Are you convinced with pull back and bull trap possible?..

Still about 50% cash. Limbo.

Are you not having FOMO not cashing the balance 50%? You should have minted money by now…

S&P last Thursday.

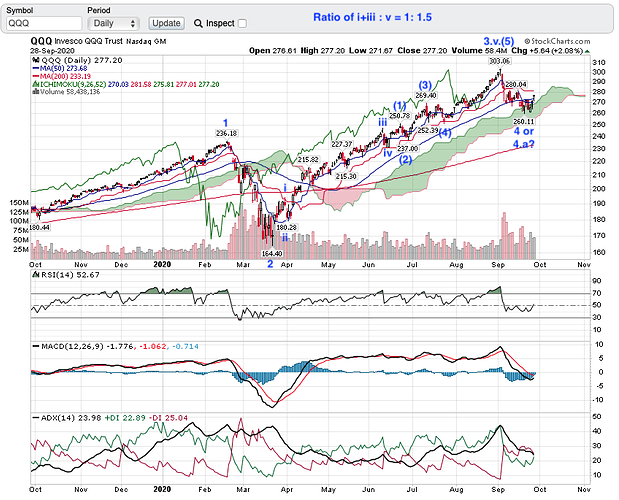

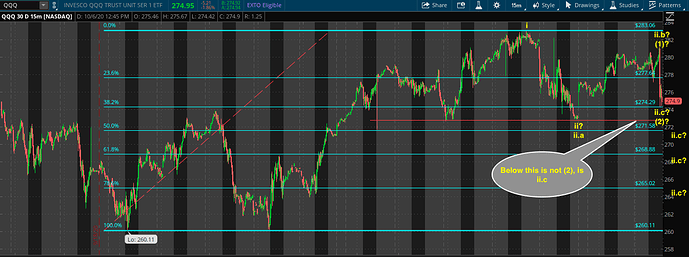

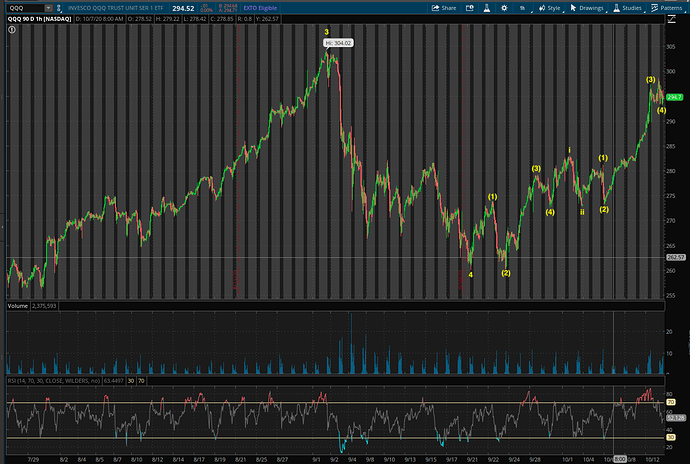

QQQ is last Monday at $260.11, refer to attached charts.

EWT: $260.11 might be wave 4 (bottom) or wave 4.a. (corrective wave 4 not completed yet). Impossible to predict what the corrective wave would look like, can be flat, zigzag, triangle or combinations. After wave 4 is an impulse wave 5 (up wave) and then a corrective wave of Cycle degree which can last few years to a decade.

Ditto, unable to judge, but the way it goes potential downtrend is possible(This is guess) mainly with election uncertainty.

Biden confirmed 21% to 28% corp. tax increase, volatility will increase further.

Refer to chart posted in previous post.

Start is $260.11 LoD on Sep 21.

Please note that EW waves are nested. For example, wave (5) was splitted into wave (i),…,(v).

Labels:

Intermediate waves: i, ii, iii, iv, v

Minor waves, (1), (2), (3), (4), (5)

Minuette waves (i), (ii), (iii), (iv), (v)

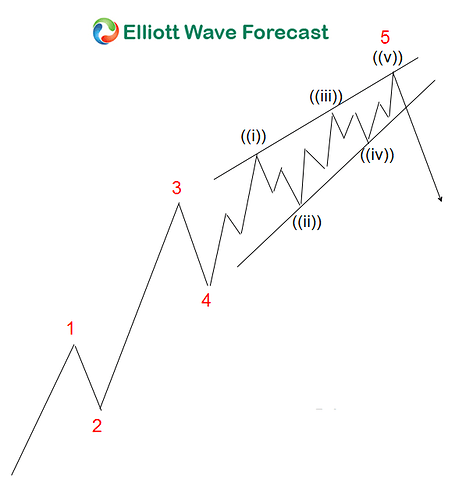

Note that wave (5) looks exactly like the ending diagonal below:

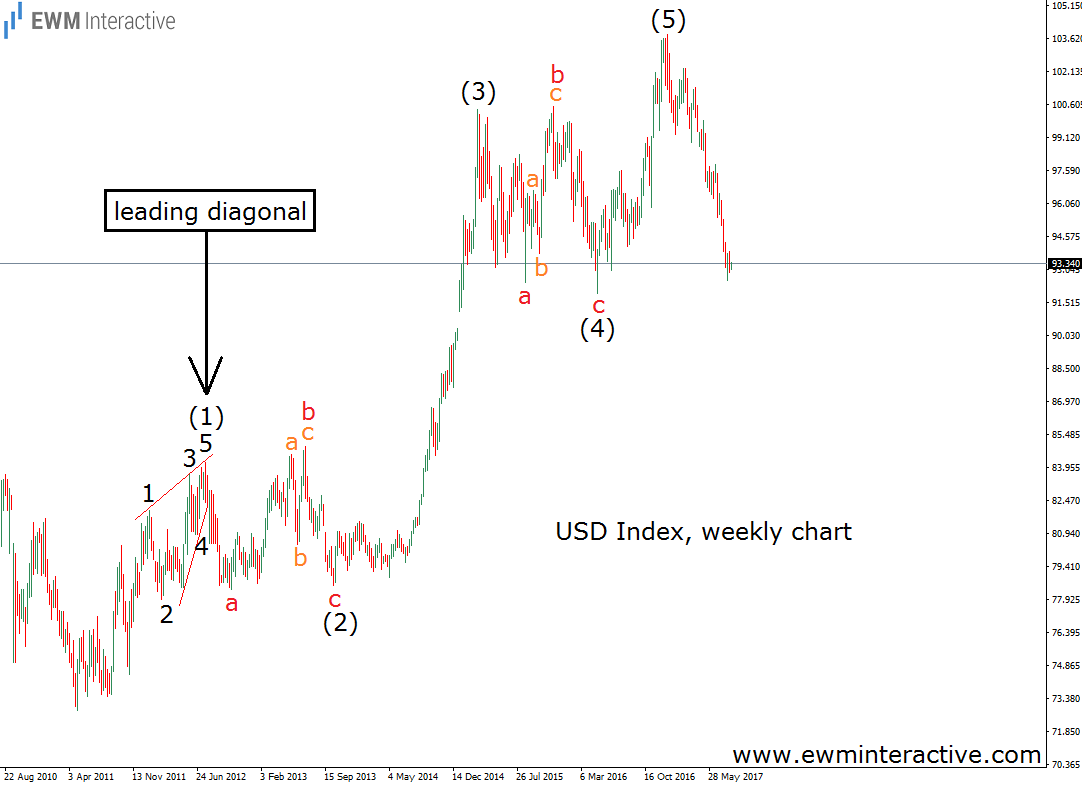

Btw, wave i is a leading diagonal ![]() Many diagonals

Many diagonals ![]() I don’t know what wave ii is going to look like* but wave iii is going to rally fast and furious

I don’t know what wave ii is going to look like* but wave iii is going to rally fast and furious ![]() refer to diagram below.

refer to diagram below.

*So I started accumulating TQQQ today. Just keep averaging in ![]()

