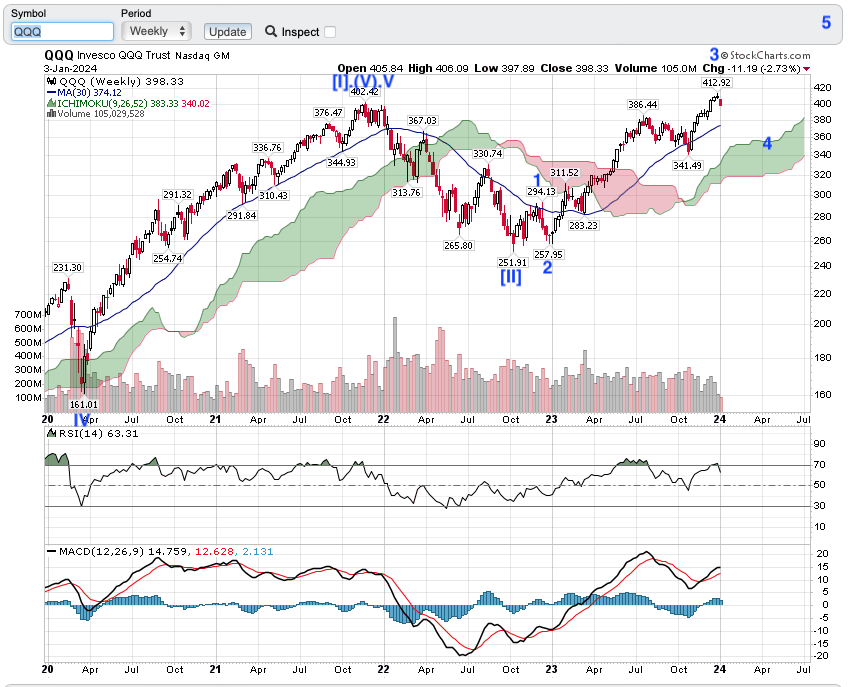

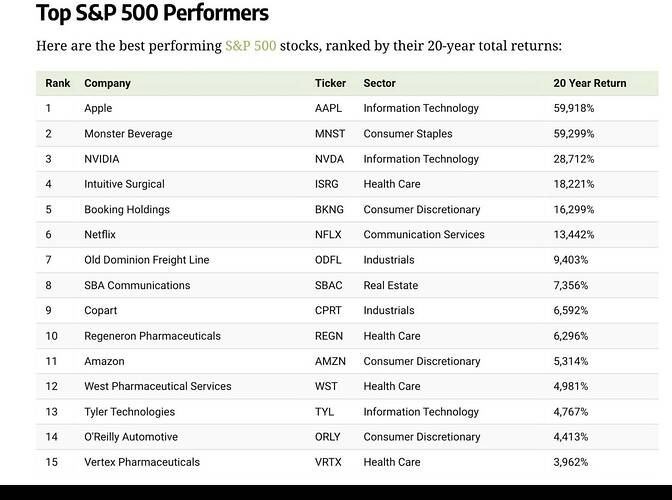

On July 14th, the new weighting was announced: NVDA and MSFT would receive the biggest cuts of about 3% each, while AAPL only got shaved by 1% (making it the new top position). Google was cut by 2%, while META and TSLA by 1%. The new rebalance dropped the overall weighting from 55% to ~38%. The NASDAQ-100 topped about 4 days later, and has since been in a minor correction.

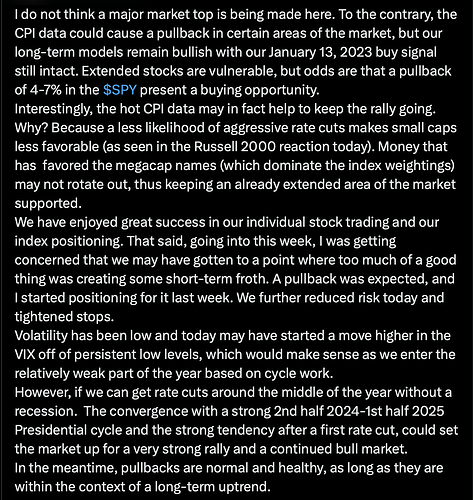

Don’t bet against America.

