Weird market today, full of divergences from normal trends. Dow down, S&P up. Interest rates sharply lower but dollar sharply higher.

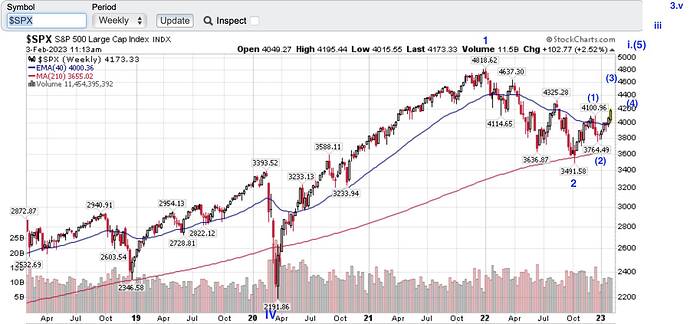

Optimistic count below.

Alternate count is the wave label as 1 is wave [I] and now in wave [II] which would last years. Because it last years, there are many layman’s versions of bull market ![]()

He thinks is a bear market rally. If it is, usually reverse when it retraces 61.8% of the downtrend i.e. reverses around 4312… marks this number. Hopefully, he is not thinking about my alternate count… can go as low as 2200 ![]() In short, we can be bullish but keep in mind the bearish possibility.

In short, we can be bullish but keep in mind the bearish possibility.

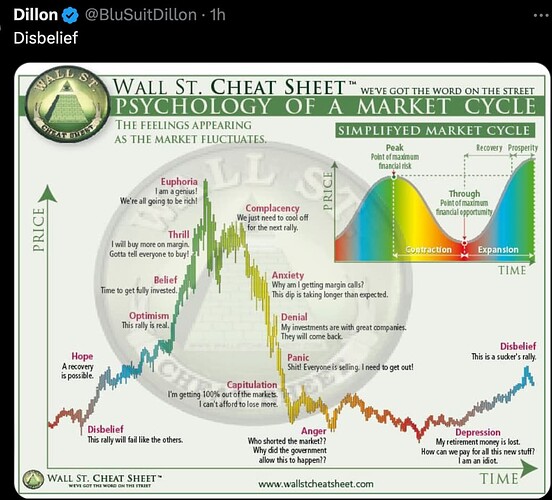

An amateur thinks is a bull market.

We’re so far removed from eurphoria though. Sentiment has been at rock bottom for almost a year. That means we should be at disbelief.

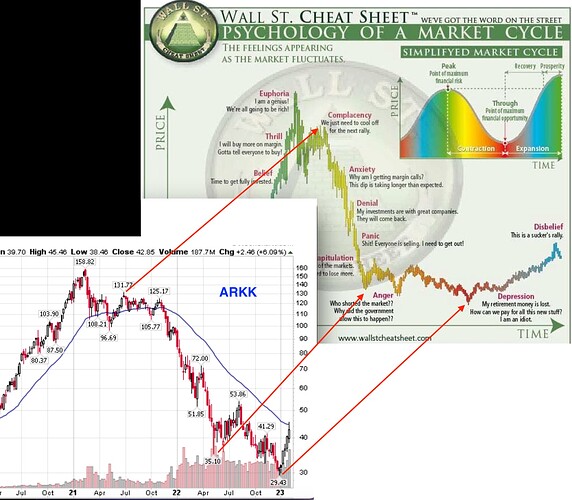

Growth stocks proxy by ARKK appears to be in disbelief phase. ARKK pierces above 40-week EMA (potentially in stage 2).

How on earth does he explain the why market sentiment has been so low for so long?

.

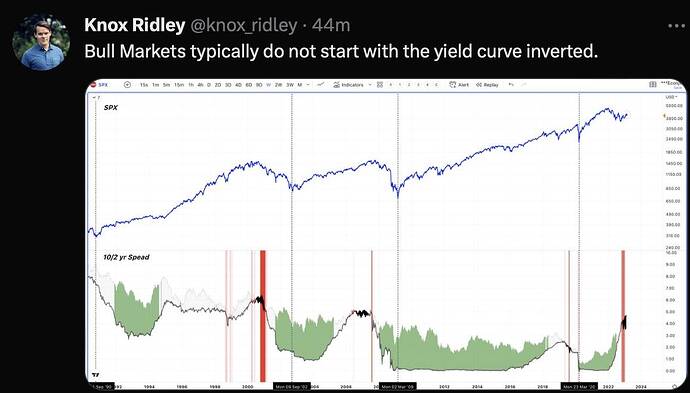

He ignores all indicators and uses “Don’t fight the Fed” principle solely. For a new bull market to start, his indicator is Fed pivots i.e. announces a rate reduction.

Golden cross (50-day SMA above 200-day SMA), price above 200-day SMA (in stage 2)/ 50-day SMA, higher high higher low >> S&P in a new bull market from Oct 12, 2022.

Oliver Kell, 2020 US Investing Champion, is actively tweeting again >> bullish signal

The other US Investing Champion, Mark Minervini, has been bullish since Jan 13.

Correct.

Big funds/investors account next 3-5 years economic issue and move money (Trillions/Multi-billions) from stocks to safe investment 10 year bond (Demand increases for 10y reduces yield).

When stock market is heavily corrected, the same big funds/investors feel stocks are attractively priced low, then move the money from bonds to stocks (Demand reduces for 10y increases yield).

This is very basic equation of a stock market!

Now, people understand why FED is keeping quiet until end of year!!

This is again my 2 cents, no interest to update any more. Good Luck.

7% decline is still a bull market.

2 cents: Watch Market turns bullish from here, 100% in market by end of day today!

Wait are you bullish now?