Buy S&P 500 ![]() to build generational wealth. DCA purchase and DRIP

to build generational wealth. DCA purchase and DRIP ![]()

Many times I insisted blind investment is expensive and always insisted read some books and research before investing.

It is exactly like buying a house at RBA vs buying a house elsewhere which one takes your future better.

Educated investment takes you a double the return. Do you want to discount that by not reading books, nor doing research?

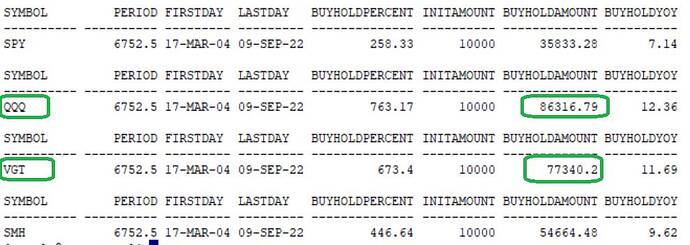

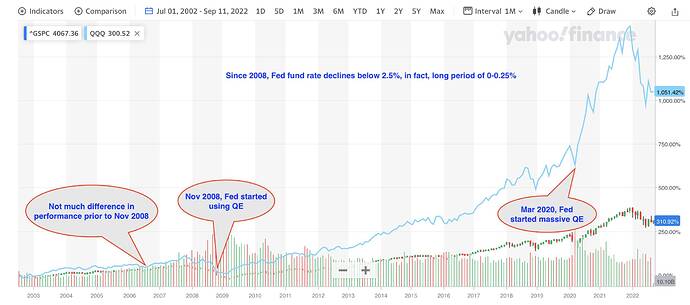

I just back tested four ETFs since Mar 2004, see the winner.

I N V E ST M E N T - E D U C A T I O N - I S - E S S E N T I A L

.

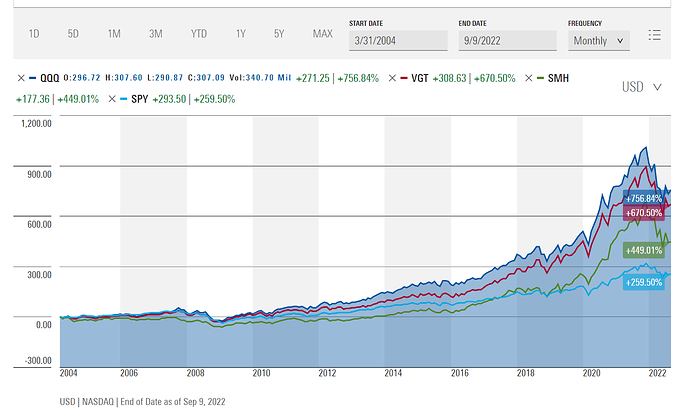

18 years can’t compare with century track record. You fall into the recency biased trap.

Also dividend of S&P is much higher QQQ. With DRIP, S&P will trounce QQQ eventually.

Please re-read the story of tortoise vs hare.

TEXAS for recency bias since 2017.

You mean 18 years of ignorance not enough, but needs 100 years of ignorance? LOL !

Morning Star accounts DRIP for all ETFs, here you go.

Since you believe in recency-bias ![]()

YTD return of…

1 yr return of…

Using recency-bias projection, S&P ![]() trounces the other three in the future.

trounces the other three in the future.

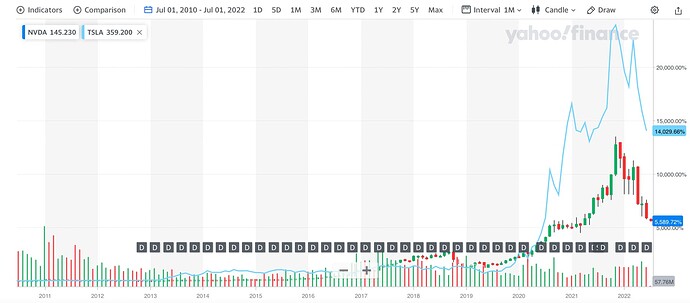

Yet another example of recency-bias.

8 years after IPO of TSLA, NVDA investors think TSLA investors are dumb. TSLA is just a car company. Silicon is the new oil, NVDA has many optionalities, NVDA to the moon, NVDA will be the biggest market cap company in the world in 5 years’ time.

4 years after 2018 proclamation, TSLA investors think NVDA investors are dumb. NVDA is just a chip company. EV is the future, TSLA has many optionalities, TSLA to the moon, TSLA will be the biggest market cap company in the world in 5 years’ time.

