I’d prefer to get a better clock instead.

.

Get an Apple Watch ![]()

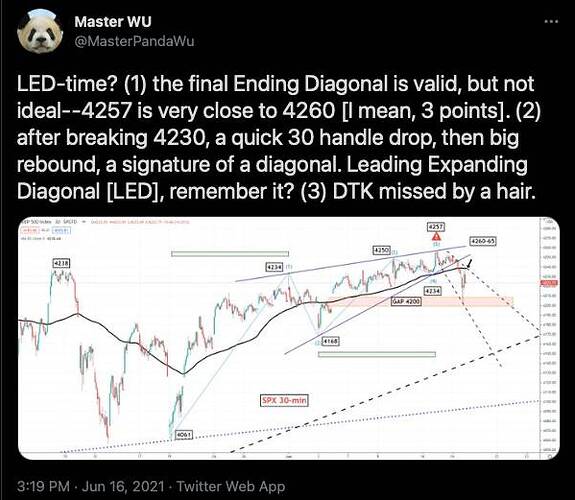

If you are sufficiently detailed, you can claim that he is wrong. He said quick 50-80 points after 4230 is broken, I see only 30 points ![]()

Btw, the ATHs for QQQ and SPY happened yesterday ![]()

I’d prefer to be approximately right rather than precisely wrong.

.

You are the one who insist on precisely right!!!

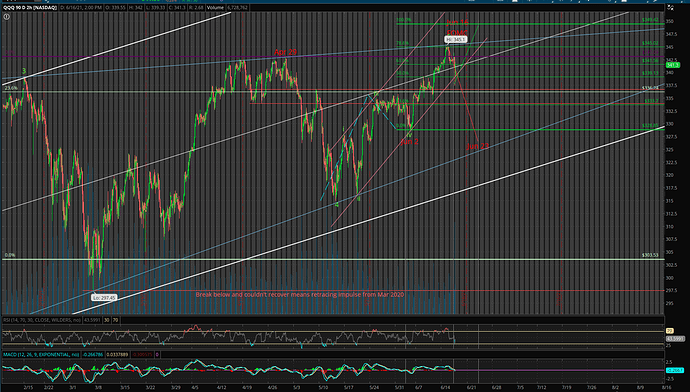

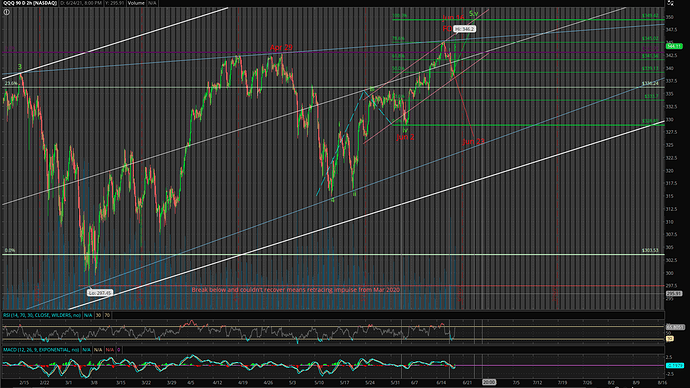

Anyhoo, my preferred and alternative counts for QQQ… all target are indicative and subject to changes as development progress… no sane planners would stick to the plan so no sane forecasters would stick to the forecasts ![]()

If you want some low hanging fruits successes after the fact…

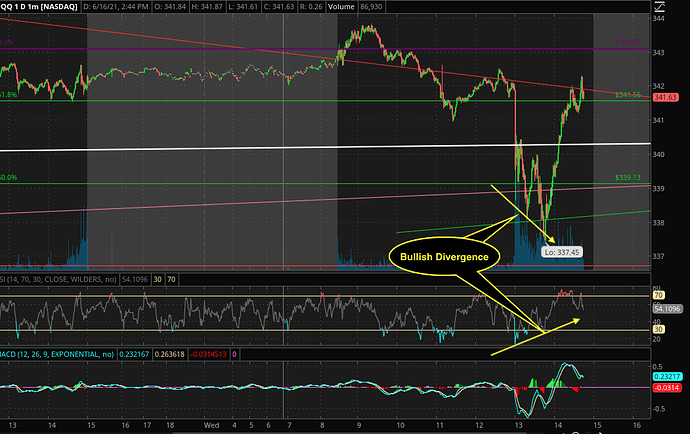

Closed QQQ/SPY weekly puts (bought in the morning) when indices were near the low where bullish divergence at 1 min chart occurred.

Closed hedges i.e. UPRO and TQQQ.

Now waiting to add to MT/LT short position.

