7 days on the market and now pending around our neighbor, San Jose.

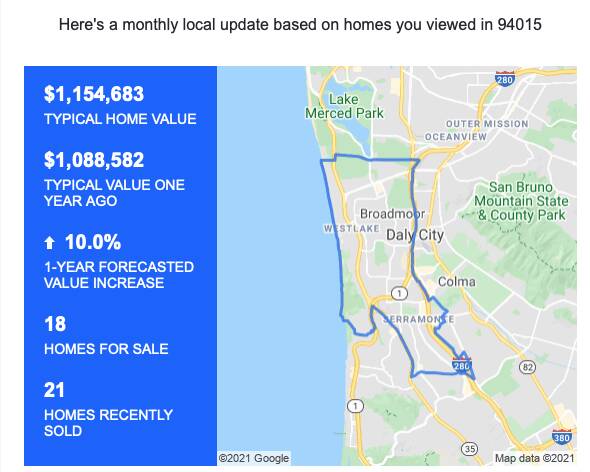

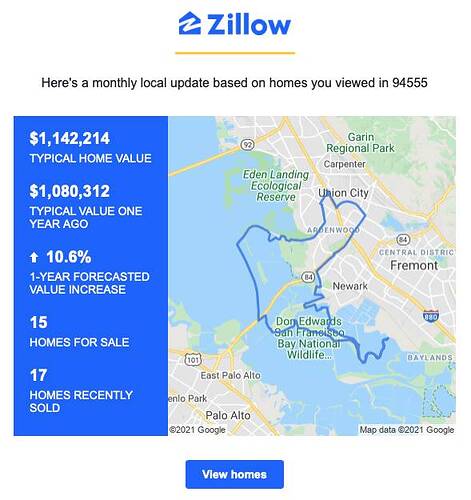

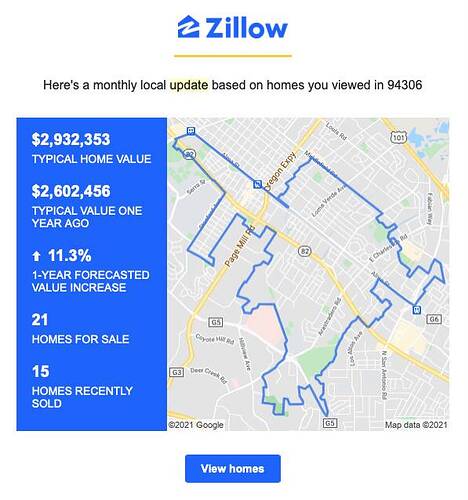

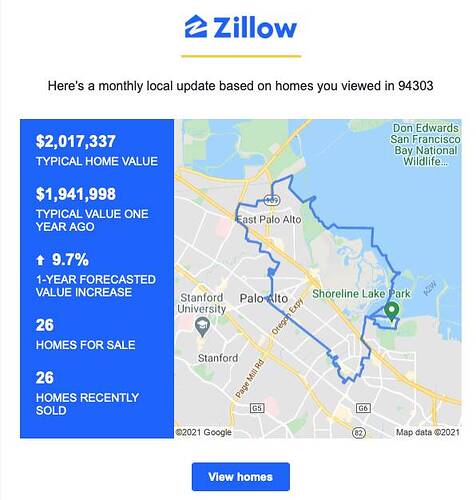

Looks like 10-11% across the board.

If this happens it will just be back to where it was @April 2018 peak before it sharply fell.

its not going to fall. too much money due to all the SPACs and IPOs. dollar value falling so everyone will be trying to convert a chunk to real estate.

If Gavin is recalled, I have a feeling he will be replaced by someone to the left of him. Gavin is just the symptom, the reason for Gavin/s are the electorate who believe in CA “exceptionalism”, without understanding why the past worked for CA.

I have signed all three recall petitions. They are made to be disqualified. Can’t write outside the lines. Only three signatures per page. Must sign in the county you live. The process is impossible. I doubt he will be recalled. I am running if he is. Tons of people ran against Grey Davis.

The inventory of SFH homes in Seattle suburbs is non-existent. I haven’t seen it this low. I know someone who was in the interview process to be an agent for fly homes. They’ve shutdown agent hiring, because there’s no inventory.

This is physical exodus. now it is digital exodus. next will be cloud and operating systems.

.

I have to wonder whether CA state government and SV city councils are awakened yet or still insist many decades they did that and businesses and highly paid guys still didn’t leave. I know @manch insist in this thinking. Wonder his rigid brain is as fossilized as those in the state and local governments. Is a fallacy to extrapolate…

The reasons in this article are not strictly due to coronavirus, but general reasons on why companies are leaving Bay Area.

This is a fossilized forum revolving around Tech. In fact it is no longer a RE forum

The SFBA has survived all kinds of different trends. Tech may wane but others will replace them. Never bet against Sam Francisco California RE.

Agree. And oh by the way, I don’t think tech is done and I don’t even think this “exodus” is real.

Larry Ellison emailed his top people at Oracle after Oracle “moved” to Austin. He told them all that they were not moving their current teams from the bay and this was basically a tax move.

I’ll wait to see a real titan move out of the Bay Area before starting to worry. Not a bunch of has beens or companies smaller than 500 people.

TSLA is not a titan?

Are you thinking in terms of black and white? All in or all out of SFBA? The trend is scattered “HQs” all over the world, don’t have to call them HQs. Because of this scattering, there is no need to have the majority (long ago is all) of HQ work to be done in SFBA. The best analogy I can come up is “HQ” morph from mainframe to client-server to cloud to edge computing style.

Companies looking desperately for ways to cut expenses and evade taxes instead of growing revenue are not the strong ones. Let’s monitor the stock performance of those who made the move. It’s a bit like seniors moving into nursing homes waiting for the final day.

Plenty of retirees leaving the BA to be able to enjoy the equity of their BA RE.

You realize HP and Oracle probably employee more people than 1,000 startups. While they aren’t fast growing or sexy, it’s a huge number of jobs.