Jobs jobs jobs= location

This is a headscratcher. The activity in the east bay and commute locations zooming past the old peak makes some sense since they are much more affordable. This activity in 94087 Sunnyvale and 94040 Mountain View is different. They are surpassing the 2018 peak by 10-20%. Palo Alto has pushed up to the old peak, but I don’t get the sense that there are past the old peak by 10-20%. Maybe I’m reading it wrong.

I think Sunnyvale 94087, Cupertino 95014, and Mtn View 94040 are all catching up to Palo Alto pricing levels.

.

I recalled @manch posted a time chart showing price changes for 100+ years in Bay Area e.g. Prices in Sunnyvale used to be higher than Cupertino, then it became lower and now is equalizing. Prices used to appreciate at roughly the same rate and then in 1970s (if I recall correctly), prices in SF accelerated.

I don’t know about 100 years ago, but from personal experience/memory, the starter single family housing price in 94087 Sunnyvale and Cupertino was around 600-700k in 2000-01. In 20 years, prices have gone up 4x to 2.5M for the same houses.

In these 20 years, the salary for a typical engineer in one of the South Bay’s large tech companies has probably gone up about 2.5x.

Even back in early 2000s, I remember that local housing was considered barely within reach for techies - one had to stretch budgets to buy a starter home in so-called “nice area”. At least, back then there was no down payment requirement, one could buy with 0-5% down.

Now, with home price appreciation outpacing typical employee salary growth by almost 2:1, and the need for substantial (at least 20%) down payment, I think only rich people are able to buy in what used to be middle class neighborhoods like 94087.

Bay Area housing has become Darwinian - only the fitted (or richest) can get in now. Average tech company employees either have to rent or buy far away in East Bay or South San Jose. Or they leave Bay Area altogether after few years.

If the same rate of appreciation as the past 20 years continues, then today’s $ 2.5M houses will be $8-10M in 2041. That seems absurd, unless inflation makes the dollar significantly less valuable by then

.

The post-war annual appreciation is 6-8%. In 20 years, $2.5M will become $8M-$12M ![]() Not surprising. You are right, dollar is depreciating every year… is in the design.

Not surprising. You are right, dollar is depreciating every year… is in the design.

That’s correct, I came here in 2002. I rent for a year and then bought a townhouse in 2003. Then bought a SFH in 95014 in 2007 and bought another in 2011. I am retired since 2002. AFAIK, share price of tech stocks and salary of SWEs appreciate much faster than 6-8%… if they can’t afford to buy a SFH after 5-10 years of working… it means something… spent too much time and didn’t save much. Or you mean they should be able to buy a SFH straight from college… in that case, expecting too much… SWE is not the chosen “race” by god.

Along the same lines. I want to learn the growth saturation patterns in the Bay area. Been here for only 10 years and trying to understand the dynamics and charm. I witnessed an average 10% per annum increase in property prices. Right from Palo Alto to as far as Dublin and Evergreen. Assuming the capital was around 750k - 1Million back in 2011 then the newer communities had a slightly higher growth rate. Keep me honest here.

I haven’t seen bust cycles and wondering how many of these newer developments will hold up? From a pure growth perspective for a primary home with a $1.5Mil budget would a small SFH in Sunnyvale be better than a big SFH in MountainHouse in the next 10 years?

that is my theory. The big swings happen outside the main “Bay Area”

.

well documented. similar behavior as all asset class bull run.

I would love to read up on it. Any articles or pointers to prove the theory.

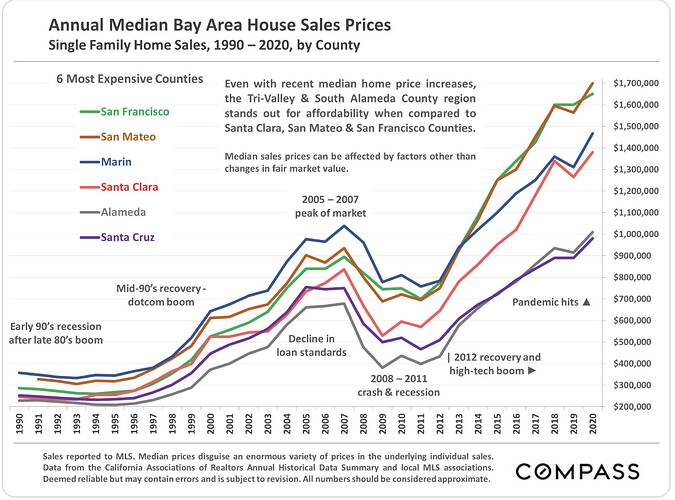

I stole this chart from Compass

From 1990 to 2007 peak to 2009/10 bottom to 2020

Alameda Co: 220K → 690 (3.1X) → 390 (43% fall) → 1.1M (2.8X)

SCC: 250K → 830 (3.3X) → 540 (35% fall) → 1.38M (2.6X)

SMC: 320K → 920 (2.9X) → 700 (24% fall) → 1.7M (2.4X)

SF: 290K → 900 (3.1X) → 700 (22% fall) → 1.65M (2.4X)

Look at the fall from housing top to housing bust, back to 2020, Alameda County has the biggest swing. Followed by Santa Clara Co, San Mateo Co, and finally SF.

