You might want to check graphs from 2008 and see where prices were hardest hit. Your opinion doesn’t match that reality.

The number of bears on the original Redfin forums in 2008-2011 easily out numbered the bulls. They all claimed to have plenty for down payment, but they said prices would drop when interest rates went back up. There was also a lot of talk that price/rent ratios still screamed bubble and prices would crash another 20-30%. They were so confident they’d be able to buy later at even lower prices.

It’s the same with who bought stocks in March, 2020 when market was down big and the VIX was at 80? Historically, a VIX of 80 is peak panic, max selling, and pretty close to the bottom. All the talk was about how much lower the market would go and how there’d be even better prices.

Fed balance sheet and debt to GDP is alot higher now than any time in the past. Any bubble deflating will be very hard to re- inflate.

Chances of $3M convert to $6M can only happen in dollar loss of value in big way that itself a bigger problem.

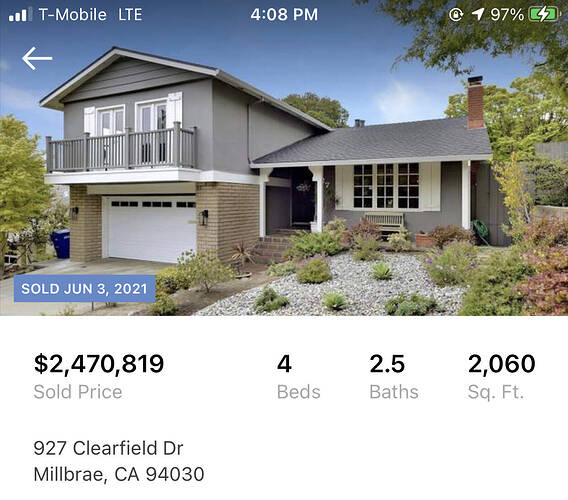

2000sq feet updated Millbrae homes sold for less than $1.5M. i already gave previous example of Millbrae where prices are not rising relative to other areas.

https://www.realtor.com/realestateandhomes-detail/927-Clearfield-Dr_Millbrae_CA_94030_M19150-47555#photo14

4300 sq feet duplex sold for $2M in Millbrae built in 1984. relatively new… This will not even cover construction cost.

https://www.redfin.com/CA/Millbrae/33-Silva-Ave-94030/home/2049231

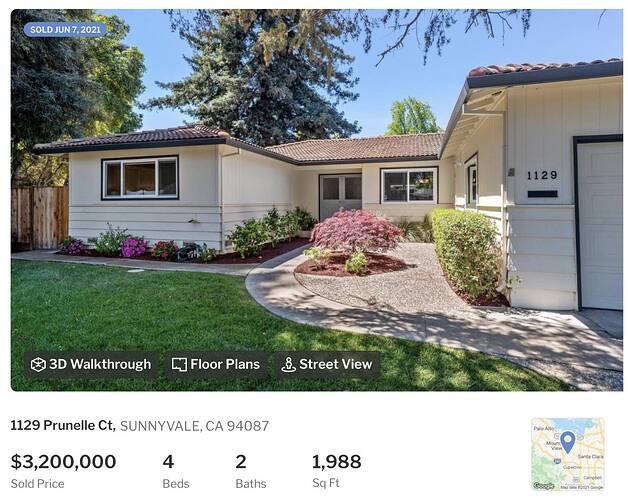

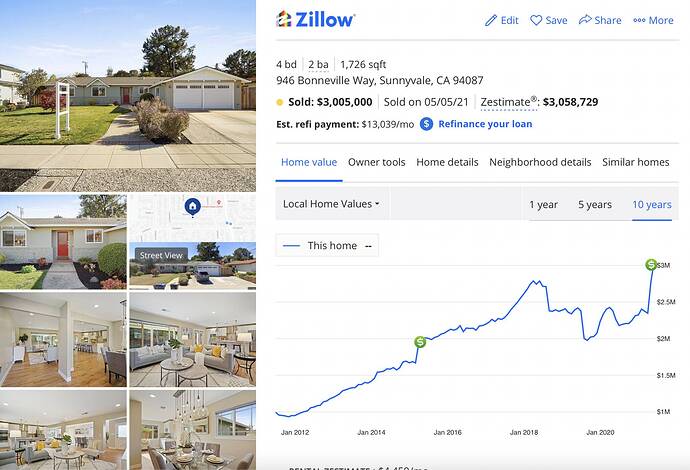

This house on Prunelle Ct in Sunnyvale just sold for $3.2M. It became famous in 2017, less than 4 years ago, when it sold for $2.47M. The Mercury News ran an article on it, saying that it was shocking that a house in Sunnyvale sold for almost $800k over asking at nearly 2.5M.

Now, I wonder if the Merc will run another article saying that the same house has again sold for 700k over asking and appreciated by almost 750k in 4 years…

Expensive and less liquid homes (that do not have good comparable) have big price swings because they have to be priced individually.

