Your judgement call. Some investors liquidate their stock and RE portfolio.

I will do the same with part of my holdings. But, I took some hit recently and waiting for it to get even hoing the market creeps up again. But, looks like we will have a few months before market plunges (if it does, and feds plunge protection team does not come into action).

I agree with Ross. Higher cost of capital will push inefficient companies/product out of market. That is essentially good for business. For a change, we will be getting rid of the poor performers (hoping the FED dues not turn on the printer again )

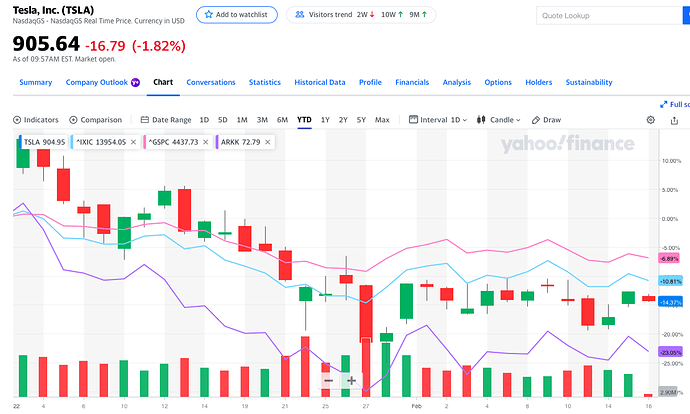

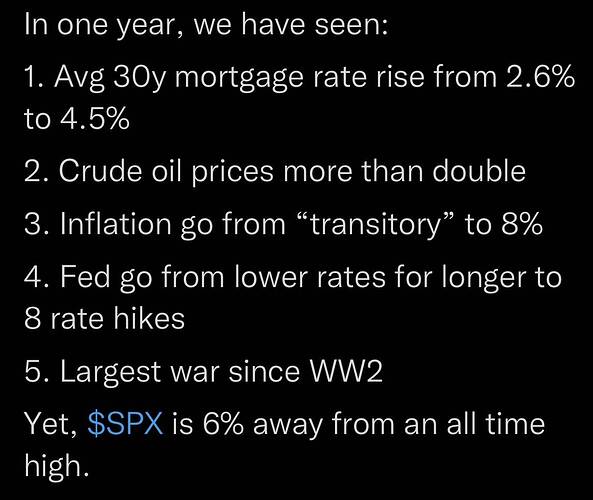

Many younger investors think TSLA is the safest stock with the best growth prospect and continue to increase their exposure to TSLA. From my unscientific (ie. didn’t bother to verify) experience), a broad based index like S&P always outperform growth stocks in a bear market and lags in a bull market. So unless the bear market has bottomed, wait, S&P is not in a bear market.

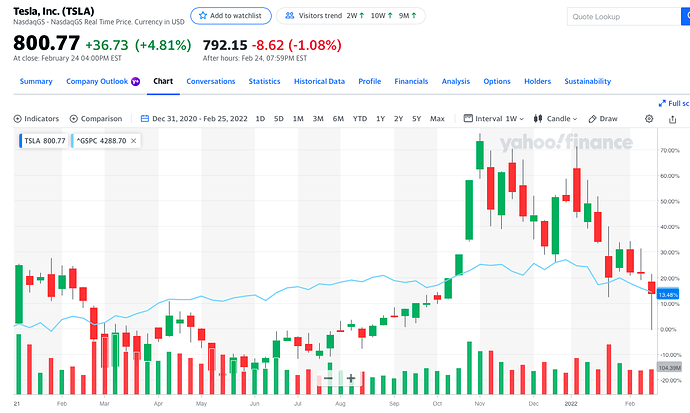

The use of a long-term dollar cost averaging strategy to invest in Spyders may not be the most profitable way to invest if one were absolutely certain that the market is on an up-trend. However, for those of us who lack the prescience, the strategy improves our odds of a satisfactory outcome while potentially dampening gut-wrenching drawdowns.

Nowadays 5+ years is considered long term. In my mind is 20+ years. Anyhoo, I view investment in S&P index as generational investment i.e. forever, to be passed over as inheritance.

@SVRE will be happy to know that since Jan 1, 2021, return of S&P is similar to the must-have hot stock of the day.

