FinTech is coming alive. Let’s what happen after Fed starts rate cut… waiting.

0.5% cut… JUMP.

https://www.cnn.com/business/live-news/federal-reserve-interest-rate-09-18-24/index.html

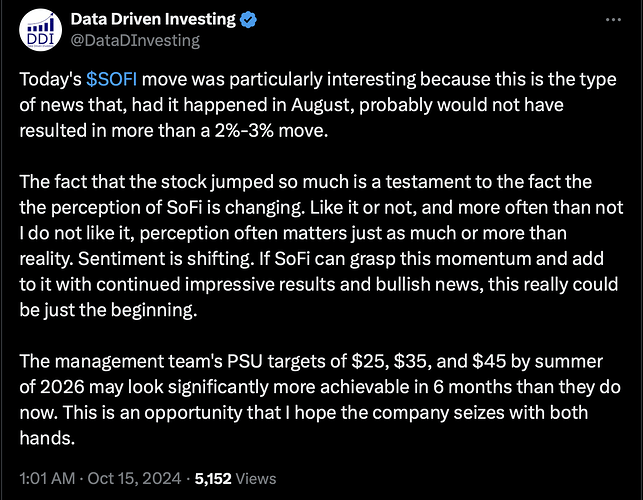

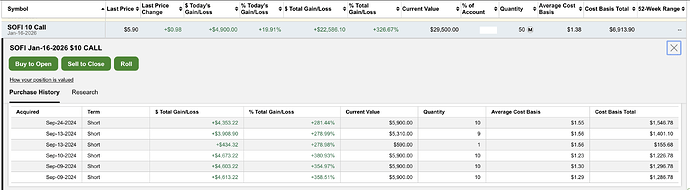

Guilfoyle felt compelled to write up SoFi after the popular fintech’s shares surpassed the $10.25 price target that he had reiterated on Oct. 9.

He promptly boosted his price target to $13.25, but then SoFi reported better-than-expected third-quarter earnings, prompting another update from him on Oct. 29.

![]()

https://pro.thestreet.com/trade-ideas/why-im-adding-to-sofi-position-after-record-quarter

We emphatically reiterate our target price of $13.50 at this time with an upward bias.

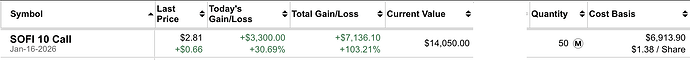

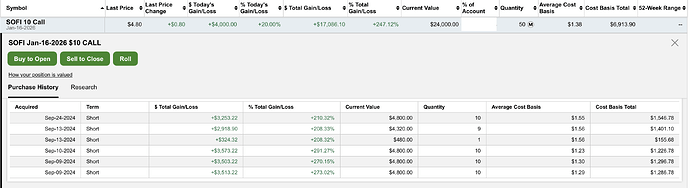

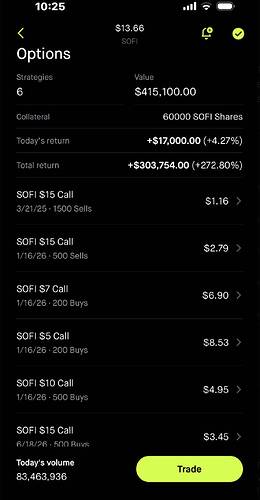

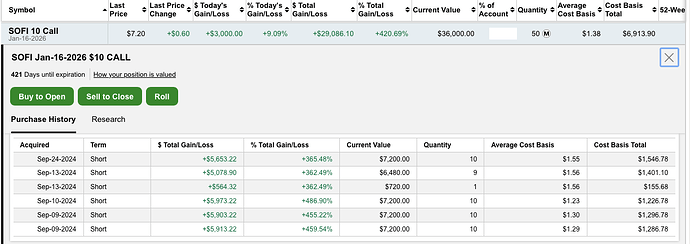

Long calls are very risky but very rewarding too e.g

SOFI calls bought about 2 months ago… over 200+% gain.

SOFI

IMHO, is a Gen Z and late millennial (who are HENRY) bank. If you’re not in this group, probably don’t understand why it is outstanding.

