This is exactly why Florida and that general South/Southeast part of the US is totally overrated and you couldn’t give me a place to live there. Natural disasters bear down on you EVERY YEAR!!! Isn’t there another hurricane literally coming at this moment? Stupid. People. Live. In. Florida. Period.

All I know is that I got two of my Farmers renewals and yes they are higher (no claims) and I can’t say sheeet…

Or…they could stop blaming the wildfires on “Climate Change” and fix that instead of trying to “fix” the insurance market. Makes too much sense.

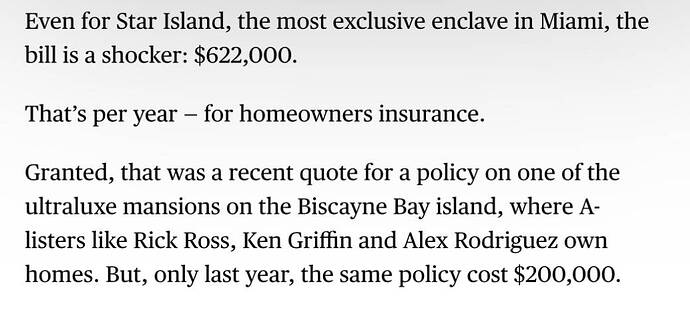

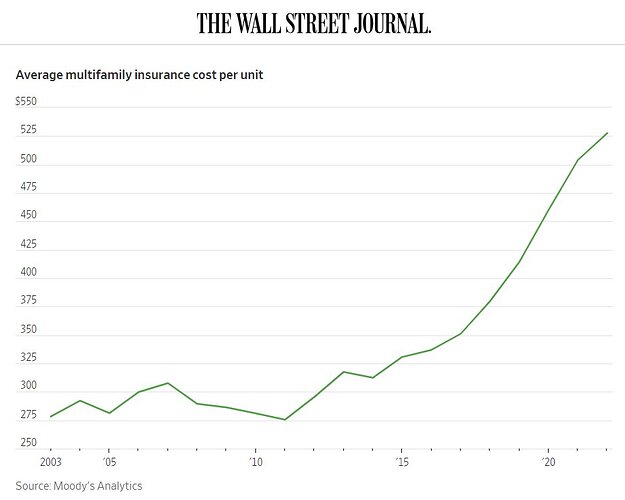

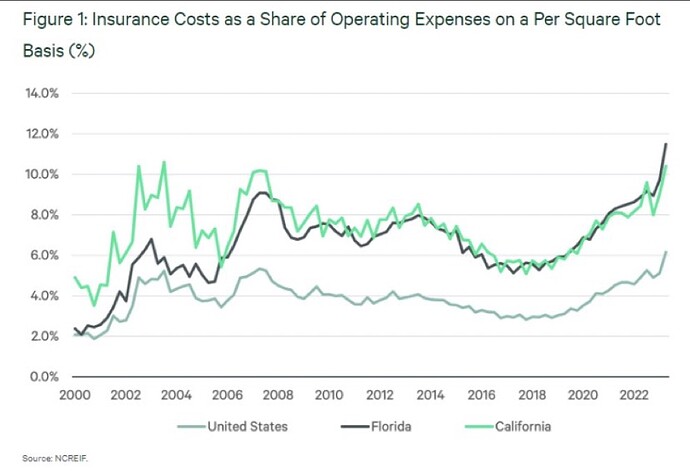

US Home Insurance ‘Bubble’ Closer to Popping as Climate Risks Mount

And it’s not just California. Farmers Insurance Group said in July it would stop writing new policies in Florida, joining more than a dozen other insurers. Florida’s publicly backed insurer of last resort, Citizens Property Insurance Corp., is now the state’s largest. In Louisiana, many insurers were declared insolvent and rates jumped 18.5% on average in 2022.

What about the buyer who bought their house? How are they paying 12000$ a year?

WFH ex-NYer. ![]()

Income tax savings > insurance premiums

Insurance is already heavily regulated by the state. I’m sure more regulation will make it cost less. Regulations always reduce costs. Idiots…

Agreed, but at this rate, we just want coverage!!! At any price!!!

Thanks for the $100 Safeco for my auto policy but just make sure you keep renewing my rental policies…

Florida’s insurance crisis is threatening the closing of Gernelle Bokuniewicz’s clients for their dream retirement home in Winter Park, Fla.

Frustration began to brew when her client received a premium quote of $17,000 a year for homeowner’s insurance, even though the current owner is paying just $5,000 for the same coverage. Things got worse when the insurance company retracted its quote, citing the high risk associated with the property, leaving Bokuniewicz’s clients scrambling for another insurer before the deal dies.

“I’ve run into issues before but nothing like this where I couldn’t find any insurance for home,” Bokuniewicz, the founder of Lively Real Estate, told Yahoo Finance. “It’s pretty scary if there is nobody to provide insurance.”

“The insurance company also found that Bokuniewicz’s buyers made claims based on their washing machine hose in their old house in Massachusetts.”

Ball valves need to be installed on washing machines so you can turn off the water when they are not in use. The older valves weren’t really meant to be turned on and off all the time. On older homes the line to each toilet which is under constant pressure needs to be checked and re-sealed where it goes into the toilet or replaced every few decades at least. My mom, in her later years, nearly lost a house because of this; fortunately I was there at the time.

We may be moving towards a situation where real estate is purchased primarily with cash and the homeowner manages risk themself. With regard to wildfire this would be a positive development as it would force homeowners and communities to get off their butts and start firewising. It would also put pressure on states and the feds to better manage wildlands.