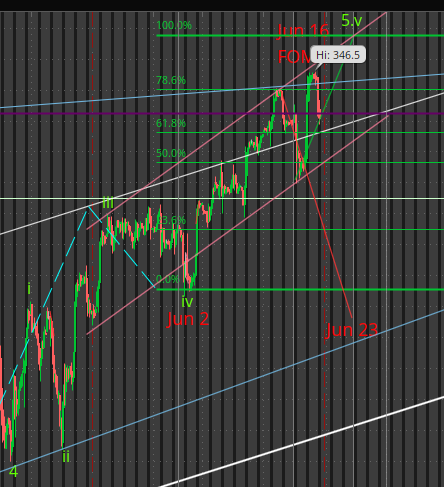

Bowing to @manch demand for precise concrete price and time targets, Panda posted the chart below… IMHO, Panda is providing ammo for @manch to pan pan him.

I notice Panda now has the same Jul 1 target as me ![]() (see chart posted above this post)

(see chart posted above this post)

Bowing to @manch demand for precise concrete price and time targets, Panda posted the chart below… IMHO, Panda is providing ammo for @manch to pan pan him.

I notice Panda now has the same Jul 1 target as me ![]() (see chart posted above this post)

(see chart posted above this post)

.

Sound logical but there is a flaw. Is FGI accurate ![]() ? Try not to make statement that is logical but didn’t ensure that the premise that it based on is on quick sand. That is, ensure that premises are rock solid and facts are facts before making a statement based on them. Easy to make logical statements as they are uttered by so many many many pundits.

? Try not to make statement that is logical but didn’t ensure that the premise that it based on is on quick sand. That is, ensure that premises are rock solid and facts are facts before making a statement based on them. Easy to make logical statements as they are uttered by so many many many pundits.

I presume you dare not challenge consensus views by technicians that indices will go into correction (individual stocks can behave differently) but don’t believe Panda’s view that there would be a crash nor indices would go so low.

Currently, SPX and SPY are trading lower than the “BTFD” moment on Wed. Unless proven otherwise, SPY 426.1 is the ATH.

Want to withdraw your statement?

ST: Might be completion of a bearish impulse and a reversal.

Include Panda’s LED for easy comparison…

If there is indeed such a consensus, which is impossible to verify, I would most certainly dare to challenge it by putting real money to go long. Consensus of talking heads is usually wrong. This is the bullish thing I hear from you this year.

.

Technicians not talking heads. Don’t change the words because it changes the meaning. I don’t listen to talking heads, I know you do… you has been posting two talking heads talking lately.

Technicians who never made much money? Sure. I will bet against them. Where did you find such a consensus? Is there a survey of them somewhere?

They are mostly just talking and not really putting money to work BTW. So they are talking heads by my definition.

Scalping… bot yesterday and will close today… usually I don’t keep overnight but the chart looks bearish… definitely no over weekend… anything can happen eg. influential talking heads like @manch might make an uber bullish call ![]() Btw, for day trading, can long calls or puts depending on the look of the chart. Long put this time.

Btw, for day trading, can long calls or puts depending on the look of the chart. Long put this time.

Panda is quick to claim success and reiterate that a crash is coming. Anyhoo my chart indicates a possible re-bounce too but not sure is like last time shot near and eventually make a new ATH.

Chart below is SPY. Btw, I see a five waves down in SPY which is different from what Panda see in SPX. That is it is possible that SPY crashing already… no meaningful re-bounce as suggested by Panda. Monitoring the price action closely… my MT/LT short position is very happy. No ST short position.

Chart below is QQQ… look like want to re-bounce… closed the ST QQQ puts for safety. Hold MT/ LT short position, contrarian to the well read crowd with great FA skills.

Latest update from Panda. He suspected that there would be a Black Monday, I think is a Red ![]() Monday, anyhoo, I didn’t add to any short position… already too large

Monday, anyhoo, I didn’t add to any short position… already too large ![]()

Panda has a love for LED, IMHO is just a normal extended fifth wave impulse… I labeled it in red.

I hope it rips on Monday morning so I can short…just for a day trading. Today was a nice day for SPXU calls I bought the other day (closed today). If SPX goes to 4000 next week, I’ll go all-in with full margin likely.

I told you not to expect any black mondays in June. Historically most of the black Monday’s occurred in the fall: August, September and October. Some took place in March. June and July are summer vacation months. Many are kicking back on the beach and in happy moods generally.

Can we have a black Monday in June? Sure, anything is possible. But I won’t bet on it.

.

Look like despite what I have said you still don’t understand. You can expect anything so long you don’t do anything, your financial position would not be changed. All this saying assume you would take action. You don’t take any action, can expect anything or say anything.

Three possible scenario for SPX… blue labels is Panda’s view. The other two are views by different technicians.

@manch will ask which is the accurate clock. It means he doesn’t understand what is price action. You don’t have to choose. For example, if break below 4000, @pastora would go all in short. Just a hint to @manch what is price action.

Three scenarios that all go down 2000 points around year end? Really?

.

Just drawing… not to scale… look nicer in parallel ![]() don’t over read. Only Panda’s one is. Don’t ask how Panda determines the time, I have no idea and don’t know how to determine time.

don’t over read. Only Panda’s one is. Don’t ask how Panda determines the time, I have no idea and don’t know how to determine time.

Look like you still don’t understand price action ![]()

Maybe it’s better not to understand, or to make the mistake of thinking you do.

![]()

Time to sell everything and hide in a cave.

![]()

![]()

![]()

If you try to time a 10% correction you’ll be 5% late for the start and 5% late for the rebound - if you’re lucky.

Correct. Best is to do nothing, or rather sell nothing. Keep buying a little bit at a time - that’s why a 401k is perfect. If market falls, you get a discount.

Only sell after retirement, and sell only a little bit at a time, not all at once

Sell nothing in retirement and just live off the dividends, giving your heirs a step-up in cost basis and avoiding all that tax.

Unless the government decides to change the rules, then do as you say.