I’m pretty sure holding index funds, and only during a recession buying leveraged funds, could give you a fantastic return over 20 years. That’s my plan moving forward (starting in a year or so)

TQQQ? I am still waiting. No point buying now unless trading.

One may have one or two stocks e.g. TSLA, that can beat the return of S&P over a few years but for a stock portfolio over a few decades, nearly impossible to beat S&P.

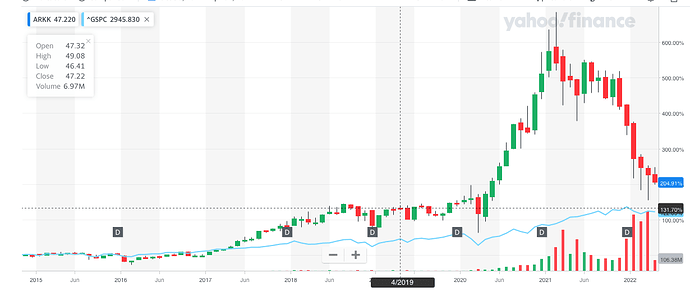

Cathie is a superbull in TSLA, her ARKK barely able to keep up with S&P after 7 years since inception.

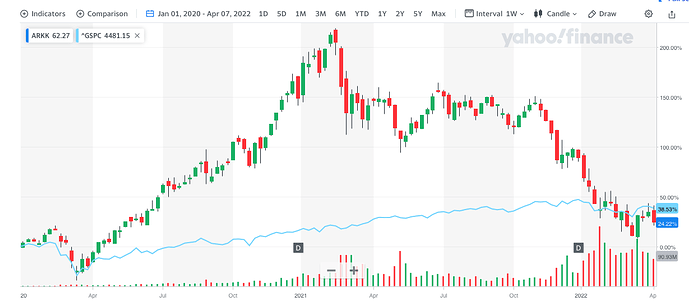

From 1/1/20, riding TSLA super rally, ARKK can’t beat S&P…

Sure TQQQ and leveraged S&P500 ones. But not now. Only go heavily in on big dips (once or twice a decade maybe). Maybe a bit on smaller dips. Otherwise hold unleveraged.

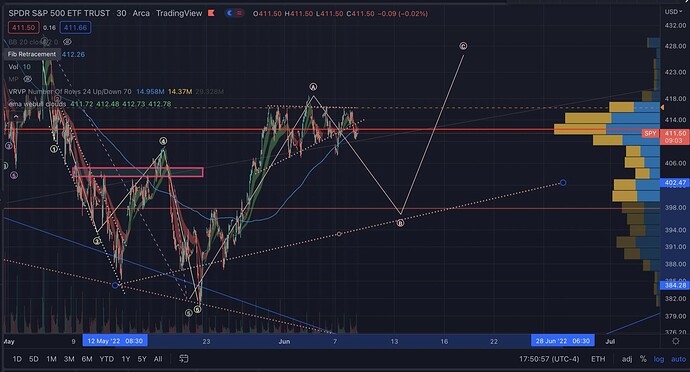

A bullish interpretation…

Bear in mind, wave a is also an impulse, a bearish interpretation would be wave ab instead of wave (1)(2). Given that dotcom bust lasted from 2000-2002 and current cloud bust started from Feb or Nov 2021, seem a bit short to end here.

Compare this market to the 70s not 2000. Oil and other commodities are driving the market down along with shortages inflation and the huge influx of Gen Y and Z into housing. Stocks sold to buy housing is a drag on the stock market. Oil shocks cause recessions. Don’t fight the Fed.

Feb 2021.

One year too early. Dates are wrong while effect is correct = WRONG forecast.

Any research paper proving that the approach yields return higher than DCA over a period of 40+ years. 40 years used to be the norm duration from working to retirement. May be used 20+ years for TikTokers and Millennials. I prefer S&P 500 index funds/ ETFs - use either SPY or VOO or VINIX.

Note: DCA for each pay check (usually once a fortnight) over 40 years ideal for W2 (most of them not interested in stock picking).

Not that I am aware of. If I find it, I will post it

Yes, DCA each pay check periodically is a better choice for earning people. However, these DCAs can be wise during FED bullish period than bearish period.