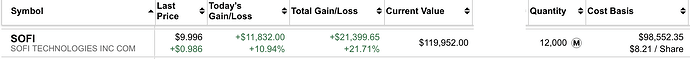

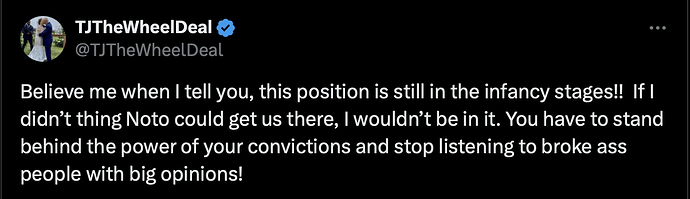

TJ’s position

Truth be told, almost clear my position because going nowhere between Aug 2023 to Aug 2024. Took risk to buy LEAPS calls (2026) in Sep when it appears to be a wave (1)-(2) pattern…

I had a run like this with STLA leaps (stellantis) and made 700% on each option. But of course, I didn’t try it with SOFI ![]()

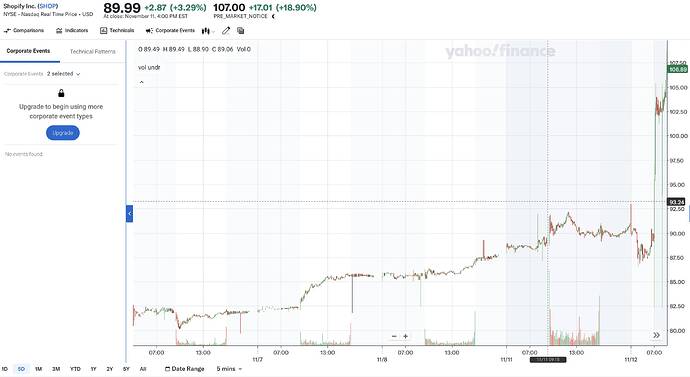

Potential inverse H&S forming.

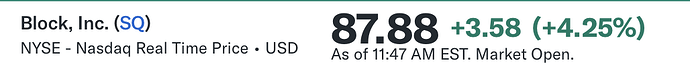

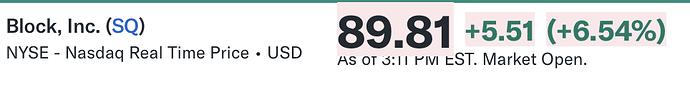

EW: Should be in wave ii (down wave), high probability that SQ could break above $88-$90 forming an inverse H&S. Initial target of iHS is $138. Breaking below 40-week SMA would invalidate this iH&S.

Weekly Chart

Daily Chart

Might be able to break above $88-$90 today or 2mrw. Holding my breath, SQ is 4th largest position after NVDA, SHOP and COIN in the high growth portfolio. Sideways for nearly three years, almost give up ![]()

Edit: 2:11pm Nov 18, 2024. Almost there ![]()

Edit: 2:15pm Nov 18, 2024. Above $90… Go… LFG…

Edit: AH, Nov 18, 2024. Yes… patiently, waiting for $138 ![]()

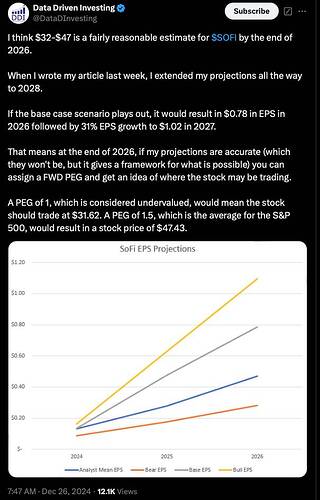

Kris is thinking Tevis is not sufficiently optimistic… actually I think he is joking/ teasing Tevis. Me, sold 9000 SOFI around $14, not because I’m bearish or don’t believe SOFI can rally above $20s, in fact, I expect SOFI would eventually rally more than $30s. The reason for selling is risk management… cutting down on margin… I have been catching the falling knife of SOFI as it declines towards $6 and paying hefty cost of margin, now that it is up, have to reduce margin. In fact, no longer on margin ![]()

EWT:

SOFI is in Primary degree wave 3, initial target $18.