Ok, with State Farm starting it off and now Allstate, worth starting a new thread on the subject. Should we be worried about skyrocketing insurance rates in our future?

I’m assuming that they would’ve raised prices if they could’ve and that Cali is mandating certain prices… At some point, the insurance companies will win - unless the CA legislators can get the Federal govt to mandate that if you cover one state, you cover them all, there’s only so much leverage the state has.

Don’t worry. If they all leave then the state will take it over. You can expect DMV level service and fiscal responsibility similar to the unfunded pension liabilities. Sounds great!

Some of the folk in my old haunt were forced to use California’s FAIR insurance plan. I’ve heard nothing but horror stories about it.

Farmers doubled my rate here in rural Arizona this year. I raised my deductible to $10,000 to offset some of the increase.

At some point I think insurers will have to drop wildfire. If the fire starts on your property it’s covered; if it’s a wildfire it isn’t. Just like slides, floods and earthquakes.

The state, community and individual can do a lot to mitigate wildfire danger. One reason it doesn’t happen is that it’s just too easy to buy insurance. If that wasn’t available fuel reduction efforts would be far greater. Breaks would be burned and bulldozed around rural towns. Here in AZ the Forest Service owns most of the wildlands. They no longer jump on every fire; they’ve had a “Come to Jesus” about how that affects fire danger long term. They ring vulnerable towns with breaks when there’s a fire and otherwise let her rip and clean out the forest, grasslands and lusher Sonoran desert landscapes the way fire is supposed to. Large scale mastication projects thin out high risk areas near towns. Less vegetation transpiring off water means more water in aquifers and reservoirs. Active management beats insurance.

If they drop wildfire, then people won’t be able to get mortgages. Mortgage companies dictate the rules for coverages.

You can get mortgages without earthquake insurance; the lenders just want to see that the home is strapped or bolted to the foundation. The same approach should apply to wildfire. Mitigate the risk.

Totally agree. I’m hoping that the exodus of insurers will be a wake up call to the CA govt to be more proactive about this. At the same time, I’m hoping my insurer doesn’t quit too.

And again, the CA gov’t will have to start allowing people to thin the forest and create fire barriers.

“Over the past 18 months in Florida, we’ve had 15 companies decide to stop writing new business,” Mark Friedlander, the Insurance Information Institute’s spokesperson, said.

Shoot, Cali may be next for Farmers whom I do have…

Given everything that goes into replacing a home it should be a good proxy for inflation generally. The discrepancy casts doubt on how we measure inflation.

Insurance companies pulling out of CA or FL have nothing to do with inflation. The whole idea of insurance is spreading risks to a big pool. So if Joe was unlucky and has his house burnt down, his neighbor Jane on the next street most likely doesn’t have the same bad luck happened to her at the same time.

But if climate change makes the whole state of CA a tinderbox, and the whole state of FL a floodzone, there is no way to spread the risks. Bad outcomes are no longer random, independent events. They become correlated. There is no private insurance company that can underwrite that kind of systemic risks.

If the “climate change” reasons were true, then Arizona (fire, lack of water in major city centers), Nevada (fire, again), Texas and the Carolinas (hurricanes) would also be seeing premiums skyrocket - but they are not. An insurance broker friend laid out for me the “why’s and wherefores” of the insurance issues we’re seeing today:

- California over-regulation.

- Inability to raise premiums during the Pandemic.

- Inflationary costs to replace losses.

- Low yields on investments (MBS’s, etc)

- “Jackpot” litigation environments.

- Re-insurance companies tightening their buy boxes.

- Plain old risk of fire and floods - a low priority item.

Given the risks above, can you think of any compelling reason an insurance company would take on risk here in the Golden State? There are some companies still willing to provide insurance, but the consumer, used to experiencing years of under priced premiums relative to risk, must now wake up to a realistic cost to insure in this present environment.

Is Florida also over-regulated?

Seems insurance companies are also leaving Louisiana.

Florida is not over regulated, however with the Surfside condo collapse (not climate change related, but decades of poor maintenance) and with lenders requiring inspections, higher insurance levels, and other reasonable due diligence actions prior to funding, many insurance companies have refused to renew policies in Florida.

The Louisiana article speaks of reinsurance issues, as well as natural catastrophes causing insurance companies to flee the state. I’m surprised anyone would think it wise to insure a flood prone swamp to begin with. The Big Easy has always been a sinkhole, and always will be. I’m sure it’s difficult to get insurance in Mexico City - located on a fault line, dry lake bed, and ringed by volcanos. That’s not a climate change issue, but one still of overall risk that’s existed for a millennium.

Florida. Louisiana. And Texas. All are over-regulated?

In the past, when natural disasters are not as big and not as frequent, private insurers can make reasonable profit underwriting home insurances. But if these disasters a) get bigger, and b) occur much more frequently, it stops making business sense.

Think about the 100-year floods that happen every other year.

Looks to me the root cause is not over regulation.

Insurance anywhere will always make business sense at the right price point. Only regulation keeps that from happening.

And no, hurricane strikes are not getting more frequent. If anything they are getting less frequent.

https://www.nhc.noaa.gov/pastdec.shtml

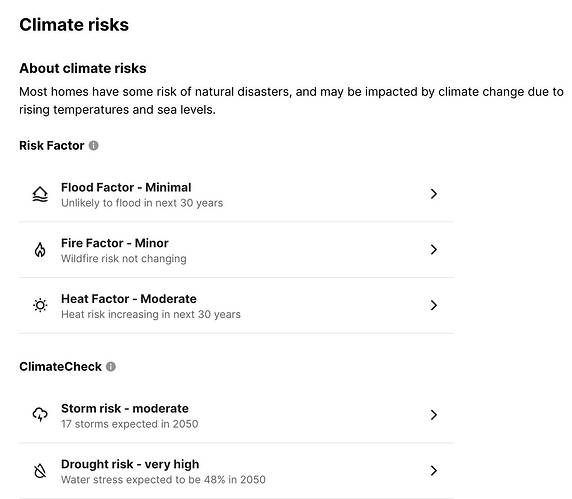

I was working with Blackknight for a short term and they are already including climate risk data to value a home and mortgage lending will soon take it into account. Florida, Louisiana were in the top high risk areas.