If this is for kids, make sure they fill up

- first 6000 in Roth IRA (not traditional) when their age is less than 30, then

- let them fill up 401k full amount allowed by IRS

- Then, primary home (home with mortgage)

and excess only needs to go taxable investment like VOO/QQQ…etc

Thank you for reminding us about TQQQ

Long ago, we conclude that the best time to buy TQQQ is when it is at a bearish low. I recall a few bloggers agree and plan to buy TQQQ when it hits a bearish low… have you guys bought yet?

Bot (if lumpsum) yet or started DCA purchase yet?

I presume @Jil has been…

…

Have not bought any yet ![]() Crash ended yet? Wait for Fed to halt rate hikes? Wait for CPI to decline significantly? Or doesn’t matter, is time to start DCA purchase.

Crash ended yet? Wait for Fed to halt rate hikes? Wait for CPI to decline significantly? Or doesn’t matter, is time to start DCA purchase.

…

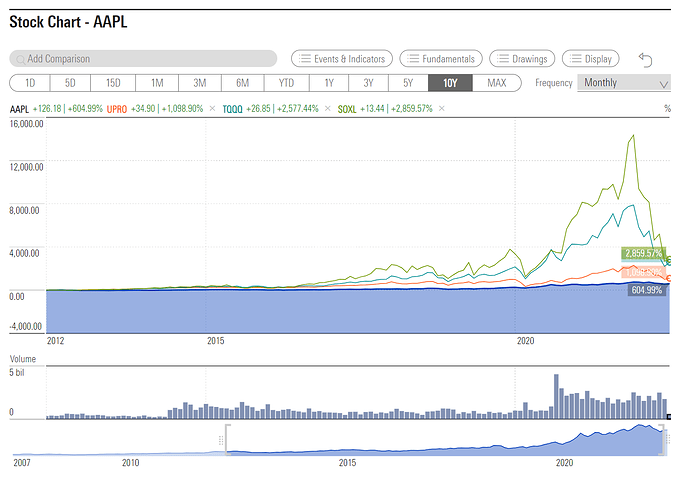

Check past performance of TQQQ and UPRO…

Performance of TQQQ since inception on Jun 9, 2010…

Performance of UPRO since inception on Jun 23, 2009…

UPRO vs AAPL (excluding dividends)

I bought a little bit of TQQQ (like 30k) in my IRA, but the rest is in TSLA spreads that will give a much better return over the next 2 years (likely a 3.5x) So my QQQ/TQQQ balancing act won’t start until I close out those TSLA positions in a year or 2.

At what avg price?

$28 a month or so ago

Use Morningstar for comparison as they include effect of dividends.

I repeat do not look at others what they are doing, you have to take “Your own Judgement” like the way WQJ buys TSLA (he takes his own decision to find the possible bottom).

The benefit is that you need to believe in your decisions. If wrong, you correct in future, if right you enjoy.

This is for everyone, do your work, believe in yourself, over time you will be better than average Joe.

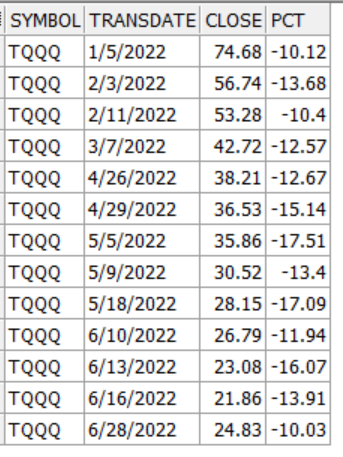

Here is the history highest drop in TQQQ in past bearish time (TQQQ dropped more than 10%).

I do not look at any other leveraged ETFs other than UPRO, TQQQ and SOXL.

This is my reasoning: If TARK drops 90%, what will happen, TARK close the ETF, investors permanently loose money.

If SOXL drops 90% from now, SOXX would have dropped at least 45% (not 30%), entire semiconductor industry stalls. No computer, no memory, no cars can be made.

If TQQQ drops 90% from now, QQQ would have dropped at least 45% (not 30%), entire tech industry industry stalls.

If UPRO drops 90% from now, SPY would have dropped at least 45% (not 30%), entire market stalls.

In such case, FED and Congress must act, reverse the course. Otherwise, we will end up like Sri Lanka now, complete social unrest which US always avoid. This is the main reason, FED is artificially exploding the bubble when inflation goes out of control.

This is the main reason, I said SOXL is riskier (just 30 companies) than TQQQ and TQQQ (which has 100 companies) is riskier than UPRO (which has 500 companies). I do not see any other ETFs FED & Congress acts.

Okay, I have given more than enough, I think it is better for me to stop.