Today the Fed forecasts not one but two rate hikes by end of 2023. Look at how the market reacts and tell me how a crash will come in the next few weeks.

.

Btw, what is your definition of crash?

Since you insist to be precisely wrong let’s use Panda’s definition.

Unfortunately, from the chart shown by Panda, I didn’t see any crashes  using his definition. He merely draw some wiggles trending downwards.

using his definition. He merely draw some wiggles trending downwards.

My gut feel is down down down… for 3-4 months. Can’t give you any precise  concrete target prices and dates.

concrete target prices and dates.

Btw, I haven’t read Fed comments and videos, spend too much answering/ entertaining you.

QQQ chart: My guess is you didn’t look at the 90d 2h chart posted. QQQ touched the upper channel line of the ascending wedge… no overshoot as expected by Panda nor undershoot… touched precisely on the line. Btw, I didn’t say it won’t overshoot… so far touched the line yesterday and pull back.

A confident Panda is back.

And then become cautious… he is not confident that this DTK red alert is that valid… wtf.

Panda got spooked by the market action today. Fed says it will raise rate two times by 2023 and market just shrugged it off.

The bond market is pretty chilled about higher rates. 10Y Treasury is still lower than March peak. 1.57% doesn’t strike me as saying the bond market is worried. Not at all.

2023?

A useless prediction. No wonder it was basically ignored. No one knows what will happen between now and 2023.

SPY is trading lower than yesterday’s LoD.

QQQ, after making a new ATH 346.2, is declining fast.

After the fact scalping activity (taking a break after watching 4-5 TV serials), long ST QQQ put around ATH and sold too early. Consolation: Added ![]() to QQQ LT short position… moving in opposite color to DTK, less red, not pink yet.

to QQQ LT short position… moving in opposite color to DTK, less red, not pink yet.

Jun 19 is a federal holiday wef next year.

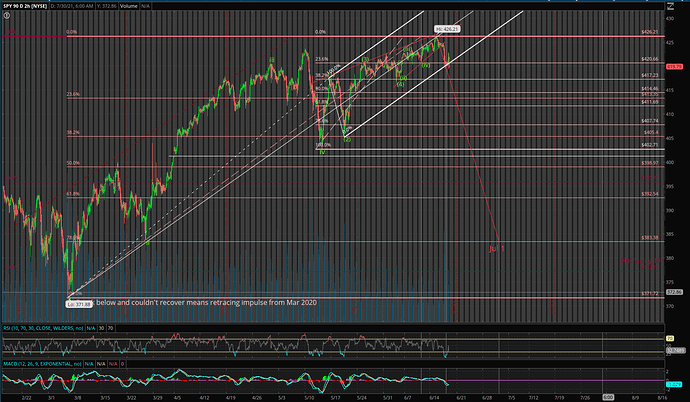

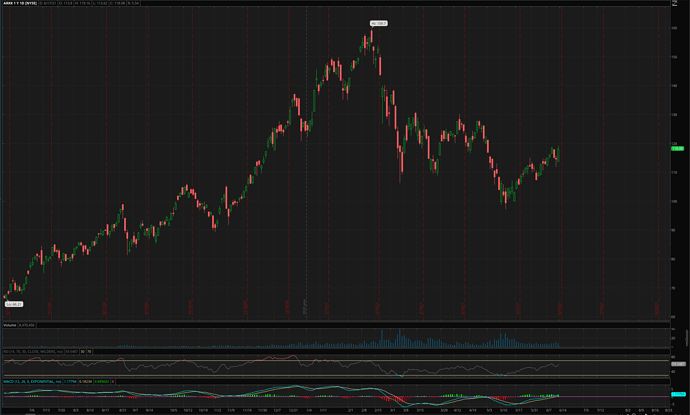

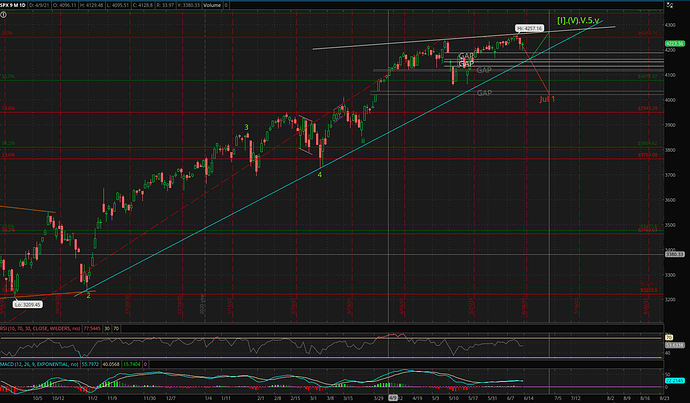

Updated SPY chart… based on fib time spiral (not cycles, not astro), the next turn date for SPY is Jul 1… how accurate is it I don’t know… might as well use it to guess is a low ![]()

There is a divergence between SPY and QQQ… FANGMANT is green so “value” stocks are dragging down SPY. Ironic right? @manch has been pounding on the table that value stocks would rocket because of the re-opening of the economy. Don’t talk about NVDA, @manch is ecstatic (he has been hinting many times) and we should pretend we don’t know about this dumb stock that he owned plenty.

