Many times I have told Media Analysts are giving nice running commentary after that fact!

No way for me to go endless debate. Just read investopedia.

Correct. It is up to us to identify and decide what to buy and when to buy/sell/hold.

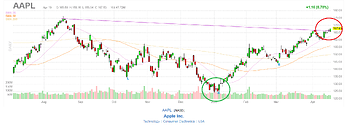

For example: Will you dca AAPL at this point ($167) or dca when it is low ($125)?

In fact, you are pulling my mouth. Anyway,my long term (months, years) predictions are like astronomy, everything from inference or analytical guess, but not blind.

But, short term 1-day to 45 day are algorthmic (it is a science, mathematics). Last few days, I made a count down, that is based on inference from my market data report peaking at present time.

However, connecting this May 3rd FOMC meeting etc are analytical and making an inference.

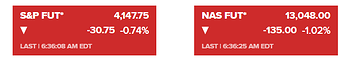

Connecting Friday is OpEx, I guess market has the potential to go down Friday, Monday and Tuesday as I have no way to know the future. Based on the data analysis, I understand the likely chances for market to go down is higher than go up. This is not astronomy, but gives me an edge to stay cash.

Yesterday, myself and my partner discussed and stay complete cash mode as market has the potential to go down (and may or may not recover - due to FOMC).

Now market shows