When you talk about century hold kind, YTD or 1 year win is short term, not a right comparison for decades or centuries.

For short term such as YTD or 1 year, compared to decade or centuries, Bearish times SPY is winner, bullish times QQQ. However, over a decade or more QQQ (or VGT) buy & hold doubles than SPY.

Reg TSLA vs NVDA, it is endless discussion and I do not want to discuss about it.

My job is to provide visibility/awareness to everyone, and there it ends my scope!

It is up to investors to do proper research and invest.

It is their money and their returns.

100% all in Tsla or 100% all in Nvda in the past decade. Both choices beat 100% all in any index fund by miles. Index fund investors are so behind it is not even funny.

.

There are always selected stocks that trounce index funds. Very few investors put 100% especially at the IPO prices.

No need for 100% allocation. Even a 5% allocation of Tesla back in 2012 will trounce any index fund.

.

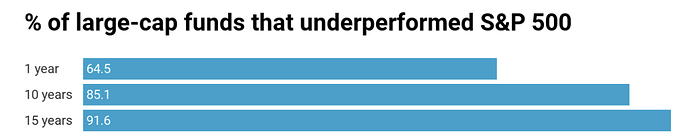

The probability is only a few investors manage to beat index fund since the other 95% could be lemons.

No point talking about those few investors who are either be lucky or savvy enough. Most don’t know enough. Remember is MOST should invest in S&P, not all investors.

Ok sure. Let’s not talk about how only a few people win but rather let’s talk about how the 99% failed. ![]()

.

Most portfolio returns less than all-in S&P. So also not talking about those who fail per se, but advising those who fail to change to S&P.

Look at the rock-star etf, ARKK, Cathie is an uber TSLA bull, ARKK maintains ~10% in TSLA.

Actively managed funds

The latest SPIVA report is typical: Just 17% of US large-cap stock pickers beat the S&P 500 over the past 10 years through 2021, and that number drops to 6% over 20 years. Time makes a fool of most stock pickers.

The evidence suggests something similar is going on in terms of who gets Alpha in the stock market. Studies show that anywhere from 90-95% of mutual funds underperform the S&P 500 index…

S&P 500: The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States. So broad-based and diversified.

QQQ: The Nasdaq-100 is a stock market index made up of 102 equity securities issued by 101 of the largest non-financial companies listed on the Nasdaq stock exchange. Mostly tech and less matured growth stocks. Is a narrow-focused index.

Take note:

Growth stocks tend to outperform in a low rate environment and

Financial stocks tend to outperform in a high rate environment.

From today, buying QQQ instead of SPY, are we betting on continued outperformance of non-financial growth stocks vs financial stocks in the future (20-40 years) in a low or high rate environment? This is what we should be thinking about and not projecting the past performance.

If CPI print on Sep 13 leads to S&P below 3900, would test Jun 16’s low of 3700.

If S&P goes above 4300, high probability to continue to 4800.

Now, hold your breath and pray that CPI print on Sep 13 is below 8.

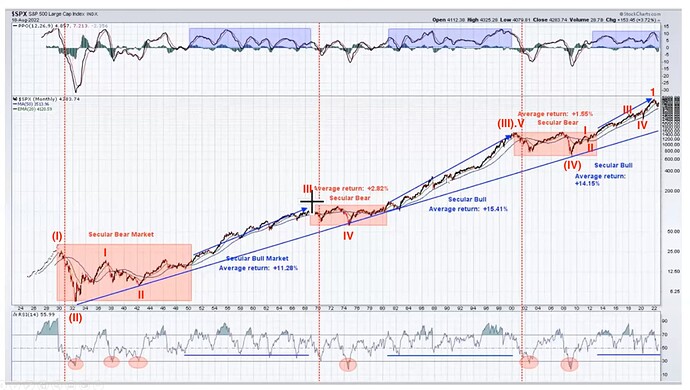

EW Speak:

In Century degree uptrend. [I]

In SuperCycle (multi-decade) degree uptrend. (V)

In Cycle (multi-year) degree uptrend V i.e. still in the secular bull market ![]()

In Primary (multi-month) degree downtrend. 2

Two well-known actively managed fund can’t beat S&P.

ARKK - managed by Cathie Woods

GK - managed by Ross Gerger

That’s if it doesn’t break the lower channel. If it does, it’s a falling knife. Even in this case, I can let my puts run quite a bit more.