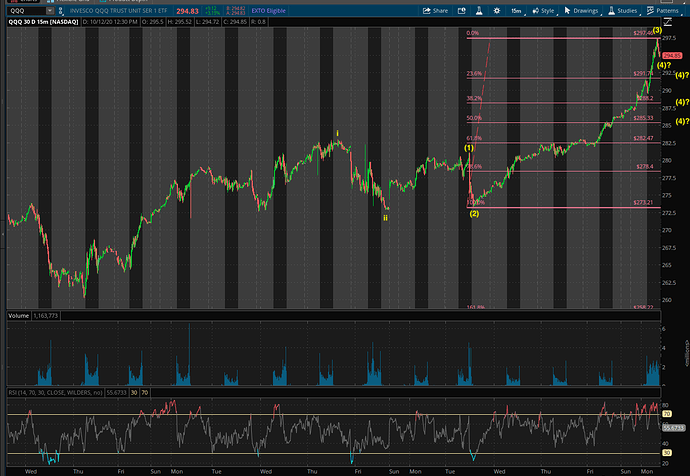

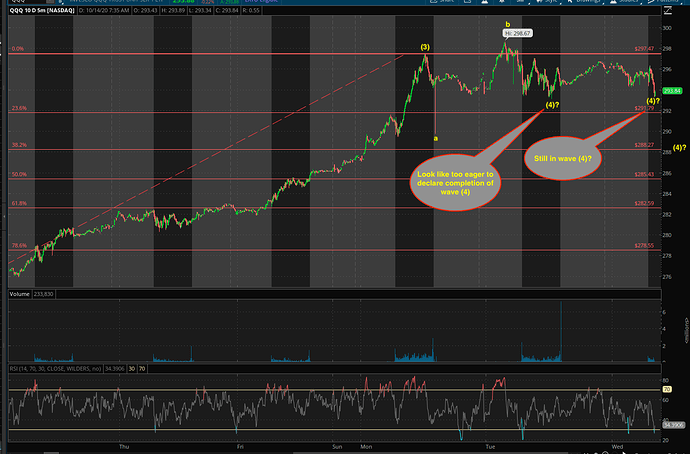

Today up may be just wave ii.b (counter trend up wave), there might be a wave ii.c (down wave) to complete wave ii. Refer to the chart by EWM interactive in previous post.

However if continue above $283, then wave ii is completed at $273 and QQQ is in wave iii ![]()

Bot QQQ too early so not much gain ![]() If above $283, go momentum! ADD

If above $283, go momentum! ADD ![]()

Edit:

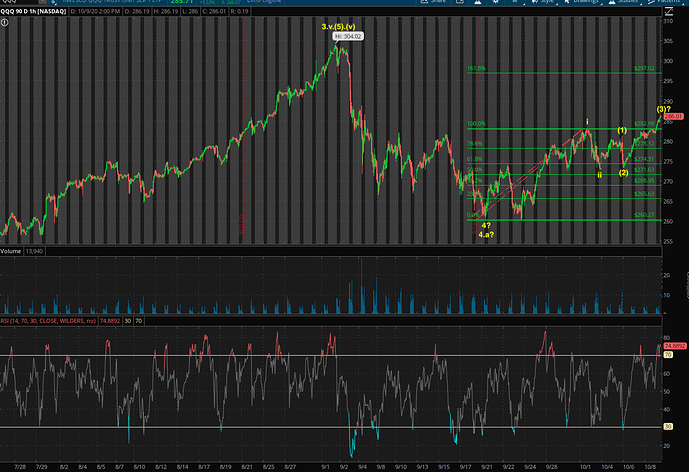

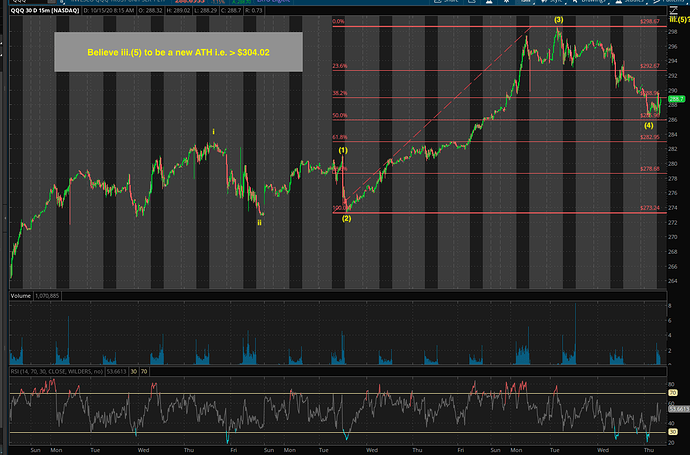

An very optimistic count ![]() of QQQ.

of QQQ.

Assuming me bet is correct, so long QQQ, long TQQQ and short puts.

No long calls, somehow I have forgotten how to do that… lost $ so far.

Monday may be a buying opportunity.

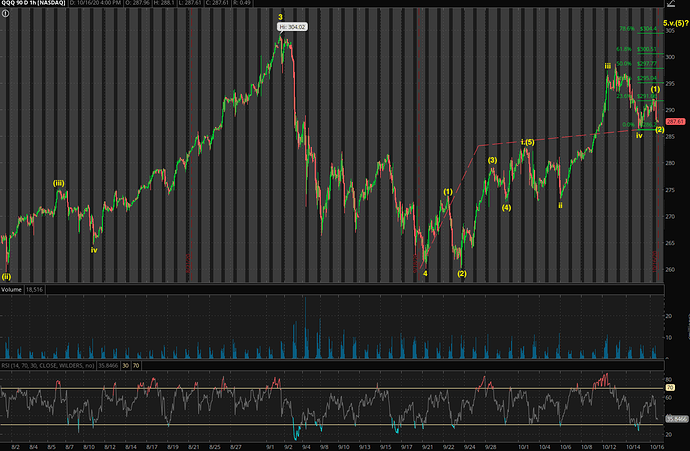

Wave iii should be completed below $300, expect wave v to be a new ATH (> $304.02).

