With crypto, from base to rip, I can stomach 30-40% drops but not at the top. It definitely doesn’t look good for crypto though right now. I don’t like taking big losses so I generally exit quick if large investment and I’m sitting on nice gains.

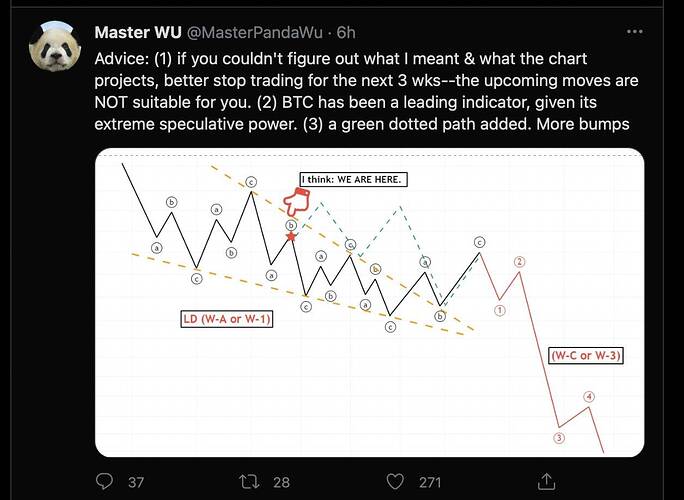

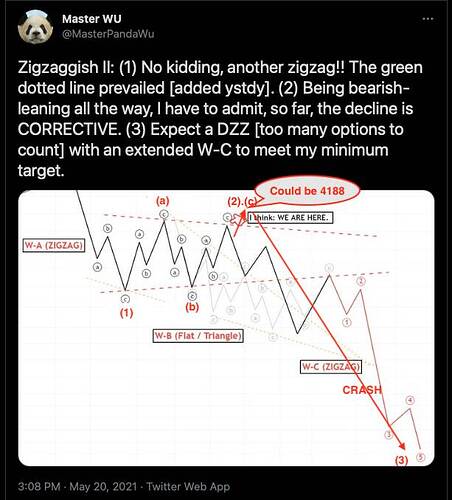

This dude is pretty good as some trades he recommended came to fruition. I think if he’s right, we have topped BTC this cycle (breaking halving cycle theory for the first time) and we should see SPX tank very soon. Possibly a week or two away as Panda mentioned. If I can exit out of BTC at 44k, I’ll put all the profit to 1mo, 3mo, 6mo SPY/QQQ naked puts ($150k+)…maybe!!

.

I need to up my $50k investment to match you.

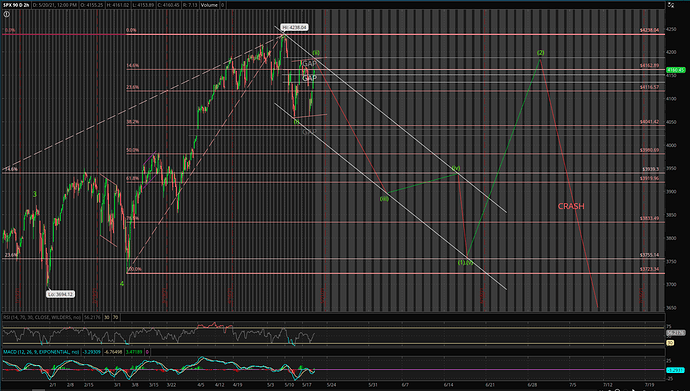

Btw, the Cycle turn date is mid Jun ![]() - don’t know is completion of wave (1) or (2)… is a turn date… don’t know is top or bottom

- don’t know is completion of wave (1) or (2)… is a turn date… don’t know is top or bottom ![]()

Haha. Yeah, I would like to see a nice multi-day ripper before I can go in with a bigger amount. It’s looking nice for a big correction. Either way, I’ll slowly build a position from what I have now. If no crypto profit, just with play money.

Btw @hanera, another finwit I’ve been following that’s pretty good. I think he has a very similar count as Panda for the next 1-2 month. He’s pretty bullish on bitcoin though and he expected this drop. Short term, SPX drop may be over. I may switch to bullish by tomorrow or Friday, then short again on a rip.