.

Updated QQQ chart…

Preferred count is rally to 349.42 before a pull back.

Alternative count is pull back to 325.

So far seem to be following preferred count, HoD so far is 346.2…

Based on fib time spiral (not cycle, not astro), turn date for QQQ is Jun 23… don’t know is a top or a bottom.

![]()

Anyway growth stocks aka Cathie stocks bottomed in mid May when everybody was busy writing her obituary.

Enjoying the fireworks today.

![]()

.

I bought tons at $150s after hearing you pounding Cathie Ark. As it declines, keep adding till 130 and gave up and sold around 135 to cut loss. What so good about ARKK? still trading less than the price I sold. So you are not talking in context, if I have bought in 60s, I would be happy and won’t be so remorseful.

I thought you were the one who preached long term buy and hold investing? Pretty weird to watch you turn into an Astro and moon cycle daytrading guy.

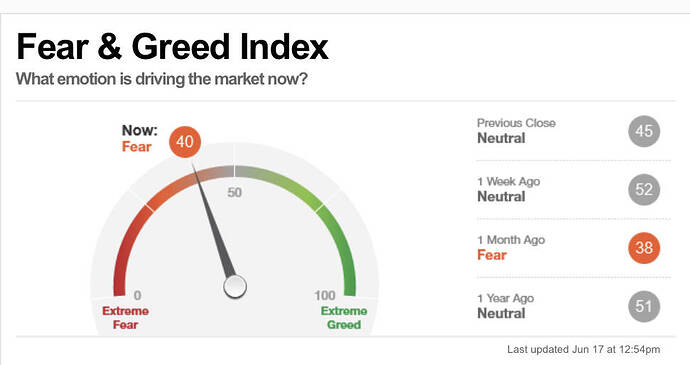

I really only follow one indicator. Seems to me it’s not a good time to short the market when there’s already a lot of fear out there.

.

Astro and moon? I am not a member of sun moon religion 日月神教 and definitely not eastern invincible 东方不败

You have memory problem? My only buy n hold is AAPLs and index funds.

Correct. When JPM keeping 500 billions cash on sidelines and many big banks have excess money market funds exceeding 720 billion sitting at FED reverse repo waiting for market decline…market won’t fall.

Any fall/dip is temporary and will keep going up and up until all gets FOMO and drain their cash into market.

Market bear will attack surprisingly after a month when everyone is FOMO with zero cash on sidelines!

Exact scenario happened in Dec 2017, market went up and up until all gets into FOMO and then dropped 8% !

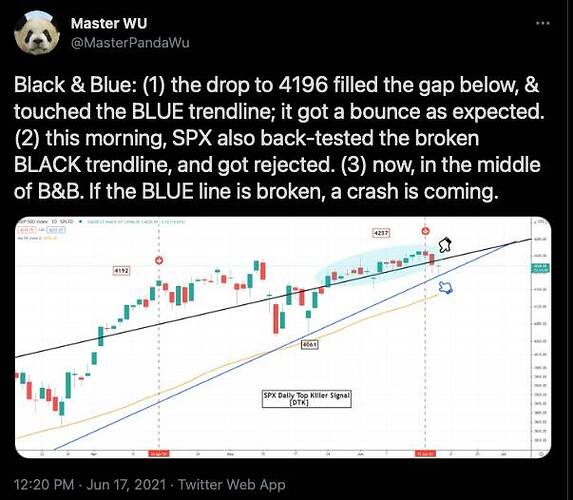

Panda answered @manch prayer for a crash… don’t know why need to be a crash, why not just a decline.

Because cult leaders gain believers like you by peddling doom and gloom. If there is not an end of the world how can he “save” you from the coming disasters?

Anyhoo I don’t like his black line (I drew as white line in my SPX chart below)…

From the chart below, a continued pull back hitting the blue line could be a re-bounce to a new ATH. Even if it is broken, I don’t see why it must crash… because still not clear whether what it is retracing… need to monitor the price action ![]() around those critical fib lines.

around those critical fib lines.