Who is in the ‘Oct 2022 is the bottom’ camp?

Referring to S&P

I am kind of thinking mainly from WB perspective. He normally buys bulk at peak bottom, seen it in 2018 and 2020. Now, he again purchased.

This is what I said “Even if FED stops that 0.5% future rates, they are convinced inflation is going to be around 2% range”.

This means many sectors for 2023 have less revenue and less income and market suddenly changes drastically.

The main reason for this comes (even though personal - may be wrong) simulation of S&P which hits top between 4155 and 4214 (as we speak now). This is the top I got it one week before and even yesterday.

Of course, I am not that much proven and it may be wrong.

I am not personally convinced a bull market from here ! It may be my personal opinion. Any way, market is market and that is final decision as we are just followers of market.

What type of economic conditions would make S&P bullish? According to Puru, whatever happened, S&P declines by 20%. Only explanation is Puru is wrong?

Inflation > S&P declines 20%

Recession > S&P declines 20%

Exactly the point. This is not a normal market.

The current market has wild fluctuations, not dependable as it can make 5% single day and bring down 7% single day.

Just to be sure we’re having the same definition. Bull market from here should mean Oct 2022 is the bottom, doesn’t preclude it being tested but must not be broken (remember wave two can retrace as much as 99% of wave one).

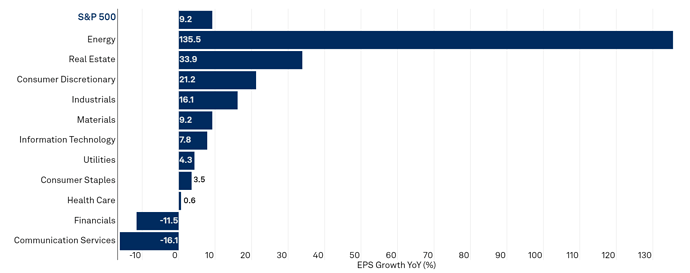

Earning recession prediction has been going around. I am a bit puzzled because…

a. Lower price doesn’t always mean lower revenue since volume could expand. Depends on elasticity of supply and demand curve.

b. Lower price doesn’t always mean lower income since volume could expand and could have better economy of scale.

c. Lower price doesn’t imply lower valuation since valuation is also depends on the discount rate.

That’s not true. The market has declined while revenue and earnings are increasing yr-yr.

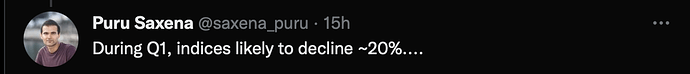

- Year-over-year, the S&P 500 index recorded an EPS Growth rate of 9.2% for Q3 2022, down 1.5% compared to Q2.

- Overall, Q3 revenue for the S&P 500 grew at 11.6% year-over-year, improving slightly from 11% in Q2.

Just look at RE company earnings were up 33.9% yr-yr. I thought RE was completely collapsing?

Perception from reading headlines /= reality based on data.

What is not true? The 2nd statement is what was said below.

It’s false that an earnings decline isn’t priced into the market. He could argue the decline will be larger than what’s priced into the market. Saying no decline is priced in makes him look ignorant.

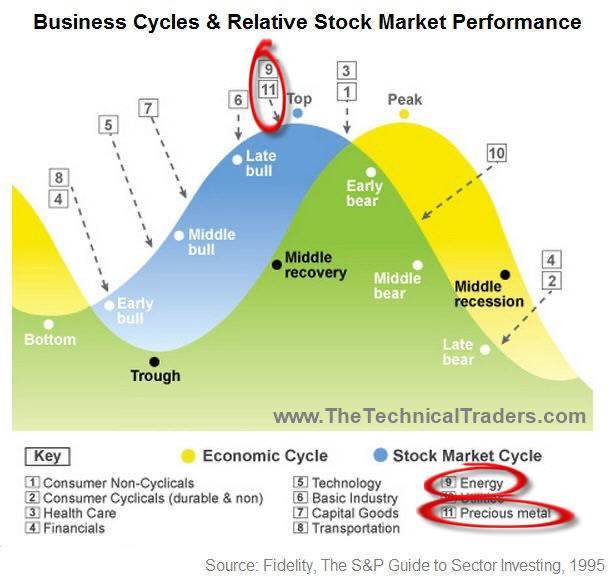

If this chart is current status as of that date, it can happen when market sees future growth is reduced.

If market sees 2023 (future) revenue and income growth will be reduced, with inflation getting reduced (prices reduced) and lay off increases, will it jump bullish?

If that jumps, it is against fundamentals and will be short lived like today market reaction.

This is what I understand.

The market peaked in Dec ‘21. Earnings are still growing and at a strong percentage. The market has been wrong.

The market is usually ~6 months ahead of the economy. The market was wrong on this one. When looking at multiple decades, the typically recession which is 6 months is irrelevant.

Popular chart on stock market vs economy

Tech usually peak before economy peaks.

Tech usually start to rally when recession is worst.

.

Utility

Are you telling that past six months or future six months?

In fact, just now yield curve is deep inverted. This is always prelude to a recession. This means recession has not come yet and will come in future.

The market peaked in December of last year, so the recession should have started this summer. It didn’t. I’m not sure we will get one. If the fed pauses after the next hike, we might avoid it.

.

Based on the performance of financial stocks, it appears that market did bottom in Oct 2022. Let’s how accurate is the chart.

.

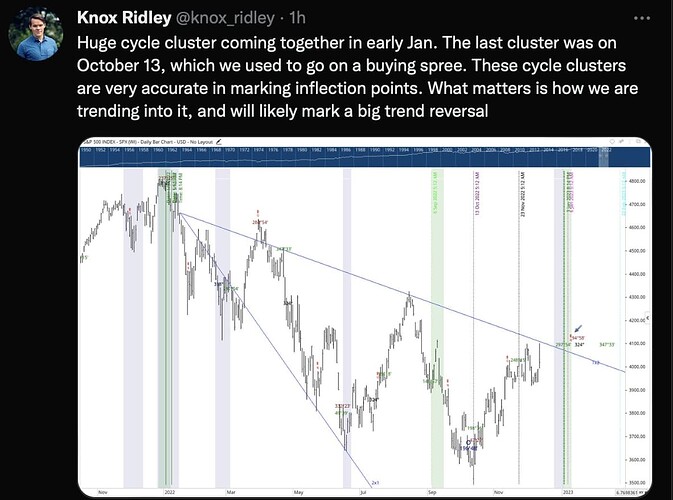

Confirmed? The right word should be “your algorithm’s prediction” or “your personal opinion”.