Please. It sold for 2.5M:

Can you be right for just one time? Phantom Russian fabs, hyperinflation, $150 oil. Seems like you live in your own hallucinated world.

Even if it sold for $2.5M. it is remodeled home. not old shake.

here is another one fully remodeld for $2.4M.

the othere one over 4000sqfeet. Prices are very less considering the inflation in remodeling work.

https://www.zillow.com/homes/13-Camino-Alto-Millbrae,-CA,-94030_rb/15508994_zpid/

https://www.zillow.com/homedetails/710-Santa-Barbara-Ave-Millbrae-CA-94030/89238132_zpid/

.

Mercury has nothing new to report. Ofc is new if you haven’t heard of it.

I suspect you and @marcus335 are not on the same frequency. Houses that are priced too far from the median price in a neighborhood are hard to sell, many of these houses have customized features… not many like these features. I always buy a median house at median price… max local supply and demand i.e. max liquid.

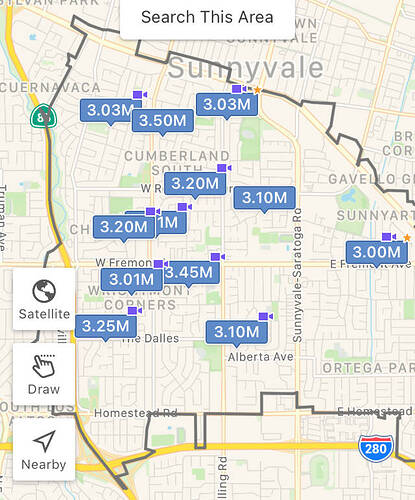

Sunnyvale has been regularly selling for over 2M it’s hardly news anymore.

At 3.2M? Now that’s more interesting.

https://www.redfin.com/CA/Sunnyvale/1129-Prunelle-Ct-94087/home/1376492

13000 sq feet lot, but odd shaped. Typical in Sunnyvale is 6000

Sunnyvale still baffles me. I think the best parallel is Mountain View. Schools are mediocre but it’s close to jobs. My impression is that MV price is still a cut higher than Sunnyvale. Is it still the case?

Yes, Mountain View 94040 prices are significantly higher than Sunnyvale 94087 - maybe by 20%.

Cupertino 95014 prices are also higher than Sunnyvale 94087, though lower than Mtn View 94040.

Best explanation I have is that Sunnyvale is sandwiched between Google (Mtn View) and Apple (Cupertino), so it benefits from both those premium corporate HQs, but is lower price than their host cities.

Some parts of 94087 are assigned to Cupertino School district - the Serra Park and Ortega Park neighborhoods. Their prices are closer to Cupertino 95014 as a result

Both Sunnyvale and Mountain View must have a ton of multifam apartment buildings. Otherwise their schools should have been at a much higher academic level based on the people owning houses there.

Sunnyvale is such a has-been - was a boom town in 1990s during the go-go dot com days, and since then over the hill. The best one can expect from Sunnyvale, Mtn View etc is 5-6% annual appreciation, going forward.

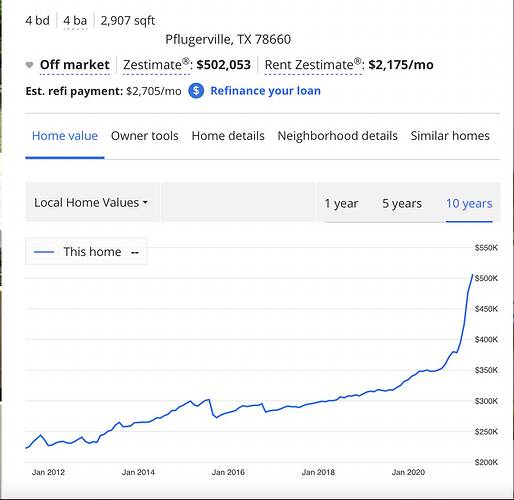

Definitely would recommend the young Gen Z cohort to invest and live in places like prices in Pflugerville TX

The voodoo chartist in me thinks it looks like a blowoff top.

The historic rate of appreciation has always been about 6% for Sunnyvale RE and other parts of Bay Area, at least since 1970. It is only about 3% above the long term US average.

Correct. That’s why I said that the best case scenario for places like Sunnyvale and Mountain View in the RBA is 5-6% average annual appreciation going forward.

For cities like these, where SFH prices are reaching $3M, the rate of appreciation is likely to slow down - probably 4% average annual appreciation is more realistic.

This is not a good scenario for a 30 something millennial couple looking to buy their first SFH. Even if they have $1M saved up (how?), they would still have to take a mortgage in excess of $1.5-2M to buy in RBA. And get only mediocre returns by way of appreciation.

Instead, the same couple will be better off buying in the suburbs of Austin, where they only need $200k or so down payment to get a similar house for $800k or so. And % appreciation will be higher too.