All I see some setback for QQQ on Monday, but I do not know whether it makes big fall or small. It may be one day issue. I am not clear.

I browsed through YouTube.com and surprised to see many Elloitticians around. After looking through their counts on selected ETFs and stocks, I found TrendLizard is pretty good as in almost identical counts that I counted for QQQ and MU, self-praise ![]() or verification that I am not too wrong. Below is his YouTube on EWT:

or verification that I am not too wrong. Below is his YouTube on EWT:

I think at some point there will be a rotation back to cyclicals as the economy fully re-opens. We have seen it start to happen then reverse a few times. I expect we’ll have a few more too.

thank you very much. I understood the overview of EWT but to gain in depth knowledge, it looks more complex than I thought. Seems like I have to put lot of effort like preparing for my interview! Will do that

Some basic guidelines ![]()

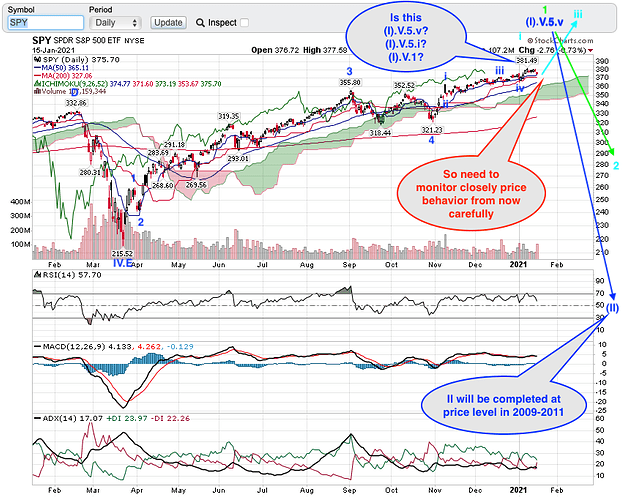

Survive the (II) crash, and ride (III) to become multi-millionaire ![]()

Make sure you have a list of good fundamental stocks and $$$ standby.

Btw, I have no idea when (I) would be completed ![]()

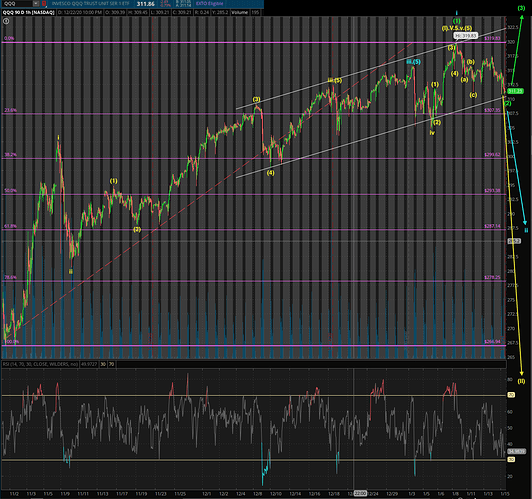

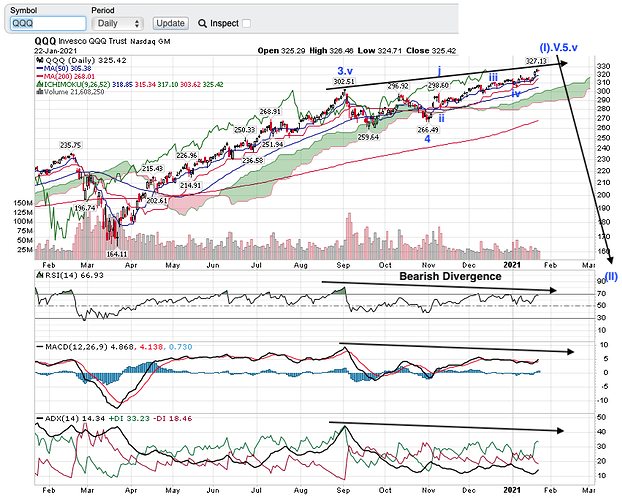

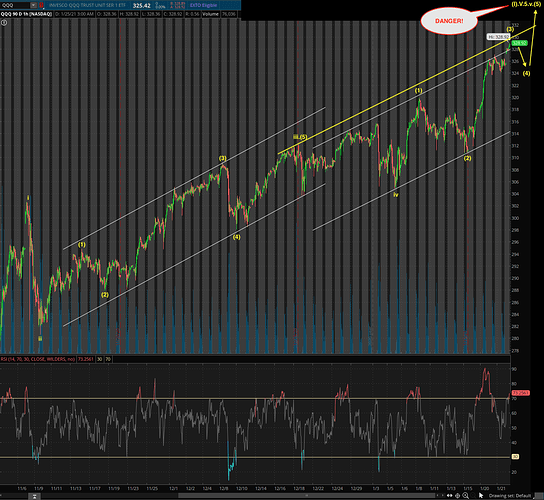

Since mid Dec, QQQ is so hard to count. Below is my best effort ![]() and I am still not sure

and I am still not sure ![]()

Preferred count in yellow labeling.

Alternate count in blue and green labels.

Looking at futures, green labels might be correct. That is, QQQ might have completed (2) last Friday and 2mrw open with a gap up wave (3).

Picture of SPY is similar to QQQ. Price behavior over the next two weeks should give hints as to what is $381.49.

Almost time. Did your algo flash SELL yet? Did you feel the adrenaline rush?

Million dollar question: Pull out now or ride till 1 second before strike 12?

@manch What does your no-hand clock indicate?

My only clock is the fear and greed index. Right now it’s not yet at extreme greed. Seems there is still room to

You are in it for the adrenaline rush not the money

I only recently understand the logic of @hanera’s trading. He needs an outlet for his trading rush so that he can sit tight with his Apple shares.

Lower degree (multi-week & lower) EW picture for QQQ.

Guess what price is (I).V.5.v.(5)?

Currently is completing (3) soon, then wave (4) pull back and the grand finale impulse wave (5).

Is wave (5) a normal length wave or an extended wave? Difference in price is quite substantial. Jumping out too early would leave too much money on the table, jumping out too late, your profit would be wiped off by a huge chunk… too clumsy, might go into RED… Wave (II) is fast and furious DOWN. Don’t be surprised get chopped by 50% in a short span of time.

I can not clearly see ahead and market may get corrected, I am not 100% confident on either positive or negative. Any decision I take based on confused state may end up wrong.

BTW: I am on cash mode two days before, except my B&H stocks.

From a spiritual standpoint that could be interpreted as a positive.

![]()

I have so many counters that I can’t run fast enough. I blame on running errands. After I came back, many change color, from green to red ![]() Anyhoo, 10% gain ytd despite all the screw-up. Still holding the bags for many names. Sold 100 MRNA :), holding 100 to please you.

Anyhoo, 10% gain ytd despite all the screw-up. Still holding the bags for many names. Sold 100 MRNA :), holding 100 to please you.

No need to please me, it does not help you anyway, it is your money and your profit ! Normally, when I sell I keep only one stock (monitoring purpose) and rest sell.

I took some profit taking on mRNA April short term calls when I saw mRNA at 146 ! I took good profit taking today so that I release some money to buy future low.

All stocks on hold as usual and also LEAP calls (2022 and 2023) intact, not sold.

Every time you make a morning Costco trip bad things happen. Next time tell us beforehand so we can do some trimming ahead of time.

![]()