@manch favorite influencers.

Their job is focussed on circulation and advertisement revenue. When stock is positive, they discuss bullish way and when stocks are down they talk bearish way.

Many do not understand the main focus of news/media, it is not focussed on providing free service where the market actually go !

All they need to do is talk something attractively to listeners and get a pay check!

What if we are in ATH when you wake up by Mar 2023? LOL!

Started to priced in ![]()

3000 here we come. Sorry this wave shit is a bunch of bull.

What’s fascinating to me is the XLI (industrials) chart is probably the best sector right now. It’s forming what could be a great cup with handle pattern. Those are cyclical. It’s illogical for those to do well if we’re heading into a recession.

I was looking for buys in early 2020 when Covid tanked things and picked up some Nucor steel. Wow has that been a money maker. 24% off its high but still almost triple its low.

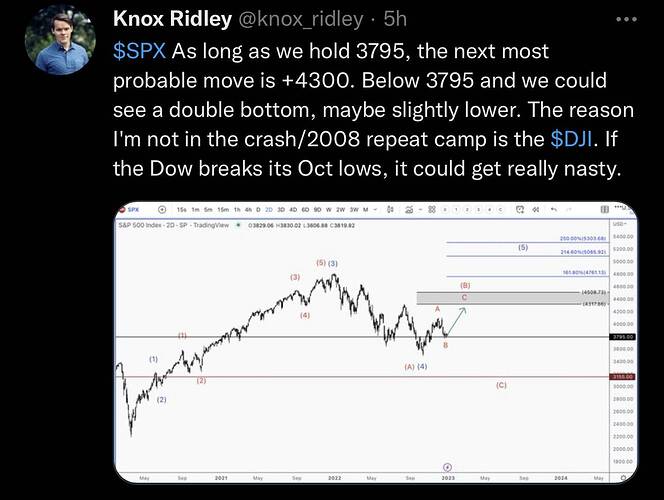

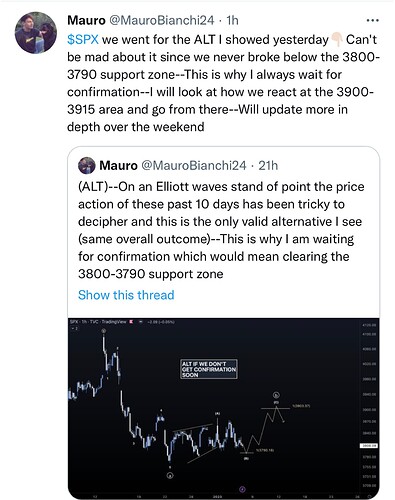

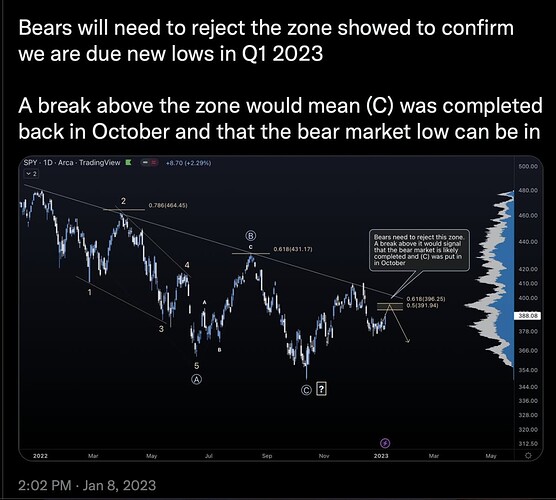

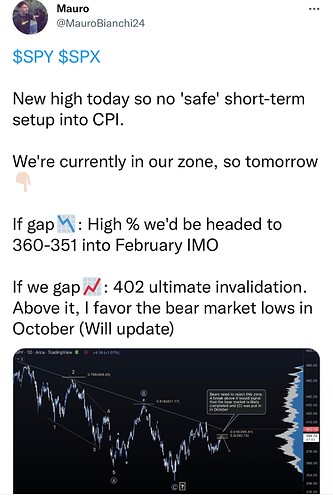

Hmm… even Mauro suspects that Oct is the bottom for the market.

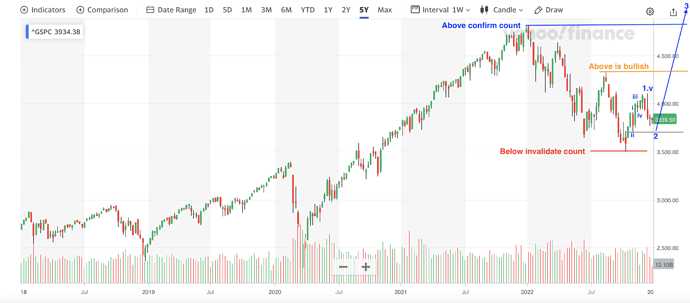

SPY > 396 confirms Oct is the bottom… in a new bull market.

Daily Chart

Hourly Chart

CPI print might be higher than forecast tomorrow.