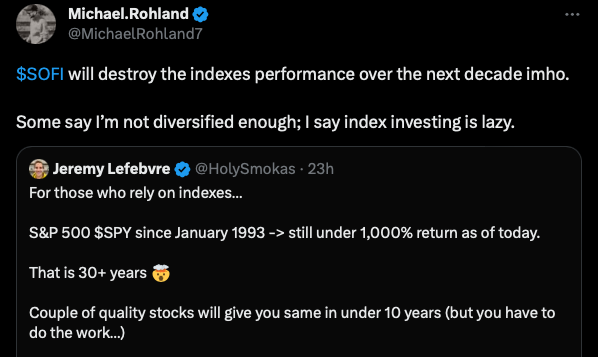

A social media blogger’s view…

Bear market again? More like a correction is imminent.

Bear market = More than 20% decline from recent high

Correction = 10-20% decline from recent high

Consolidation = less than 10% decline from recent high

A social media blogger’s view…

Bear market again? More like a correction is imminent.

Bear market = More than 20% decline from recent high

Correction = 10-20% decline from recent high

Consolidation = less than 10% decline from recent high

Ultimately earnings have to increase to drive shares higher. The forecast for this year is looking very mediocre even if the surge in Q4 materializes. And P/E’s are in the low 20’s with rates above 5%. Rates could fall some and this market would still look pricey.

Market is forward looking by ~6 months. Mediocre earnings are already discounted. Unless is much worse or better than expected.

Historic average P/E is 15 - covering all variety of interest rate environments. We’re at about 22.

Mediocre earnings already discounted?

Why would job losses in tech be bearish for stocks? Cutting jobs means lower expenses and higher profits. The fact they don’t understand something so basic makes it difficult to believe anything they say.

Getting more difficult? Still don’t want to come out and say outright this ain’t no bear market rally?

This may be one of the most hated rally in the history of rallies. Makes me very bullish. Lots of fuel left to ![]()

How can inflow be lower than 2022? Proves the point this is one of the most hated rallies. Maybe the most hated one I am part of.

Institutions are still bearish. Can’t make this shit up.

Goldman shows that institutions are still largely bearish.

“Despite the recent market rallies, investor sentiment is still largely bearish, according to the June Marquee QuickPoll, which surveyed nearly 900 institutional investors.”

“If last October marked the low, this has been an unusual bull market in that it has taken so long for the market to lift itself out of purgatory. The only analog that comes close is the second half of the 1940s”.

2nd half of 1940s also had an inflation scare very similar to the one we just had. Massive supply side disruptions due to the end of the war, and demand going thru the roof because soldiers are coming home and bottled up demand finally unleashed.

Since 2009, S&P has been above 52-week SMA, hence S&P has been in a secular (multi-year) bull market. 2022 multi-month bear market is merely a correction ![]() According to Almanac, the secular bull market should continue to 2029 (100 years from 1929

According to Almanac, the secular bull market should continue to 2029 (100 years from 1929 ![]() ). There should be 1-2 multi-month bear markets i.e. shouldn’t decline below 52-week SMA, on the way to 2029. So I am not sure why there are bearish rumbling that S&P would decline to below 3000… that would mean end of the secular bull market… not possible except for Black Swan event.

). There should be 1-2 multi-month bear markets i.e. shouldn’t decline below 52-week SMA, on the way to 2029. So I am not sure why there are bearish rumbling that S&P would decline to below 3000… that would mean end of the secular bull market… not possible except for Black Swan event.

The great thing about being a chartist is it’s always easy to create an another chart. Just manipulate the time frame to suit your agenda

Even WS is turning bullish ![]()

When the S&P 500 has an above average first half return during Presidential Cycle Year 3, the second half of the year tends to be stronger than the typical second half with an average second half return of 3.9%," Suttmeier said.

While the third year of a president’s term is typically the strongest for the stock market, the fourth year has also historically seen solid performance heading into an election.

So far, any dips are bought ![]()

Ytd return of your stock portfolio should be more than a broad based market index e.g. S&P or QQQ.

If your ytd return is less than 45%, you should just stay with S&P or QQQ or a mixture of the two.

Posters on reddit seem to think that that tqqq could fall 10% (qqq maybe 3%) due to the rebalance

.

Well… so far didn’t happen… index fund managers could have learned of it before public announcement, and did the necessary adjustment.

After making a bold statement, he is doing what most people are doing…

Broad-based index as foundation (in IRA and 401k) + a stock portfolio (taxable account).