The most core area of San Francisco Bay Area is San Francisco.

![]()

Last decade has been unusual because of massive money printing. Homes across all over the USA have seen massive appreciation at more or less same rate. Bay area average has been about 6-7% since 1970s.

This is exactly what I mean when I said that Bay Area real estate has became Darwinian - there is a subset of techies whose salary increase by more than 8% annually and who get showered with stock by their super-high market cap employers. They are the cream-of-the-crop and are driving housing prices because there is so little inventory and they are willing to throw money at it.

But there are people in tech, even in Silicon Valley, who are not earning that handsomely. In my company, which is a tech company but not software, we don’t get stock - just salary and a modest bonus. In a decade of working there, my salary has increased by 35% or so - basically 3% raise every year. Most of my co-workers either rent in the South Bay or those who own, commute from East Bay (Pleasanton, Livermore etc). And these are people with 10-20 years of experience. The new kids, 5 or less years out of college, almost universally rent.

In order to get 8% or more annual salary increases, one has to either aggressively move up the corporate ladder or aggressively job hop every 2-3 years with a big raise. That comes with its own stress. Those of us who work long time in the same role and same company (thereby preserving some work/life balance) get 2-3% annual increments. Unless one bought in house pre-2010 in places like Sunnyvale, such people (I.e., the average techie) are forever priced out.

Having been in Bay Area during dot com bust of 2001-2 and Great Recession of 2008-9, my humble opinion is that you will be much better off (and safer investment) buying in a core Silicon Valley town like Sunnyvale rather than a far-away exurb like Mountain House. When I was buying my most recent house, I was considering Fremont since it’s relatively cheaper. My realtor advised against it saying that in downturn Fremont prices could nosedive whereas Sunnyvale/Cupertino prices would merely flatten. If that’s the case for Fremont, then prices in Mountain House/Tracy where there is vast open land will positively fall off a cliff in a bad downturn.

Your problem is that for $1.5M, you will not get even a small single family home in the nice part of Sunnyvale like 94087. At best, you will get a fixer in 94089, which is the least safe part of town. Or you would have to buy a condo/townhome and live with paying HOA dues etc

.

Not sure whether you are talking to me, anyhoo, the generic behavior of assets…

Upturn…

Type 1 asset: Desirable (blue chip stocks, “real BA”, …) appreciates

Type 2 asset: Less desirable (2nd tier stocks, just outside RBA, …) appreciates at faster rate than type 1 asset

Type 3 asset: Even less desirable (3rd tier stocks, exurbs, …) appreciates at faster rate than type 1 & 2 assets

Downturn…

Prices in type 3 declines

Prices in type 2 declines slower rate than type 3 asset

Prices in type 1 declines slower rate than type 2 & 3 asset

Very normal behavior, you can verify with whatever assets you are interested in, check their historical prices

As to the price changes over 100+, somewhere in this forum, I don’t know how to find it, the search function is not very effective. Anyhoo, this topic is stale to me, has been raised by many new bloggers to this forum and discussed ad nauseam. All the oldies know how price behaves in various counties and zip codes.

Btw, the sudden acceleration of house prices from 2011 is due to FB starting the salary wars to steal talented SWEs from other companies, before that there is an agreement not to steal talent (that is made illegal now), so a sudden acceleration in salary of SWEs which use this windfall to buy RE driving acceleration in prices in RE faster than the post war (world war) annualized (I take it you understand this term) appreciation of 6-8%.

.

I didn’t say techies. I said SWEs. SWEs don’t include those in hardware e.g. semi and those software professional in MIS (not sure what is the new term for this group, IT industry keeps introducing new terms for different jobs e.g. Chief Creative Officer ![]() ) SWE is also a new term introduce I think 3-4 decades ago. I no longer hear terms like business analyst, system analyst, …

) SWE is also a new term introduce I think 3-4 decades ago. I no longer hear terms like business analyst, system analyst, …

I don’t see anything wrong with this. Why should they be entitled to live where ever they like in SV?

Your realtor is extrapolating history. Fundamentals are different now… FB and TSLA are now in Fremont. Is the reason why I quote the example,

At one time, Apple is DOWN hence CU is down, now Apple is UP hence CU is up. Ditto for Sunnyvale, used to be HQ for YHOO (if I recall correctly)… Is the problem with city with only one anchor employer, now Sunnyvale is UP again for a different reason… think… You need to know what are driving the desirability of a neighborhood, a zip code, … not based on extrapolation of historical trend/ behavior.

Basic rule of economics. The rich get richer. So your rich bosses will never share enough for W2 workers. To beat the inflationary housing circus you have to buy as soon as you can and hold on. You have to have conviction like a certain Tesla stock owner on this forum.

The more expensive neighborhoods will keep widening the gap from their poorer neighbors.

Well, my most recent home purchase was a few years ago, well before the pandemic related WFH trend accelerated. This was back in the day when the highways in Bay Area were clogged, so it made sense just from a commute time savings point of view to pay a premium for Sunnyvale/Cupertino compared to Fremont. And it was also well before TSLA stock exploded (back then TALA was a much smaller market cap, loss making experiment in EV). So yes, I agree that fundamentals may be different now and Fremont is every bit as desirable as Sunnyvale, and hence less prone to price drop in a downturn