When can we expect this to happen based on your analysis of waves?

.

If correction,

VIX should be over 20, is not above 20 yet.

SPX should be below SMA 20 day, still above SMA 20 day.

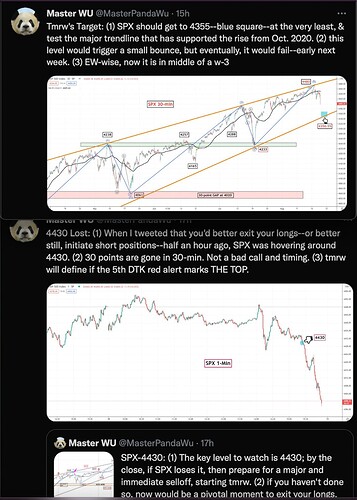

Well, Panda and Beth are wrong. Is only a pull back, not even correction. DTK is correct though.

Regrettably I bought more MU instead of NVDA.

Meanwhile the only one that matter, AAPL poises to make a new ATH.

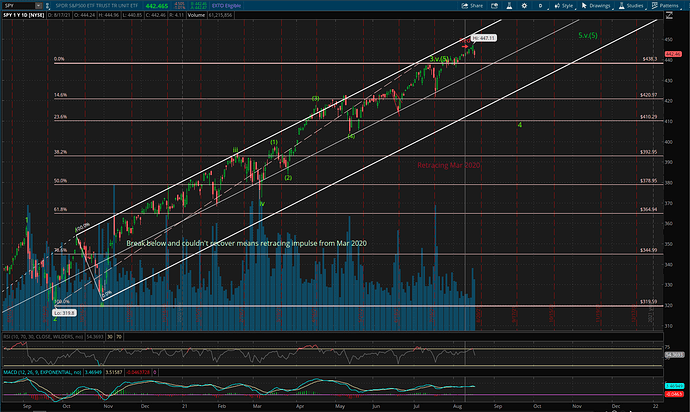

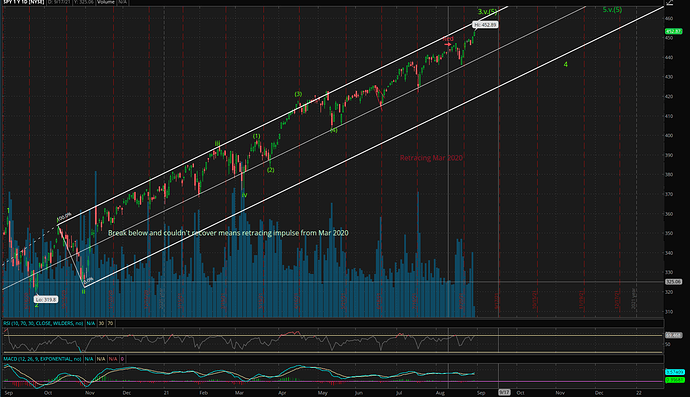

Ofc, I am right ![]() See above chart posted 6 days ago.

See above chart posted 6 days ago.

Thank you for the recognition. Believe in my own EWT count, not that of Panda or Beth ![]()

Panda is a loser. You’d make far more betting against him.

Bullish count for SPX to be inlined with face ripper. The middle line of uptrend pitchfork is holding very well.

It’s different this time.

10-20% Correction is an opportunity to pick up fundamentally strong stocks at good price.

“Phelps also stands against market timing. He told me about how he predicted various bear markets in his career. “Yet I would have been much better off if instead of correctly forecasting a bear market, I had focused my attention through the decline on finding stocks that would turn $10,000 into a million dollars.”

Excerpt From: Christopher W. Mayer. “100 Baggers.” Apple Books. 100 Baggers on Apple Books

Bring on a bear market

As long as there are plenty of bargain hunters we won’t have much of a bear market.

The problem is when buyers have no more free money to buy.

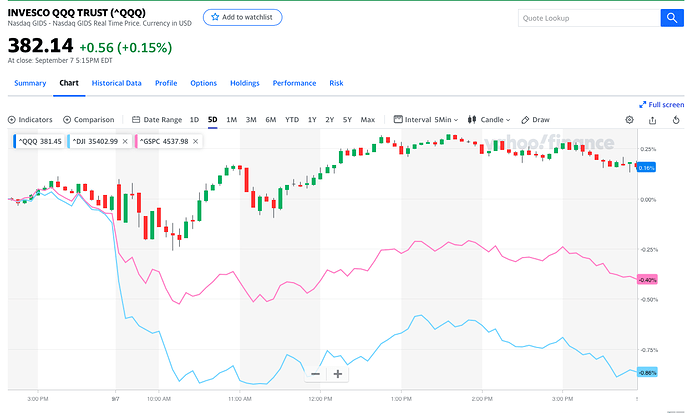

QQQ holding while DJI and SPX dropping. My guess is due to Delta variants and traders are selling recovery and re-opening stocks. Tech stocks rule ![]() pre-Covid, Covid and post-Covid.

pre-Covid, Covid and post-Covid.

SPX dropped below 20-day EMA

VIX shot above 20

So probability of a correction (price decline of 10-20% from recent ATH) is high. However, according to @manch this is impossible because he said so. Btw, the wiser pundits no longer use correction, they use volatile, historically Sep is volatile

Man, S&P is barely 2% off ATH and already we are talking corrections? F&G is already at 33 flashing Fear.

By the time is 10%, everybody know. Sometimes I have to wonder… SMH… Anyway, Sep is volatile

Have you forgotten what happened in Feb 2020? FGI continues to drop till…