When did he buy SOFI? It was over $10 as recently as December, so celebrating this seems a bit silly unless he perfectly timed the recent bottom.

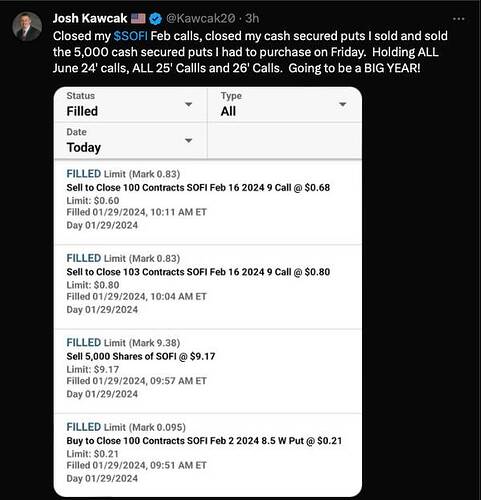

It makes sense the options are recent. Most of his profit is from shares. Isn’t that what the first row is or is that the total of options positions then we just see 1 under it? If he’s playing options with that much money, he’ll go completely bust at some point.

.

If he is not careful. I recall many AAPL call traders went bust because of Great Recession. Every option traders are bragging 10x gain before that. Well… easy come easy go.

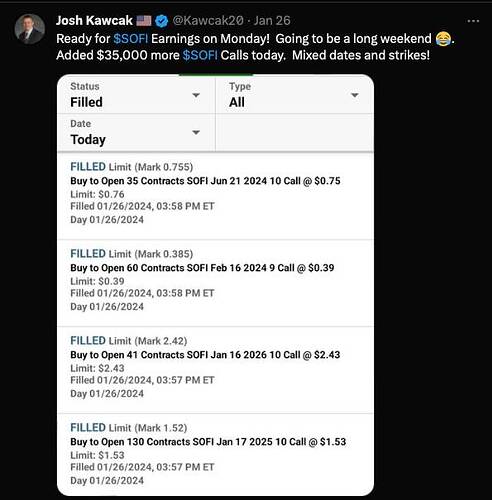

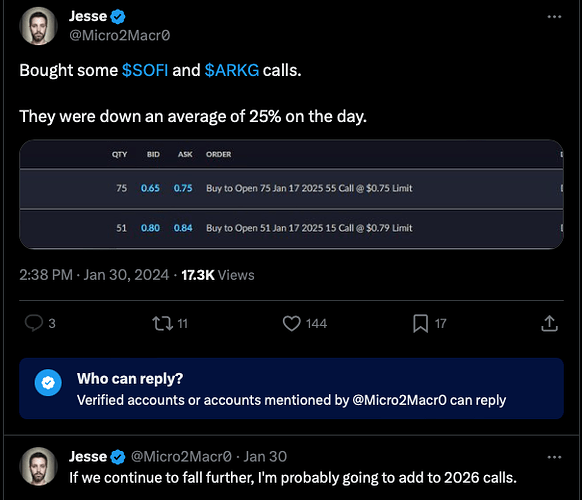

Big options trades before earnings are literally gambling. There’s no way to have an edge without inside info. It’s super risky considering it’s often more about guidance than the actual quarterly results.

This is why people get the impression options are risky. Granted, the trades are small in dollar amount. They are basically lottery tickets.

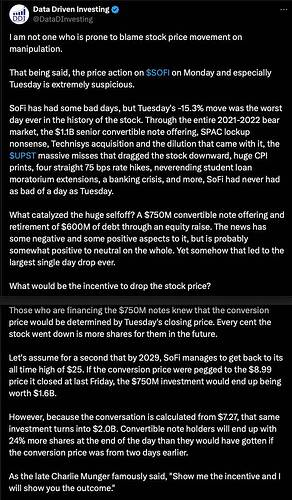

Credit card delinquencies are rising. BNPL is going to be interesting the next 2 quarters as people try to payoff holiday purchases. We’ll find out if their risk models really are better than FICO scores.

UPST is down 22% AH on earnings report.

Wow! FinTech keeps getting killed. Could be it due to Fed’s comment that more regional banks could fail and/or rates may stay higher for longer? FinTechs have close ties with regional banks. And regional banks are holding many hold2maturity commercial mortgage loans at initial valuation instead of writing down to market valuation.

