Jeff is happy to exploit the poor to get richer and you invested in AMZN

Anybody with significant net worth parked in a capital weighted index fund has a goodly chunk of $$ in Amazon.

It’s funny but I never use them. They haven’t got what I need or the prices are so high compared to non-Amazon players it’s laughable. It’s true even with books which is where they started. Of course I have pretty esoteric interests.

To me, I use amazon for the convenience but I still use others too when I do price comparison shopping. I’ve been using amazon fresh a lot as well and it’s quite good. I haven’t been to Safeway in months.

Safeway ![]() Costco

Costco ![]()

Megacap and semi are doing well. Rest ![]()

I love Costco but I hate going there. Too many people and delivery for the items are limited. I also found out that Walmart got good stuff online too and delivery is free.

I suppose you’re referring to the Costco Sunnyvale. Costco Austin is never crowded.

Hmmm, my first preference goes to Costco, then home depot and then Amazon. In some cases, amazon vendors used to quote lower or even matching Costco price. Amazon is my nut and bolt store to get special items, esp well known branded hardware.

Amazon is easy to search, cancel, return and is available at doorsteps. WFH resulted watch amazon prime and netflix!

I invested in all three. Walmart, Costco and Amazon. Amazon up almost 100% is the best return for me. Obviously timing is important. But it seems to be going up again.

Looks like amazon may be making another run to maybe even $4000. It’s my biggest position by far from weeks of building consolidation and it’s paying off. If they ever announce a split, it’s going to 4000-5000 IMO.

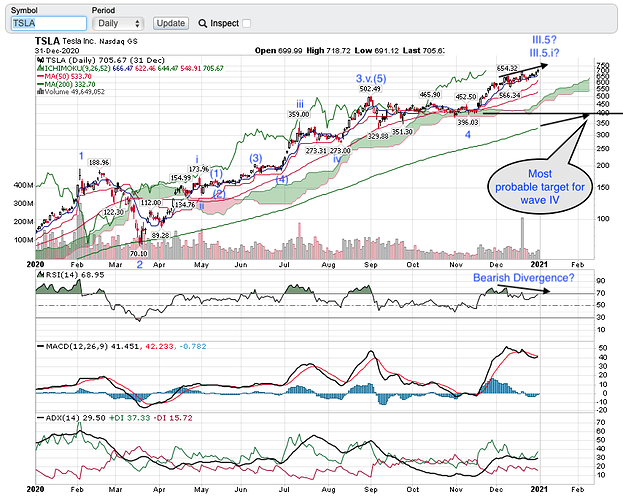

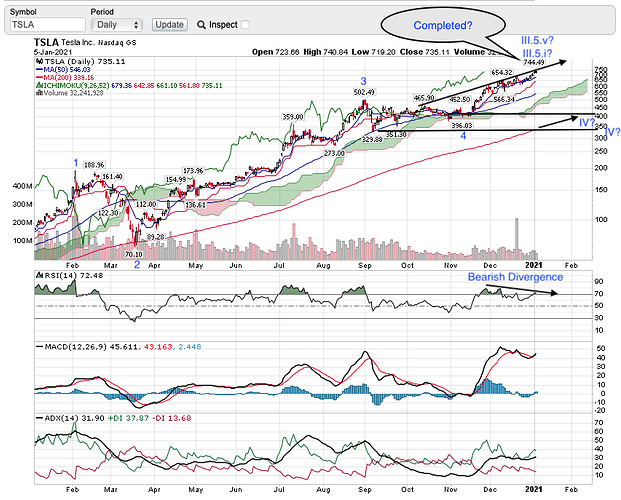

After much agonizing hours, … one is the big picture (up to Cycle degree) and the other is the shorter term picture (up to Primary degree). If wave III.5.i is going to be completed soon, many more months to rally. If wave III.5 is going to be completed soon, corrective wave IV would take 6 months to a few years to complete.

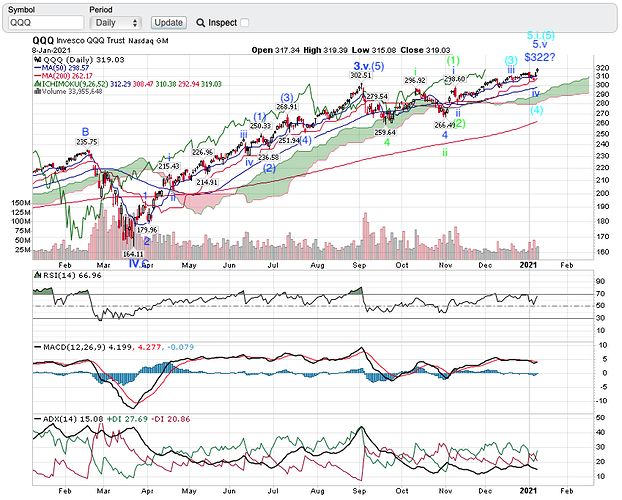

Is your algo flashing sell? QQQ hits the target that could be either I.5.v (a deep pullback would ensue) or I.5.v.i (pull back not lower than $303.60 and could have completed, upon completion new ATH). Decision time: Close all position or add

It flashed RED last 15 mins on Dec 31, 2020. Unfortunately, I was traveling to Los Angeles for new year during market hours, esp last 2 hours, but I noticed on Saturday - which became after the fact. But, I do not know how much it goes down. See my conversation with my partner.

Correction starting. The market needs corrections . Better to have lots of little ones than a few big ones.

If next two days market continuously going down, possible 8% correction.

However, my inference - from my own algo data - indicates that today drop stopped and likely market (at least QQQ) goes up.

Even my partner does not believe market would be positive tomorrow ! He has bought some puts, but I stay away from any options.

BTW: Predictions can go wrong, viewers do not play stocks based on this blog update. This is for discussion purpose only.

No longer to be found so who care.

Just a slight update to the chart posted 4 days earlier. Wave III.5.v or III.5.i might have completed or may be one more wave up. AAPL, QQQ and MU have similar EW counts.

Satori Fund is out of tech stocks except Oracle. Such behavior has been reflected in the EW picture. However, they could be wrong about the market direction. Anyhoo, I think tech stocks are just too over-valued like Dotcom era, the only difference is now many of them have high revenue growth but losses or very low earning. So is very risky to hold tech stocks (incl TSLA) in 2021.

Is clear that QQQ is in Cycle degree wave V. However is not clear where it is now. So every time I see a five wave structure completed, I am not sure whether it is completion of,

Wave V (ofc is the same as V.5, V.5.v, V.5.v.(5))

Wave V.1

Wave V.1.i

Erring on the safe side, I closed all but 100 TQQQs (I think I made a mistake, should just sell those2 and replace with 100 QQQs since if it is wave V, the decline is fairly significant which could decimate TQQQ to single digit.) That is to say Biden-Harris term could be a multi-year bear market starting from anytime now to Jan 20 (definitely don’t add new money till after Jan 20) to have a clearer political and economic picture… could be 4 years of riots and high taxes.

Single digit TQQQ? That would be amazing!!

Not overnight unless touch wood some1 is shot dead. A very likely scenario.