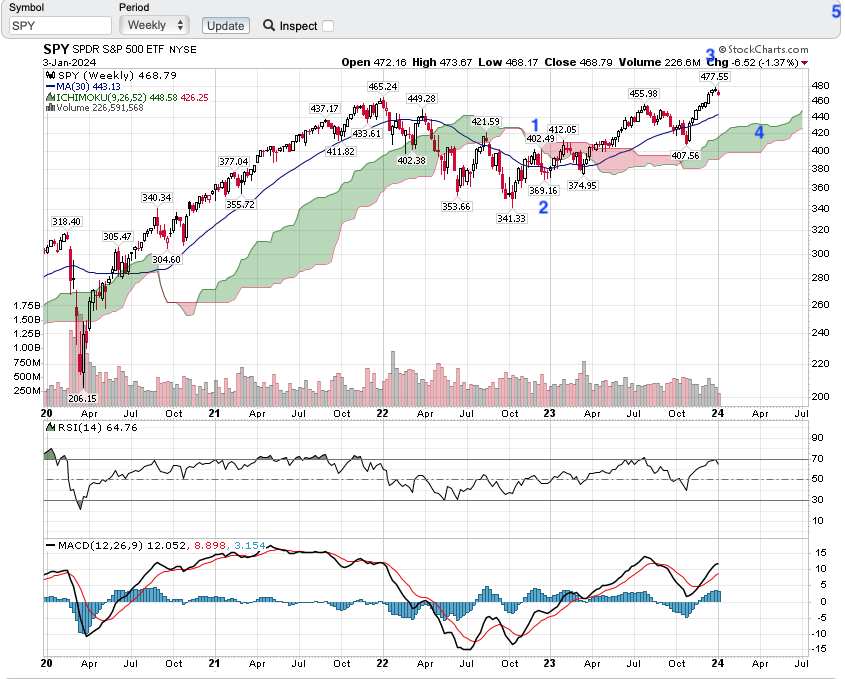

The S&P 500 is now 5% higher than where it was when the Fed started hiking rates in March 2022.

Fixed it for you…

'Murica!

It has been a while since the S&P 500 experienced a 1%+ drop. According to SentimenTrader, this type of dynamic is almost exclusively witnessed during bull markets.

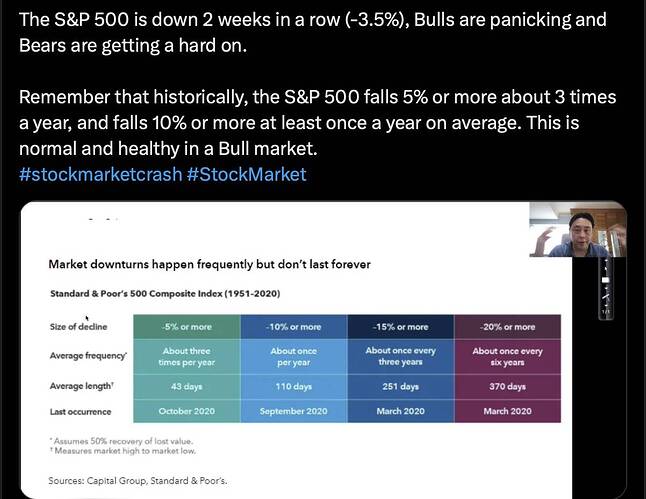

Some facts to calm the nerves of bulls… not time to panic yet… though sometimes it is better to panic early… what Mr Khoo forgets to say is S&P may have declined only 3.5%, high growth (high beta) stocks have declined 20-30%! Many retail investors are into high growth stocks only… we want to make money fast… 10x over a few months, yay! boom or bust!

I’m watching JEPQ. It holds QQQ stocks and sells covered calls against them. It lays out the proceeds as a dividend and is yielding 10%+. Since it’s a dividend, it’s more tax efficient than selling your own covered calls.

That is, buy US stocks that sell products globally e.g. AAPL and don’t bother with investing in other nations’ stocks. Companies like Apple is fairly diversified in that they don’t depend on a single geographical market.

Multiples expansion is another reason.

15,000 at the end of the decade => 18% ![]() CAGR which is higher than historical 7-11%.

CAGR which is higher than historical 7-11%.

Disclosure: Own S&P index fund/ etf.