speculation? With that kind of money, bay area real estate is not a good investment. The only reason RE is a good investment vehicle for many people is leverage and tax deduction of interest. which no longer seems available at that price range. one should buy a home to live. There are many others ways go grow money than buying speculative real estate.

BA RE has always been about appreciation. Especially single family homes.

1535 Fordham, wow.

There are other ways to maximize deducting interest expenses Maximizing Deductible Interest Expense | Silicon Valley Bank.

I still don’t quite get the increase in prices from 94040 and 94087. I know someone mentioned the lower priced activity in PA being more of a farce. Then again, if PA ranchers were regularly transacting like the one that Boolean posted about https://www.redfin.com/CA/Palo-Alto/188-Lois-Ln-94303/home/546263 it makes more sense.

Fordham doesn’t even have any landscaping in the backyard to speak of. They literally just scraped the dirt.

If someone is buying an expensive real estate to live, it is a different matter. Because then s/he is consuming the benefits. But Is RE in bay area of the kind that is selling for 3+ million a good investment vehicle without the benefit of leverage and the tax breaks? Without these benefits, it is as good as buying a bond that yields about 6% + lot of volatility + hassles of being a landlord.

Like I mentioned, the calculation has always been that way. If it helps, I don’t see a lot of speculation. It’s not like the lead up to 2018. It is what it is.

As an investor (assuming you are one), you should be able to evaluate different investment options. For the amount of risk you take, and capital you lock, there can be many other way to invest. At 6% per year, your investment will double in value in about 12 years. That (6%) is the historical rate of growth of RE in BA. That rate might be lesser going forward if population of CA stagnate or declines. I just read someone who said he multiplied his capital 6 times in 10 years in stocks. Go Figure!

I think in these expensive parts of Silicon Valley, people are buying $3M+ houses both to live in and as an investment. These are ambitious and highly skilled professionals.

I suspect they are making the calculation that while the rank and file engineers may be able to work remotely, those who want to climb the corporate ladder need to be physically present at HQ of the FAANG and such companies in order to hobnob with the bosses, customers etc.

So, if they buy a 3M house, live in it for 12-15 years, their kids go to best school districts and get exposure to Silicon Valley mindset, and they have a shot at rising to Director, Sr Director or VP levels at Google, Netflix, Apple etc. Compensation goes up exponentially for those who are successful in rising and they can pay for the expensive house.

I know of such a high achieving couple, the husband is a technical superstar at a premier large chip company, wife is VP of Sales or Marketing at a mid size tech company. For past 15 years they bought and lived in West San Jose (Cup schools). Recently, in 2021, they “moved up” the Valley social ladder by purchasing a $4.5M home in Los Altos. I don’t think they sold their West SJ home…

Should have moved up to Los Altos Hills?

But yeah 4.5M is easily affordable for them.

In that case wouldn’t you rather spend more and get a decked out home for 100k more?

https://www.redfin.com/CA/Palo-Alto/1031-Fife-Ave-94301/home/657091

That Fordham house looks to be in need of updating. Fife isn’t just updated, it’s another level up. There’s a lot more to enjoy than living through a remodel. Fordham has ceilings that slope below 8’ in 2 of the bedrooms. That’s a big negative, it’s an add on or conversion of some sort.

I can understand these homes provide lot of opportunities to the occupant/consumer. Would these benefit someone who is investing to rent these out? Are these good investment given that there are better opportunity at that level of investment? For rental business, mid-market homes are the best. High end homes rent less, and pay less. Low end homes pay more but suffer from bad tenants and require active management.

.

![]()

Cost of land in RBA is rising very fast.

More like 2013. I don’t mean there will be acceleration in price increase. I mean price increase from 2019-2021 feel like 2011-2013. I have no plan to sell my rentals.

.

You think is great? In the last 10 years, many stocks are like this.

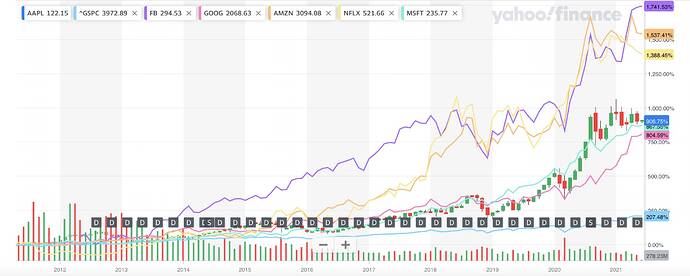

Over the last 10 years, FAANMG gained 8-18 times ![]()

$1M to $8-$18M

$2M to $16-$36M

$3M to $24-$54M

…

From 2013-18, SFH prices in RBA went up by 50-60%, before dropping by 10% or so. Do you think something like that will happen again - if so, today’s 2.5M house will rise to 4M in 5-6 years??!

If that happens, will only the Directors and VPs of the top companies be buying in RBA? What will happen to the rank and file workers - will they be exiled to the exurbs?

This only supports my arguments that holding real estate for capital appreciation is not the best investment strategy for someone who has graduated into the millionaires club. For wage earners, a primary home is still a good tool to save money due to the leverage and tax advantages.

If someone can afford a home in Atherton or Palo Alto, I am sure the person knows who to be a good investor.

Real Estate markets have crashed in the past to align the prices of homes with salary and rents.

Added Later: If that nature of work changes and the presence of rank and files workers is not required, then they can relocate to exurbs without any impact. No commuting ties between exurbs and RBA is expected.

The problem with crashes, be they in stock or RE markets, is that the timing and triggers tend to defy easy prediction. Yes, Bay Area home prices will crash in the future, but for example, the next crash may be 20%, 5 years after it has appreciated a further 50% compared to today’s prices. That’s just a random scenario, for illustration purpose

No. The real issue is when there’s a crash everyone is too scared to actually buy. They are convinced prices will keep falling or there will be a second crash. By the time they feel safe buying, prices will be above the prior high.

And the people who have stretched themselves to buy overpriced homes and those who have little margin of safety if they loose job, they will be worst hit.

The unusually high priced homes tend to loose value fast in the time of crash.

Particularly the Trophy homes, that are bought high and are sometimes sold low.

Buyers are more constrained during a crash. They have to get a down payment from somewhere. For a 2.5M home, minimum down is 500k (20%). That kind of money is typically obtained by selling stock. But stock also crashes in the downturn. Very difficult totime the market so well as to sell the stock when it reaches a peak, then hold in cash until the crash occurs to put down payment and buy RE…

.

Exactly what I say I don’t mean this will happen. Just because first two years feel like the same doesn’t imply the same behavior later on. I have no interest to guess. I have no plan to buy or sell, whatever happen won’t affect me.