$300M? Playing with fire?

They are bored. Day trading is a hobby. Needle point seems more profitable these days.

It depends what tools, time and money people have !

Definitely, 300M is not easy account, there may be some analysts/software help.

No I respect anyone who can stay even-keeled and deal with the ups and downs. I would get too distracted.

San Francisco wants to out do AOC. This wack job is running for Weiners seat. You San Franciscans must be real proud.

Heaven forbid anyone concerned about a housing crisis would have any ties to people who build houses.

She has declared war on cisgenders.

what bothers me is the following:

I have been tracking case volume and we are on track to hitting over 200,000 cases a day (back of the napkin math) by end of Jan if nothing is done to arrest the curve. We are in widespread uncontrolled spread across most of the mid-west and south. This is not like the beginning of the year where it was pretty contained to coastal states.

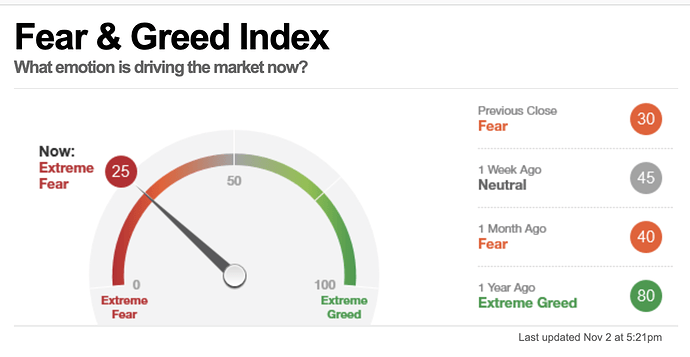

The argument’s always everything is priced into the stock market, but is a bigger and worse virus surge priced in? together with the ensuing death toll? we are already at 1000 deaths a day. by end of Jan, (even if the case count per day does not go up), that will be another 100,000 dead people. That’s quite a bit of GDP hit.

I think the prospect of a stimulus package would move market more. Midwest is getting hit hard but the two coasts and the south are not doing too bad. That’s where the bulk of US GDP gets generated.

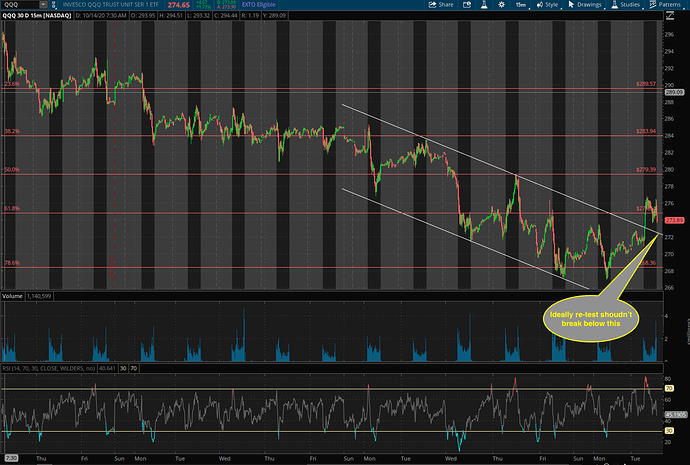

What we want to see is re-testing of the upper channel (downtrend) line without breaking it and then rally above the 50-day SMA. ![]()

![]()

![]()

CV hit different sections of the country at different times. It always zooms sharply upward before leveling off. Of greater concern than the midwest are those coastal areas which had super-tight lockdowns. Look what happened when Europe did that - they “crushed it” - until they didn’t.

At the end of the day people will just get used to it. With the antibodies appearing to fade quickly with time their won’t be any herd immunity and their won’t be an effective vaccine. Colds never go away, the flu never goes away. Once the 1% most vulnerable to this new virus have been seriously sickened or killed we will just stop worrying about it. In many parts of the nation where it’s surging people already have.

Imagine if covid19 kills one percent of the population every year.

It doesn’t. It kills the most vulnerable 1% when it is first introduced. Just like the other 6 Coronaviruses we already had did when they first hit the population. The six that now cause nasty colds. The six we’ve never developed a vaccine for - and have no herd immunity to.

Under peer group pressure.

Cut TQQQ from 1500 to 900.

Already owned some SQQQs ![]() and SPXUs. There might be civil unrest instigated by Trump if he loses.

and SPXUs. There might be civil unrest instigated by Trump if he loses.

Mostly, he will take up with legal, but not civil unrest.

It all depends on how Michigan win to Biden.

I cut TQQQ as I do not want to be greedy and moving to SPY and QQQ soon.

Anyway, lot of stimulus discussion, thanksgiving and December month creates more volatility.

Plan to buy back TQQQ (ofc sell SQQQs/ SPXUs) if there is a dip due to civil unrest.

Net TQQQ + SQQQ + SPXU is long

Civil unrest won’t dip, but this one

He did exactly what I think he would do, instigate a civil unrest.

Anyhoo, too close to the possible resistance line. Just wondering whether to unload more TQQQ or add SQQQ now or wait for it to get closer to the line.

Civil unrest is to show anger or retaliation, that is an act of uneducated mob/mindset people. I do not why such educated people think this way? It won’t topple government.

Put yourself on Trump’s place. With his money power (vs Dem party money power), If lawsuits are made, it will give an opportunity to come back if votes are counted or discounted in his favor. Again, Dem Party won’t leave it easily either.

When the margin is slim, lawsuits may resolve many things than civil unrest. Now, the election authorities/courts will have tough time.

Reg stocks, other than unloading TQQQ and Calls, I did not unload anything as market will go up for some more time. Until I see next swing, I keep holding my QQQ/SPY.

Bought UBER+LYFT yesterday, holding it as there are chances to recover. I sold all calls.

I never expected this much big jump, otherwise, I would have made some aggressive calls instead of TQQQ.