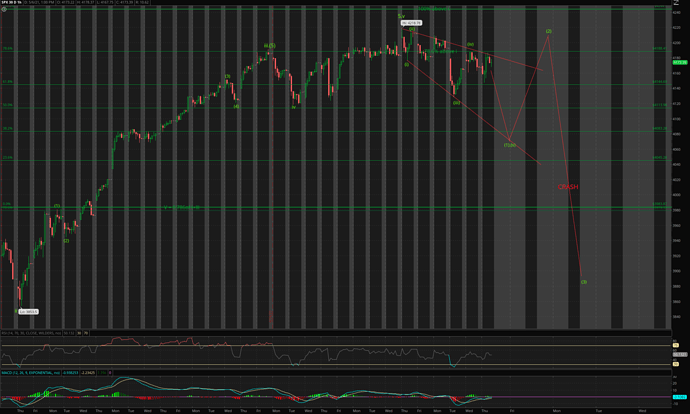

Very tradeable. Long ATH put with 1 month expiry ![]() Now I am eager to see completion of W-5

Now I am eager to see completion of W-5 ![]()

.

Since Panda said start building position…

BTO 1 SPY put(Jun18 $420) ![]()

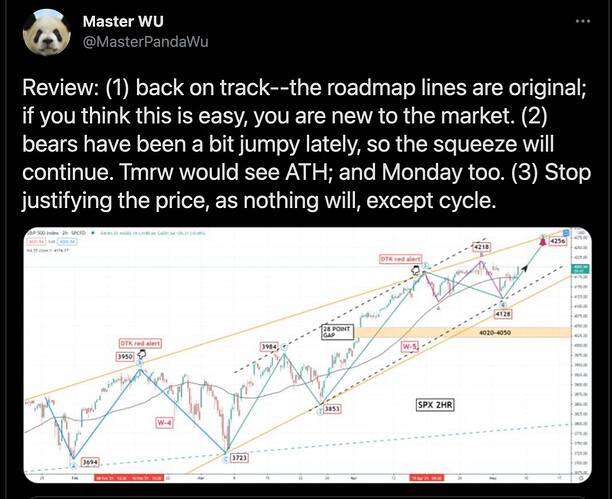

Will keep adding as GSPC pushes towards SPX 4244-4274.

Also considering BTO SPY put(Sep30 $420) ![]()

Will go aggressive once SPX pushes past 4244… BTO SPY put(May21 $425)

Looking at the SPX chart, if we take 4218 as completion of the century wave [I].(V).V.5.v… then the price action following that looks like an expanding leading diagonal ![]() That is should long put now… I suspect Panda saw this alternate count so he started short position… there will not be a 2nd DTK red alert! The first one is the correct signal. So…

That is should long put now… I suspect Panda saw this alternate count so he started short position… there will not be a 2nd DTK red alert! The first one is the correct signal. So…

BTO 1 SPY put(Sep30 $420)

So my short position is now…

BTO 1 SPY put(Jun18 $420)

BTO 1 SPY put(Sep30 $420)

To confirm, did you say you went long the Jun18 420 put and the Sep 30 420 put?

BTO = Buy to open

BTO put = Long

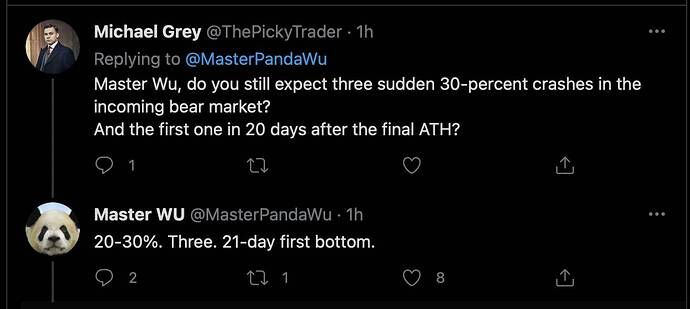

Blowoff top for SPX 2mrw or Monday?