Yes, just invest in S&P and forget about it for next 10 years #peaceofmind

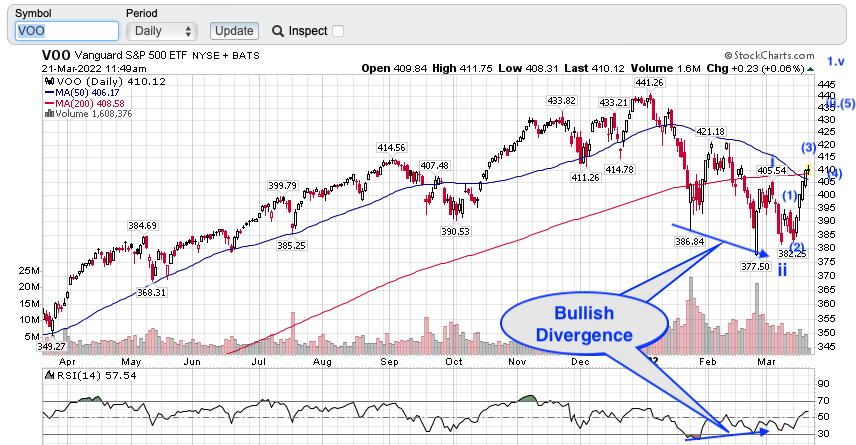

Nibbling VOO in my son’s account. No speculative growth stocks in his account. Only VOO, COST, BRKB, AAPL.

In the trading account, tempted to buy some TQQQs but didn’t pull the trigger. Market could be very volatile because while Ukraine and Russia want a short war, USA wants a very long war lasting 10-20 years. USA has achieved the aim of weakening Russia without using a single American soldier. Who say Biden is dumb? Only Trumpsters think so. In addition, greenback is strengthening against all foreign currencies. Hail, Biden.

I bought some QQQ put spreads and SPXU for insurance today.

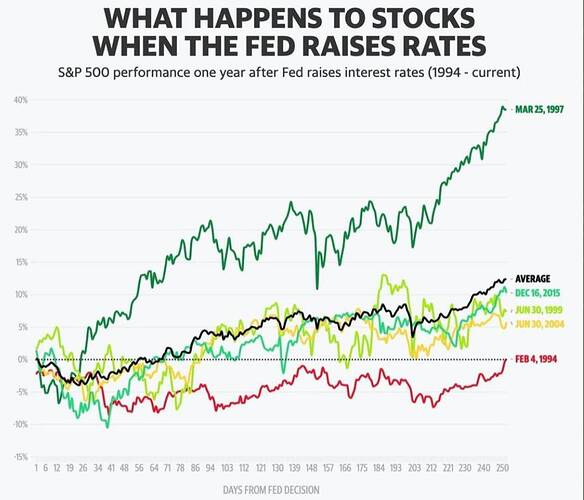

Puru has been cursing SPX for a few months now, must be disappointed with his expectation that growth stocks are better than SPX in the long run. I am beginning to doubt that a basket of growth stocks can beat SPX. His 5 years outperformance doesn’t prove is better because the alpha in his portfolio is from hedging and shorting, not because of his good picks. If you want to beat SPX in the long run, you have to narrow to a few (2-3) stocks… boom or bust. My biggest bet is RBLX U COIN ![]() the rest are comparably smaller… boom or bust in 10-20 years.

the rest are comparably smaller… boom or bust in 10-20 years.

I have a MBA, Mr Upst. I don’t believe in FA, TA and research. Believe in luck ![]() Ultimately, whatever effort you put in, luck determines the outcome.

Ultimately, whatever effort you put in, luck determines the outcome.

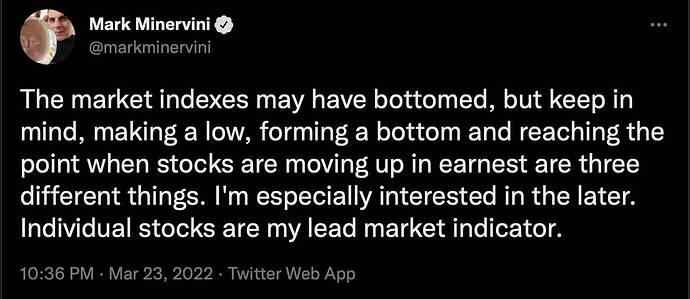

Mr UPST, two times US trading champion, thinks indices might have bottomed ![]()

Two days ago, used up all cash in my sons’ accounts for VOO ![]()