, unlike the Chinese trailblazers.