It’s bullish when majority is bearish. Obviously it’s not going to be straight up from here. There will be some dips to make the bears feel vindicated.

Shorts are loudly saying market has not bottomed…

Two posts prior, Mark Minervini

New leaders? Always true?

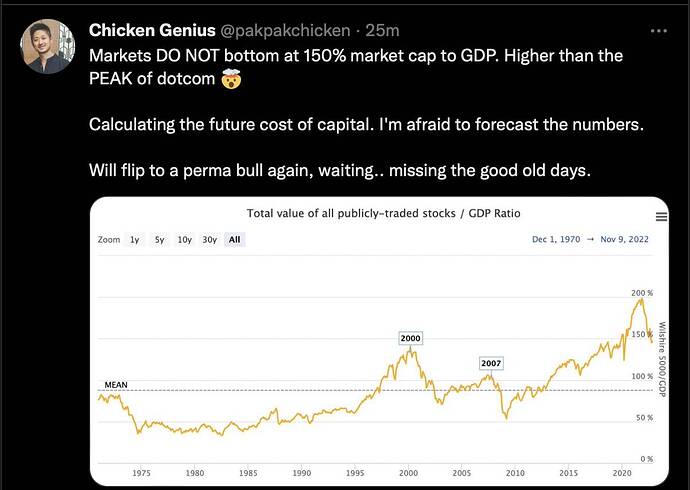

Chicken Genius

Does the ratio changes with M2? Foreign money?

John

Investor Millionaire

Market rallies in a pool of bad news is a bear rally?

Puru

Is the first statement always true?

.

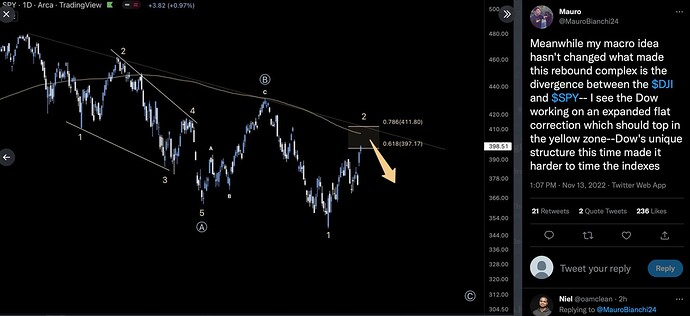

Is only a multi-week bull case.

His multi-month case is bearish. Note that his higher degree (multi-month) label is A and (A)… this is zigzag… bearish. His “bull” case is SPX would rally till Dec FOMC then tumble which is opposite behavior to…

![]()

Right or wrong Face Ripper is crystal clear on his call. There is no if’s no but’s. Just straight up numbers with time limit so you can easily see whether he’s right or wrong.

Love his style.

Saying December will be the last hike is extremely bold. I think there’s 50/50 chance that it will be. But I wouldn’t bet on it. Again, kudos to Face Ripper on making a clear cut bold call. He put his reputation on the line.

Momentum is up till it is not. 4100? More accurate to use 200-day SMA. If more than 3% above 200-day SMA, may not be a bear rally, likely is the start of a multi-month bull run.

Targets about the same for different TA approaches, EWT, Jake’s funnel, moving averages,… all assume is a bear market rally.

Tom Lee’s target is on the high side, seem to indicate a multi-month bull run.

It needs to prove it can break above resistance to not be a bear market rally. We should all find out soon. One thing we all know is eventually bear markets do end. The most difficult part is determining when. I actually like the odds of it, because these big swings are usually not predicted and go against consensus.

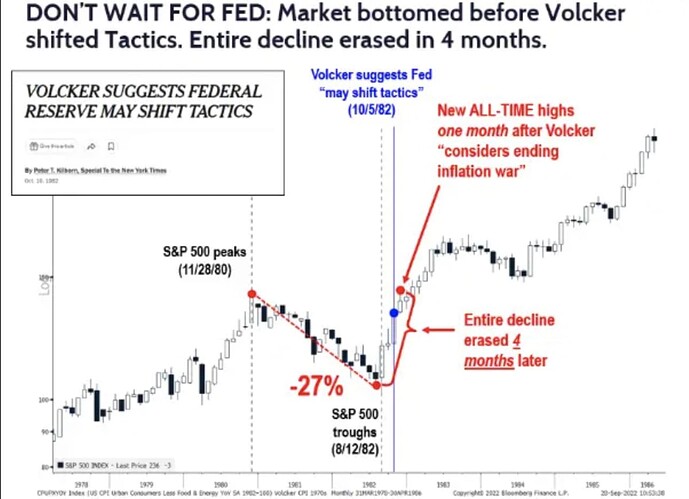

Market bottomed and by the time Fed announced “shift tactics” market almost at ATH.

Shift tactics = pause or u-turn?

I’m honestly not sure, but I think we are hitting a point where the further downside risk is small. We know that 5 years from now the market will be higher. Getting in anywhere within 10% of the bottom is good.

.

True for S&P ![]() but not sure about those high growth stocks. After discounting for SBC, nothing seems good… bite the bullet and pray? FANGMANT should be good too… yes, even META.

but not sure about those high growth stocks. After discounting for SBC, nothing seems good… bite the bullet and pray? FANGMANT should be good too… yes, even META.

I’m not optimistic on anything ad related. They are running out of market share to steal. Where will the growth be?

Growth’s massive out-performance over value has depended on rock bottom interest rates. I’m not sure that is coming back even in a recession. Interest rates may have seen a generational low.

.

![]()

Many will not make any new ATH. I suspect should STFR if you still have them. Many may eventually decline to oblivion.

Mauro finally updated his count…

As expected. 200-day SMA is an important level regardless of what TA you use.

He can not be right ![]()

Do you still believe him? You have seen market many decades, 2000,2008,2020…market reached a real bottom after one or two circuit breakers.

This recession too will result one or two circuit breakers.

If Tom lee is really experienced person, he must definitely know about circuit breaker and yield curve inversion.

Now, yield curve inversion happened ( 10y-3m ). Market shown upside volatility 7% ( Nasdaq ) single day. This shows it can equally go down that will result a circuit breaker. This will have multiple shocks like earthquakes!

On Wednesday I was telling my partners about circuit breaker, he was not believing that it will happen this time, but after Thursday he agreed, “if market can go up 7% single day, it can go down too that much single day”

FED team never stops until they see circuit breakers: it is very rare chance. Keep cash until then !!!

When that happens who has the guts to buy stocks? The old man Buffet will plunge his money even at that time calmly. They are the winners.

Follow the right people, never be bullish nor be bearish, just be realistic ! History repeats !!

Easy to get 5% on cash now with CDs. Even liquid money markets are already at 3.5 headed to 5%. Good place for safe money… parked until RE bottoms. Actual sales in Tahoe indicate prices are only down less than 3% on average since May highs. Rents are still going up.

http://www.staor.org/wp-content/uploads/2022/11/SF-Mkt-Anaylsis-October-2022.pdf

There are plenty of good companies giving dividends too. See Warren Buffet’s holding PARA which gives 5.10% dividend and forward P/E 14 (ignore current P/E very low). As long as buffet holds it, we can assume he did a good fundamental study, we can buy and hold long term. This way, we get 5% dividend returns along with some future growth. I looked at yesterday, looks like it bottomed at $16 range and jumped to $18 now.