Diving below Mar is worse than end 2007-2008? Btw, if SPY breaks above the upper channel of the expanding triangle, the bull has a lot more to go. Price behavior in coming 1-2 weeks i.e. before election is critical.

I guess it will be lower than current level just before election.

So obvious ![]()

The stock market rally has come to a turning point. The major indexes and many leading stocks are pulling back in a manner that could foreshadow a bullish advance or bearish retreat.

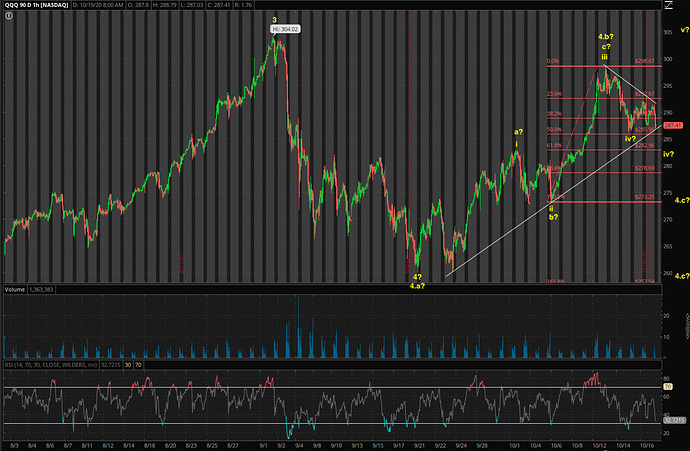

From EWTperspective, still in wave iv ![]() , a corrective wave retracing the wave iii, an impulse. Count valid till QQQ breaks below $283. Then alternative count would kick in, in wave 4.c, a corrective wave to wave 3, an impulse. Depicted below, you need a rudimentary knowledge of EWT to understand. If I have to elaborate, it means you have 0 knowledge of EWT.

, a corrective wave retracing the wave iii, an impulse. Count valid till QQQ breaks below $283. Then alternative count would kick in, in wave 4.c, a corrective wave to wave 3, an impulse. Depicted below, you need a rudimentary knowledge of EWT to understand. If I have to elaborate, it means you have 0 knowledge of EWT.

http://www.forexhit.com/learn-forex/elliott-wave-principle.html

Due to potential complexity of the corrective waves it is best to confirm their end by using other technical analysis tools.

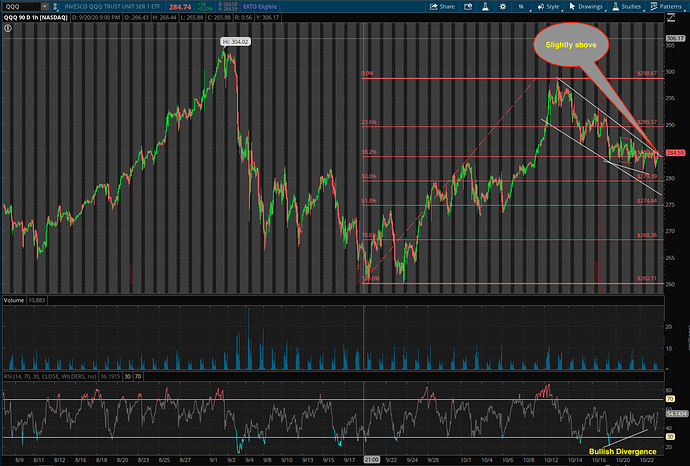

Quite often, I foolishly try to predict the end ![]() . That is what I am doing now, using fib numbers and trend lines

. That is what I am doing now, using fib numbers and trend lines ![]()

If I have to elaborate, it means you have 0 knowledge of EWT => I do not know the EWT.

I trust my own creation, crystal ball , my magical crystal is flashing some REDs now. It is precarious stage now, slowly ramping up for a possible show down ! As I said previously, I moved everything to cash including AAPL.

Even though AAPL sold more iphone 12 beyond expected, it will touch a low (IMO) and come back.

As I said previously, I moved everything to cash including AAPL.

No buy n hold???

…flashing some REDs now.

Orange?

Not Orange, but RED…If you remember all my buy/hold are valid until big drop I sense ! Now, I feel so.

BTW: This is for discussion purpose, not a stock advice, nor a finance advice. You are on your own for anything in stock market.

