Just look at SPY earnings. They haven’t fallen much at all. Granted, a portion of that is record earnings in the energy section thanks to the war.

Knox Ridley of IO Fund…

"You might assume we should brace ourselves for a new low in the S&P 500. That would be the prevailing trend preceding every FED meeting this year, but the market isn’t operating in a vacuum, and when you look outside of the S&P 500, a different story continues to emerge.

While some FAANGs and tech darlings, like TSLA, continued lower, many sectors and global markets continued higher. We’ve been trained for over a decade to follow tech, as it will lead the market. However, a seismic shift is occurring in real-time, as new leaders are being minted.

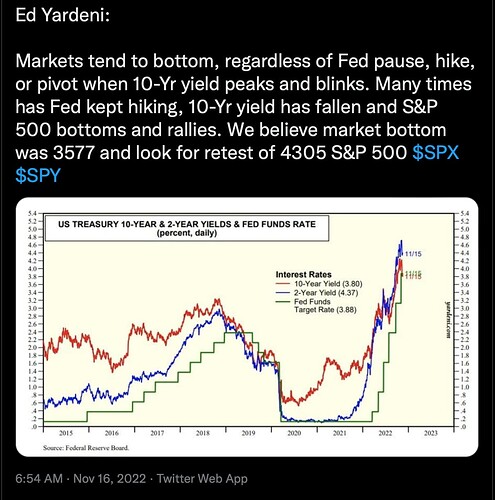

The bond market was signaling to anyone listening that this FOMC meeting was different, as the complex bottoming process we have been discussing for weeks continues to build.

The oft-ignored DJI has just given us a clean and clear 5 wave pattern off its late September low, while also reclaiming the 200 day-moving average. Not only did it bottom before the NASDAQ and S&P 500, but this 5 wave pattern suggests a much larger trend is developing.

Translation: If the next pullback holds the low, and we can breakout to new highs, I see the Dow Jones powering to new all-time highs in the coming months."

In addition to Tom Lee, Knox Ridley is also a bull. Rare bulls in current environment.

Here after market instability continues like today.

What the heck is this guy talking about? 2T loss in cryptos? Worst earnings since 2020?

I am tired of these people making shit up. Show me the data.

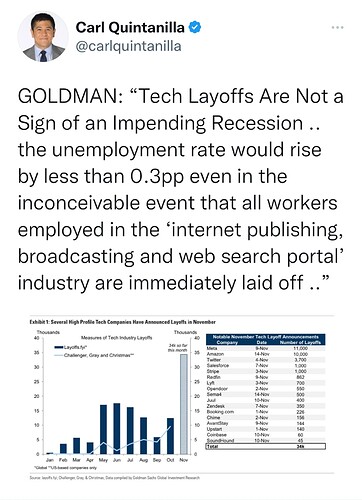

As I keep saying, tech layoffs aren’t that big a deal. A drop in the bucket in the grand scheme of things. And many of the laid off people will find new work in 6 months or less.

.

I am only a messenger ![]()

What is Goldman talking about? Not talking about those guys. Ain’t tech guys are highly paid compare to other industry? Don’t white collar recession stun spending on discretionary high ticket items?

Show me the data ![]()

Go on Blind to search for yourself. One random post below. If a SWE got laid off this week, and the person has up-to-date skillset, I’d definitely expect them to be employed again before June 2023. Especially if market turned itself around. Sentiments will quickly turn bullish along with price.

Here is why I say never believe daily news for market actions!

Market actions are pre planned, not based on daily events, but news/media attaches a nice convincing story.

Retail investors are convinced but fooled by media!!!

IMO, next 2-3 days must be negative day. I do not know how much fluctuates, but finally it comes down.

After seeing thanksgiving sales, market may go up.

All these guess/inference- no guarantee!

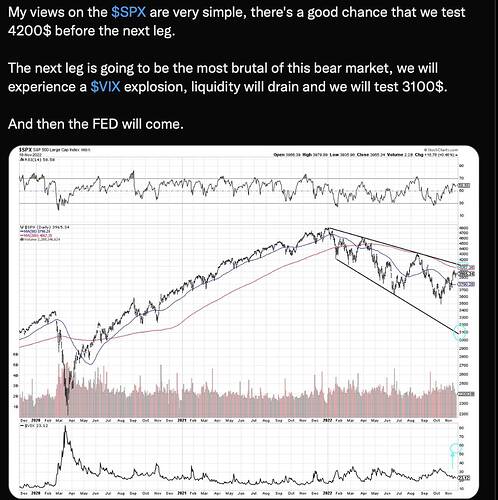

Using straight line resistance and support TA… descending expanding wedge pattern…

Sound good but take note, bullish after 3100 ![]() very bearish

very bearish ![]() after hitting the upper wedge channel

after hitting the upper wedge channel

4200 to 3100 is a whopping 26% ![]() decline

decline

Very likely happens ! The market is not in good shape.

The S&P 500 will set a new price trough of 3,000 to 3,300 in the first quarter of next year before jumping back to the 3,900-level by the end of 2023, according to Morgan Stanley’s Michael Wilson, chief equity strategist.

Consensus is 3100 is the trough?

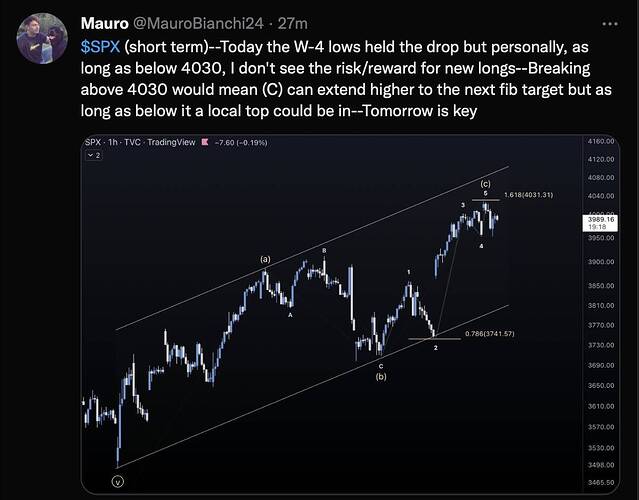

Who wrote this? Mauro? I am exactly seeing this final explosion!

However, market is hiding this and cheating all naive bulls as if it recovered. In 3-4 months time frame, may be Mar 2023 - Jun 2023 we may get into bottom, but it depends on what FED will do.

3100 is the plan of big boys ![]() Paying money to technicians, influencers, journalists and analysts to talk about it. After reading many such views, traders know what to do. Whether it will happen or not…

Paying money to technicians, influencers, journalists and analysts to talk about it. After reading many such views, traders know what to do. Whether it will happen or not…

and whether they can crack AAPL. They have been trying for many months. AAPL is heavily retail, hard for big boys to control effectively. In addition, Apple is extremely well managed, supported by WB and buybacks. Hard for big boys to find weaknesses to attack. Latest is to use EM and TWTR.