.

Panda added a sideway green dotted alternative… bullish compare to original leading diagonal… it won’t change the mid Jun crash…

why did xlc and xlk did good today?

Don’t follow them or any macros.

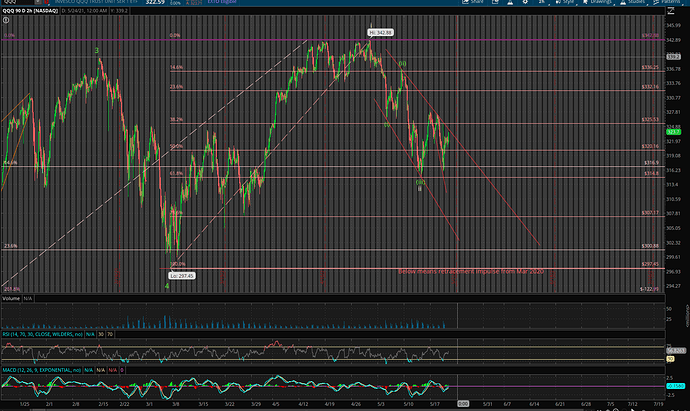

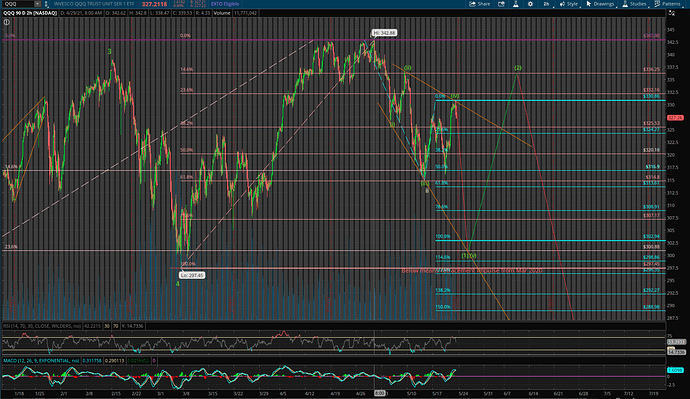

While Panda opined that SPX is going into a bear market, QQQ has a bullish count that is more plausible than the bearish count!

Green is the preferred count (based on Panda’s view)

Yellow is the alternative (bullish) count

Ignoring Panda’s view, I would think yellow label is the preferred count because the wave ii is at 61.8% (exact!!) retracement of the wave i and the re-bounce from wave ii is impulsive follows by a corrective down wave… I am confused… to hedge, I bot some TQQQs!!! In fact, I regretted not closing all QQQ puts for safety… when confused, close all position… btw, in case @manch starts making ignorant comments, talking about trading, not investing. Investing and trading are two different worlds. If I am investing, I would have started nibbling HIGH CONVICTION (not sure what this meant) stonks with DIAMOND HANDS like Cathie. May be I should scale into COIN SQ RBLX ![]()

Critical decision point for QQQ…

Trust Panda, SHORT HARD…

Lost faith, CUT LOSS…

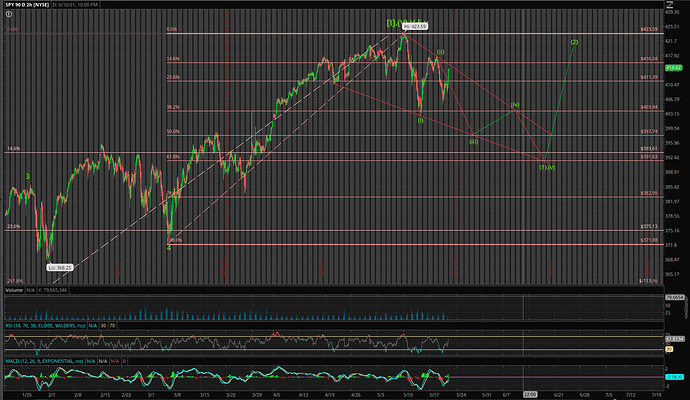

As for SPY, few more points to critical decision point…

I’m waiting until Friday for direction. I got rid of all my puts at opening. I’m already in heavy across bitcoin, coin, Cree, celh and viac so it’s been working out ok. No need to go long for me yet. Another put opportunity approaching.