Your buy n hold is swing to position trade, not buy n hold at all. Well, relative to your day trading, is buy n hold

Your buy n hold is swing to position trade, not buy n hold at all. Well, relative to your day trading, is buy n hold.

Knowing ahead that market is going to fall, why should I hold (assuming I am correct both bottom and peak)? What is the point in doing that if I do not have concern (IRA accounts) about taxes on capital gain?

assuming I am correct both bottom and peak

Only if you’re correct 100% all the time ![]() for each peak and trough. Always need to monitor the market closely. Whereas, buy n hold, can switch off, only need to look at earnings once a quarter. Want me to show you my AAPL again? Do nothing regardless, so long the long term picture is unchanged.

for each peak and trough. Always need to monitor the market closely. Whereas, buy n hold, can switch off, only need to look at earnings once a quarter. Want me to show you my AAPL again? Do nothing regardless, so long the long term picture is unchanged.

Correct 100% - sure, but monitor closely => No.

The system was developed by Dec 2017 and still running fine for me, able to get the UPs and Downs at least 90%-95% accuracy, far better for me to grow.

The system was developed by Dec 2017 and still running fine for me, able to get the UPs and Downs at least 90%-95% accuracy, far better for me to grow.

Update in Dec 2027, hopefully forum is still around ![]()

From EWTperspective, still in wave iv

, a corrective wave retracing the wave iii, an impulse. Count valid till QQQ breaks below $283.

This count is still valid.

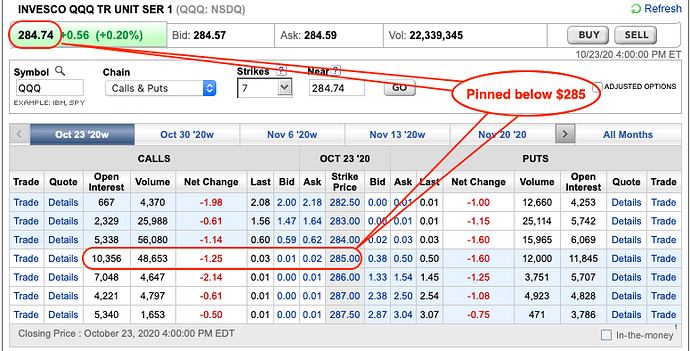

AH re-bounce to $285.78, 50% fib acts as a resistance.

Update:

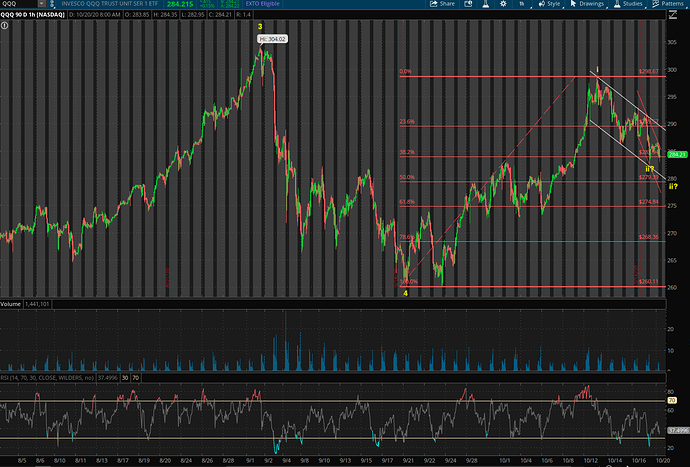

Overnight realize there is an alternative count which is more likely given current behavior,

Update to previous count (last post). My hunch is won’t be resolved 2mrw, may be Monday.

If I guess, tomorrow is +day(1%-2% S&P up), but very likely negative on Monday (not 100% sure). If tomorrow S&P is very high above 1.75%, Monday market sags.

This is pure guess inference, which may go wrong.

If I guess, tomorrow is +day(1%-2% S&P up), but very likely negative on Monday (not 100% sure). If tomorrow S&P is very high above 1.75%, Monday market sags.

My chart is for QQQ ![]()

Covid cases are climbing again and we won’t have any stimulus in place before election despite what the pols said. Negative headwind for sure.

Even if we do get something Covid cases are climbing everywhere else as well.

Europe and US are not “everywhere”. Check East Asia.