$286-$288 ![]() If not, around $296

If not, around $296 ![]()

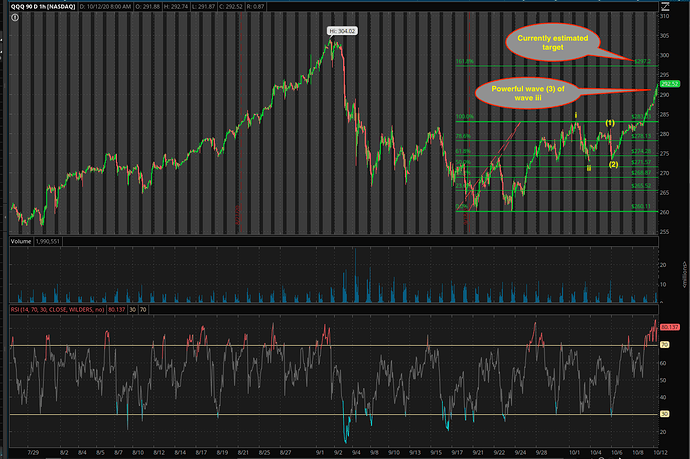

Hope everybody is riding the powerful wave (3) of wave iii ![]()

Currently estimated target = $296-$298 before a consolidation. A gentle reminder that a new ATH (>$304.02) would occur before election. Highly likely to have a sell the event (in this case, election) effect.

For those who are new to traditional EWT, impulse has 5 waves (new theory can has 3 waves, may be because of too many HFT manipulation?). Completion of wave (3) is start of wave (4) down wave, then wave (5) up wave. Completion of wave (5) which is also completion of wave iii, would be start of wave iv down wave, follow by a wave v up wave which I suspect would be completed before election. Completion of wave v could be completion of a wave one (generic label) which would lead to a wave two (generic label) - a sharp drop ![]() of magnitude greater than those occurred in Sep and Oct - not sure the exact degree yet

of magnitude greater than those occurred in Sep and Oct - not sure the exact degree yet ![]()

Wave (3) completed at $297.46. Now in wave (4).

Good luck guessing where wave (4) would be completed at, I’m clueless. So I close all day trades (bot last Friday and today’s morning). Holding on to Long TQQQ. Die die insist on selling TQQQ above a new ATH. Hope my optimistic count is correct, else I will lose $ ![]()

Assuming my count is correct, corrective wave (4) should be completed, now in up wave (5) - guesstimate is $303-$305. So long ![]() some QQQ calls for a multi-day trade.

some QQQ calls for a multi-day trade.

Still holding long TQQQ for the grand prize of completion of wave v.

Still in wave (4)? Will add to long QQQ calls if drop to $288-$290.

Edit:

CST 12:55. Run some errands, back, till not ![]() $288-$290. LoD so far is $290.26.

$288-$290. LoD so far is $290.26.

Unfortunately, my Magical crystal is blank (not clearly telling any hint), guessing either today or tomorrow (if dips), that is low for this week.

Best Stocks To Buy? Apple, Microsoft, Tesla Lead Techs Building Bases, Are Part Of QQQ

Buy an exchange traded fund like Invesco QQQ Trust (QQQ), and you’ll gain access to all of these stocks, and much more.

![]()

The $145.2 billion ETF, launched in March 1999, is trouncing the broader market with a 37% year-to-date gain through Wednesday’s close.

Good benchmark. If your portfolio is not growing at > 37%, switch to QQQ.

QQQ’s top holding, Apple, is up 65% this year.

If your portfolio is growing faster than 65%, congratulation. You are an outstanding trader/ investor.

Low of the week means BTFD? Did your system indicate BUY? I have lost ![]() some optimism and now prefer a less optimistic count. So is STFR next week. Still don’t think i-ii-iii is abc. Hopefully I’m right, otherwise next (or next next) week will see $260.11 tested.

some optimism and now prefer a less optimistic count. So is STFR next week. Still don’t think i-ii-iii is abc. Hopefully I’m right, otherwise next (or next next) week will see $260.11 tested.

My Magic crystal inference: Market will be up tomorrow (Monday), that is the last chance for me to sell everything to cash mode. Few days, it can also jump, but I never believe that is bull run.

Market will have a drastic fall thereafter.,This will go like this 2008 repeat scenario…This is my inference, but can go wrong 100%. Use your own judgment and this is not a stock advise or suggestion.