.

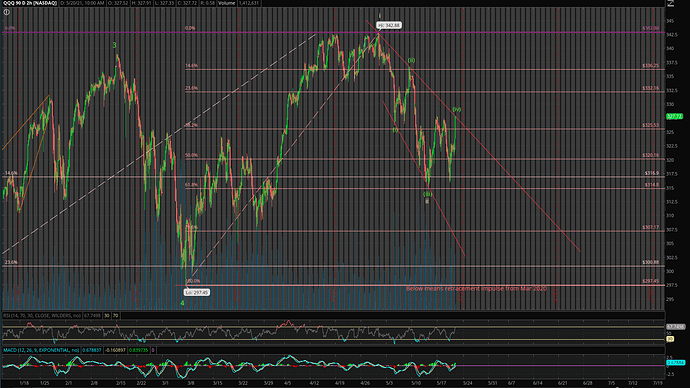

I just closed the TQQQs hedge. The price action is in line with Panda’s new dotted green lines. Look like no more leading diagonal for SPX. But look like leading diagonal for SPY, and a LED for QQQ.

I was debating whether it is better to get rid of puts or long calls/TQQQs/ UPROs, I decided to long TQQQs. In fact, I bot TQQQ just before the close yesterday and added more during PM. I kind of getting the hang of day/swing trading… not fixated to any directions, let price actions tell you. But still not very clear the right strategy to use.

As for adding to long puts, I am not sure it is better to add now (kind near the peak if Panda is right) or wait for 2mrw where IV would be crushed. What is your view? Note: Given the volatility, I agree with Panda that safer to build MT/LT short position and avoid ST if too inexperienced and clumsy.

I’m likely going to wait until Friday or next week for buying any more puts. The put premiums have been going up and I think those need to get flushed down. I prefer to wait if indecision. I like looking at MACD (daily and weekly) and daily is at inflection point and may actually head up. Weekly definitely over-extended. They are not the best indicators but daily MACD has been pretty good for QQQ lately. We are getting close. Maybe another 1-2 weeks of rip/zigzag, crush the IV and things will get flushed down.

Assuming Panda is correct about SPX going into a bear market, my take is his guess of a leading diagonal (to confuse stale bulls and clumsy bears) is not correct, looks more like a normal extended wave three bearish impulse as follows:

wave (ii) is a flat, currently in wave c (up wave) and about to be completed probably Friday or Monday.

Panda is quick to claim victory. However, if it is a flat instead of a double three, then 2mrw SPX would push to 4188 (see red labels). And follow by a CRASH, it would be a joke that Panda himself miss the tip of W-2… 2mrw would be interesting. Anyhoo, I continue to add to my LT short position.

Due to the threat of an alternative bullish count, dare not have ST short position (too risky), only MT/ LT short position,

~$60k outlay

10 SPY put(Sep30 $400)

30 SPY put(Mar31 $285)

15 SPY put(Mar31 $360)

Yeah, SPX 4180-4190 was the line I was thinking about. I’m not surer if I’ll bet big yet because if it does breakthrough higher, I think we can melt up. Also, Bob Loukas’s cycle bottom worries me.

.

SPX hits 4186.11… a five wave structure from 4061.41… the flat may or may not be completed because 4186.11 could just be a lower degree wave one of the fifth wave…going below 4150 would confirm that the flat is completed… anyhoo, I am surprised the gap is not filled, only few dollars from filling… which means future wave (2) is likely to fill it… that would be a very big whip saw, down big, up big… I would rather see it filled today rather than few weeks later.

Edit: Hit 4188.72 ![]() Good job.

Good job.

Since peaking at 330.86, QQQ has been grinding down gradually… many BTFDers slowing the decline… any1 game to long short term QQQ put? I bot…

10 QQQ put(Jun18 $315) ![]() I need QQQ to decline FASTER.

I need QQQ to decline FASTER.

20 contracts Jun 18 Spread 312/307

6 contracts Jul 16 Spread 319/315