Thinking of doubling short position 2mrw ![]() Double again on Monday if till goes up. Once in a lifetime, must do

Double again on Monday if till goes up. Once in a lifetime, must do ![]()

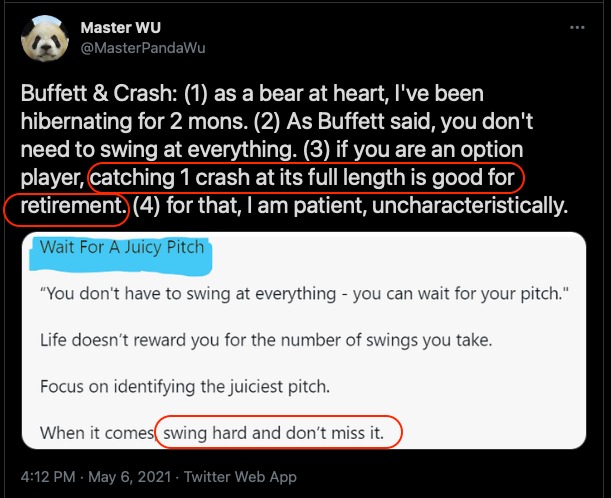

Hmm… swing hard and don’t miss. So I will up my short bet from $20k to $1M.

Now, when is the crash window?

SPX 4236.72 not in 4244-4274 zone yet…

Now…

BTO 1 SPY put(Jun18 $420)

BTO 2 SPY put(Sep30 $420)

Yep, looks ripe for short soon. I’m looking for one more rip along with crypto, then I’ll reduce crypto positions across the board and short the stock market.

If the confidence is high about a crash, why go ITM? Comparatively OTM is more risky but has higher returns afaik. I’m curious to hear your thought process about this play

HoD SPX 4238.04 not in 4244-4274 zone yet…

First thing first, I am a lousy trader especially using options ![]() That is, I don’t make much overall using options… I tend to hold calls for too long (greedy and underestimate the gamma and theta) and hardly trade puts… this is one of those rare time. The huge bet I bot 4500 TQQQs instead of QQQ calls because I am ready crap in trading calls… luckily I bot TQQQs, if QQQ calls, I won’t be laughing now.

That is, I don’t make much overall using options… I tend to hold calls for too long (greedy and underestimate the gamma and theta) and hardly trade puts… this is one of those rare time. The huge bet I bot 4500 TQQQs instead of QQQ calls because I am ready crap in trading calls… luckily I bot TQQQs, if QQQ calls, I won’t be laughing now.

Anyhoo, I doubt the top is in and the “crash” is a wave three so still need SPX to peak, then a decline (wave one), a bull trap (wave two) and then crash (wave three). The best reward for OTM put is during wave three (crash). So is not the time for using OTM put. Make sense?

Just in case you miss below… is just initial play… not the uber aggressive play yet ![]() If successful, increase $$ for uber aggressive long OTM put to make the uber return… hard to time… will try.

If successful, increase $$ for uber aggressive long OTM put to make the uber return… hard to time… will try.

Btw, cash position in the three trading accounts:

Account 1&2: 100%

Account 3: ~95%

Waiting for the inevitable bull trap (wave two) and the crash (wave three) to do hard swing… hope I don’t miss it ![]() Meanwhile, messing around to keep myself alert.

Meanwhile, messing around to keep myself alert.

ok. I started a small position - spy otm put 6/18. Will keep adding next week if it goes higher.

One big issue with options is that can’t trade extended hours. Quite often, share price peaked or bottom during extended hours and reverse direction swiftly during market hours. I lost a lot of money or profit because of such price actions. Trying to buy at bottom and sell at top won’t work for options… need to give up some money for safety.

That’s been my experience as well. I got burned in the past trying to be greedy so I sell for good gains and not excellent all the time.

Catching up here after a few very busy weeks. So, are the experienced traders here gearing up for a crash/correction next week?

Is today’s 0.83% gain classified as blowoff top?

.

When you see a hill, there is a hill.

When you see a hill, there is no hill.

When you see a hill, there is a hill.

You need to lift your head further up to gaze the stars.

Beth’s EW guy Knox has an uber bullish preferred count for NASDAQ 100… chart dated Apr 9

Today is May 9, we know his count is wrong.

@manch may be following Knox and is disappointed so he boo-booed EWT. What he should do is boo-booed Knox and embraced Panda.

Caveat: Count from Mar 2020 is pretty hard to label, all we know for sure is in wave 5, other than that so hard to label the lower degree counts… all labels don’t feel right ![]()