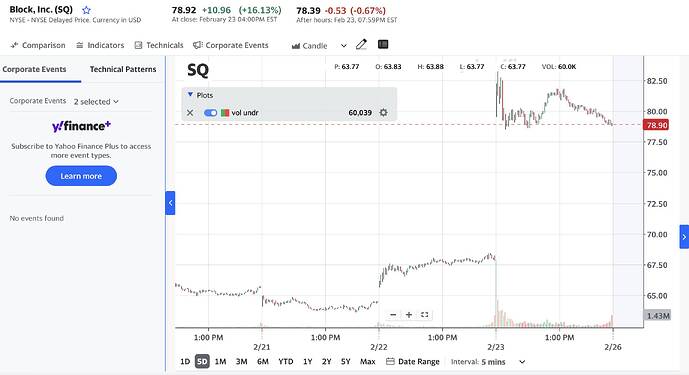

Either break out of the overhead and aim for $120 at the min or continues to trade sideways with low at $50s. Still holding 1000 shares of SQ. Hopefully is the former ![]() Some Xers commented that SQ and HOOD are proxies to crypto.

Some Xers commented that SQ and HOOD are proxies to crypto.

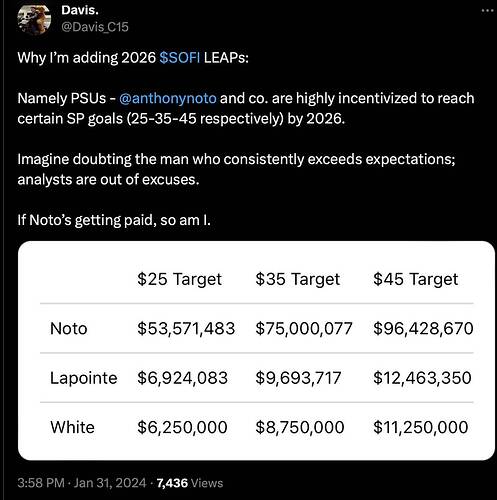

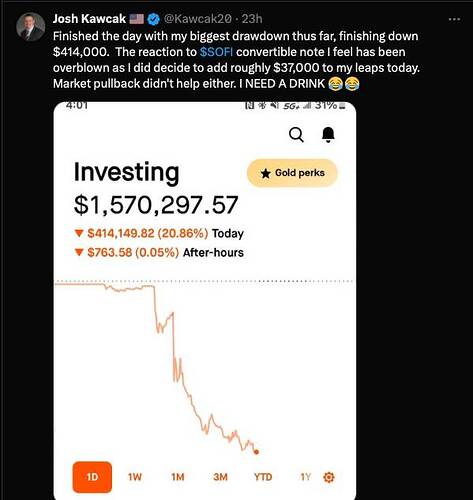

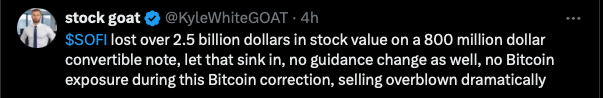

Out of nowhere, CEO of SOFI, Anthony Noto, announces a huge dilution to shares. ![]()

Since I don’t have that much shares, didn’t lose that much, still angry.

If SOFI doesn’t go back above 40-week SMA shortly, I would be nervous.

Suddenly, Xers are interested in SQ ![]()

Disclosure: Closed all calls (Jan 2025 $80). Holding 1000 shares.

I lost 1/3 from recent high. Worse performing stock in my high growth stock portfolio.

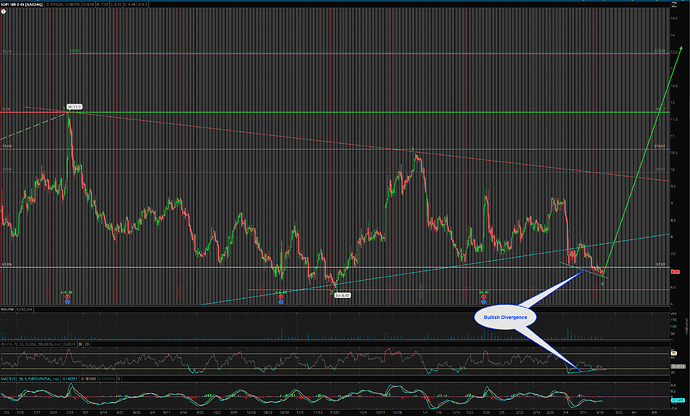

EWT: Wave ii of wave 3. Count invalid if decline below $6.41. Bullish divergence detected.

Many Fintech stocks crash after earning.

Is it end of Fintech in particular and SAAS/ Cloud computing era in general?