can you please remind my wife???

No doubt, it is going like that ! They will survive with dividends and buyback, but not on growth.

Can’t trust Jil, change position on a dime.

For old timers, bought at $3 or $10, it is good to hold, but not for those who bought it at $225 !

It can not be buy and hold for $225, it is dead-end or ever loss.

S&P can recover 6 to 9 months, but AAPL it is long way. Practically, not worth buying at $225 and holding it for recovery, better to take loss.

If I blindly hold, even after TC revised estimate, then I am fooling myself. It is better to ride with some other stocks.

After Dec 26th purchases, I sold only AAPL, rest are all doing great progress, holding it.

hahaha… you are funny Mr Big Portfolio. By the way, “no matter what” is a very dangerous phrase to use in investing… oh, I forgot, you got it all figured out

you are funny Mr Big Portfolio. By the way, “no matter what” is a very dangerous phrase to use in investing… oh, I forgot, you got it all figured out

Yes, you are indeed old and broke no matter what

You are right, I am broke. I am actually one of your tenants. I can’t pay anymore.

The liberal eviction judge will side with me when I show her your “big portfolio” posts

I didn’t know that you are a scum in addition to being old and broke.

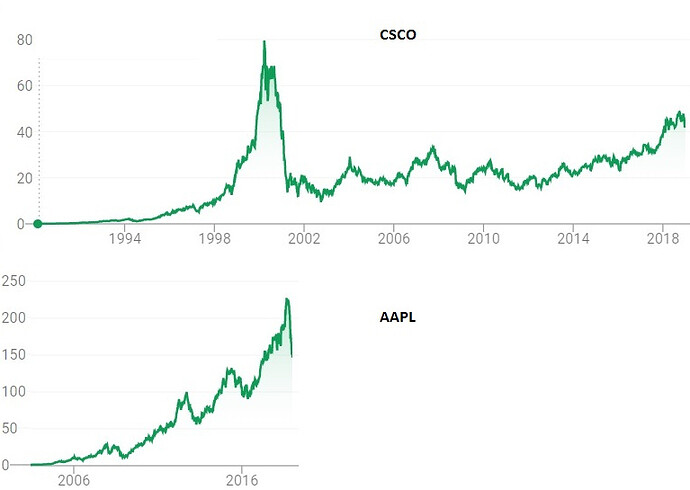

What was Cisco’s PE ratio at the peak? What is Apple’s PE ratio?

future P/E ratio depends on what E does in the future…

Current PE ratio. Cisco was 174.

good point. The decline may not be quite like CSCO’s, but it could certainly stay flat for a long time.

Also, don’t forget about buybacks… I wonder what AAPL’s PE would be if they had done no buy backs since 2008? I doubt CSCO did stock buybacks in the 90’s

Apple is still generating a ton of cash. They can do more buybacks or boost the dividend. Even if total dollars earned is flat, the lower share count will increase EPS. That would mean even if PE ratio stays flat the price will increase.

agreed… but the scenario you are describing doesn’t sound like a growth stock anymore at all… certainly not the place to keep your money for the next 20 years… Plenty of stocks paying higher dividends selling things that people will not stop using anytime soon…

this can all change, in my opinion, IF they bring the magic back and come up with the next big thing. The Apple watch didn’t do it (my wife has one… geez, what a waste of money)

The proper comparison is with Microsoft from 2002 to 2014, the Ballmer years. It made tons of money from windows and office in those years. Increasing revenue and profit but stocks went nowhere. Investors concluded Microsoft was no longer growing and no matter how much buyback it did stocks remain depressed.

On any case, AAPL lost appx 450B market cap (I funded some portion of it - my loss) which is more than FB current market cap ! It is too difficult to come back to the 1 Trillion cap.

Even if Apple jumps back, it is hard to catch up Amazon and Microsoft now.

Here you see, even Samsung drop on expected results due to slowing down economy of China (Not tariff impacted).

I do agree. One shouldn’t be buying AAPL expecting a whole lot of growth. Personally, I hold on to it as a value stock. I benefit mainly by collecting big dividends and using its size as a cushion against margin.

Comparing the two charts of CSCO and AAPL shows plenty of flawed logic. Why would you compare the two?