I did not follow Elts advice “sell in May and go away”. Glad I did not.

Powell said no dropping of rates. Clouds are slaughtered, why?

SHOP dropped 8.8%!!! @manch is crying with joy!

The irony of companies with very little debt crashing is great. These companies don’t need lower rates to be successful.

S&P 500 posts best first half of the year since 1997

https://finance.yahoo.com/news/stock-market-news-june-28-2019-124538321.html

FOMO!!!

Market weakens due to this or increase in unemployment rate?

(China Won’t buy US Soybeans Until White House Clarifies Position; Prices Down

Job creation was higher than expected which lowers the chance of rate cut.

Wow! Despite the trade war, is so hard to lose money in the stock market

Pardon me for being apolitical, any1 exploit Trump remarks and scoop up stocks today? Didn’t know what to buy, so no action.

The Chinese are getting hardcore. Trump finally realized that. I don’t think there will be any major agreement this year at least. More volatility is coming.

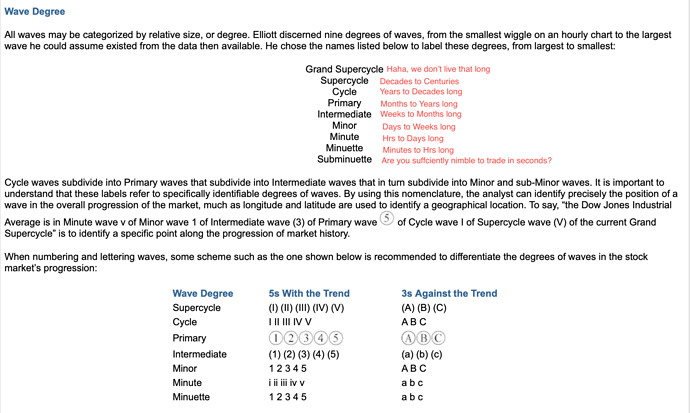

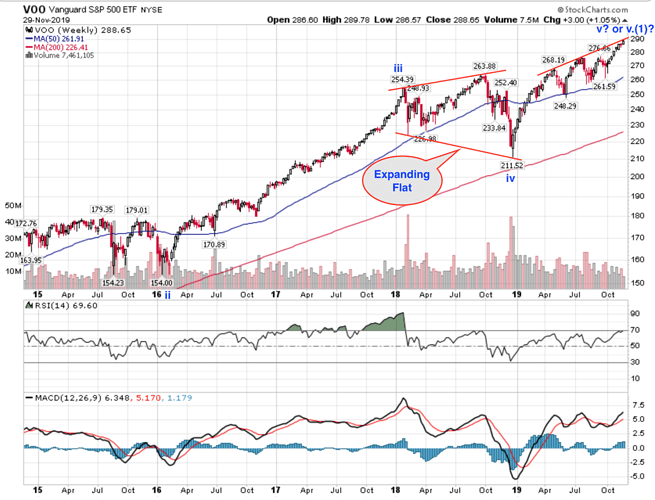

You are drawing long term EW since 2008. I thought EW is short term UPs and DOWNs and thought it is predictable range with some math calculations.

Below are the degrees of EW and their corresponding timeframe.

Identifying a pattern is not difficult. The hard thing to do is associating it to the correct degree. The inventor of EW is dead. The WS guy, Frost, who use EW to win many competition is also dead. Nowadays, EW technicians are wannabes, know a little but don’t really know. I am one of those wannabes.

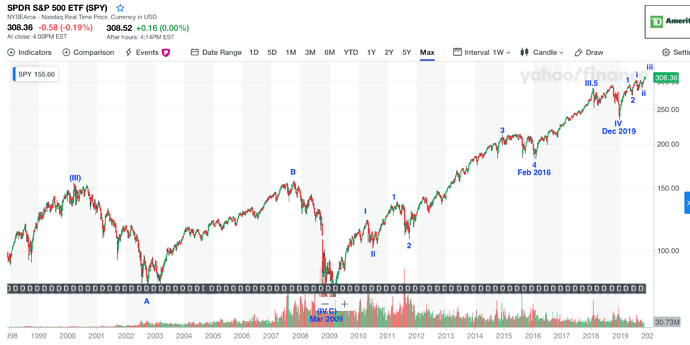

Looking at more info, from 2019, I realize my original labeling is most likely wrong. Below is the new interpretation. If I’m correct, the bull market is going to last a long time more, at least a few more years.

Yes, I have the R.N. Elliott's Masterworks: The Definitive Collection: R. N. Elliott, Robert R., Jr. Prechter: 9780932750761: Amazon.com: Books, but hard to go through (or not enough time to read leisurely), still with me.

Regarding long term, no idea how the market goes or I need more info (and right info) to analyze.

Short term, with 30-90 days, I do not worry about recession nowadays as I can swing reverse reverse stocks or keep cash.

Dec 2018 was a nice run (19.5% down) I am able to pass through, hope I can manage future as I am better prepared for it.

Have you all noticed “Yield curve reversed like normal times” after 3 fed rate reduction now.

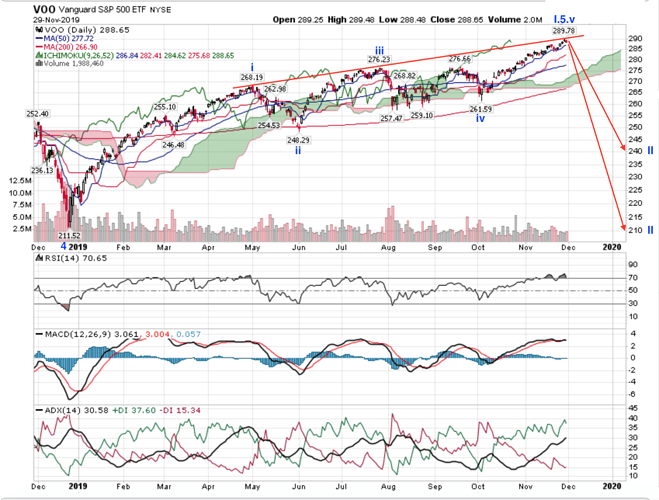

Praying that I interpret wrongly,

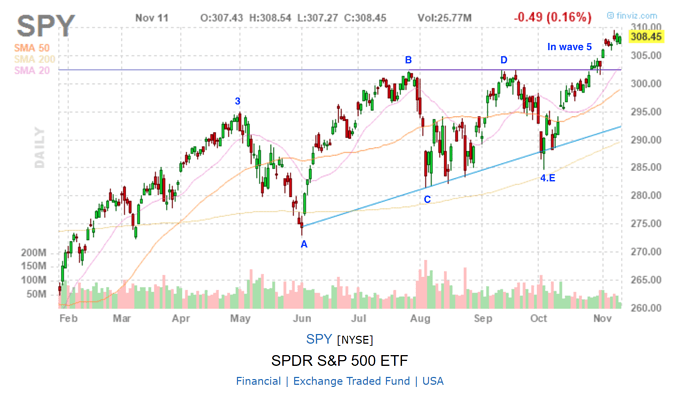

Posted above in Nov 2018. Guess I didn’t say is EW so @Jil didn’t realize EW can interpret multi-years to multi-decades to … The updated picture is below (note that is an expanding flat ![]() ):

):