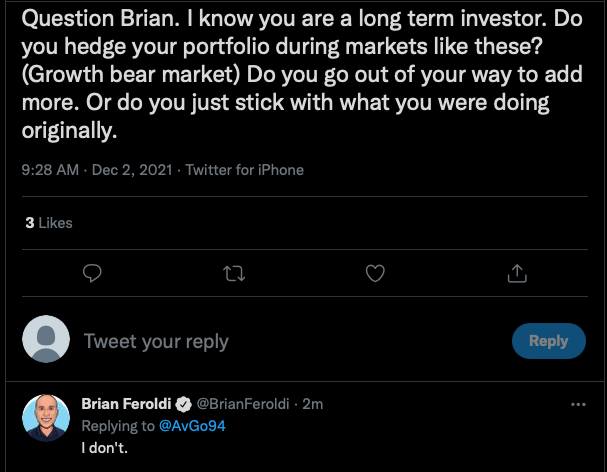

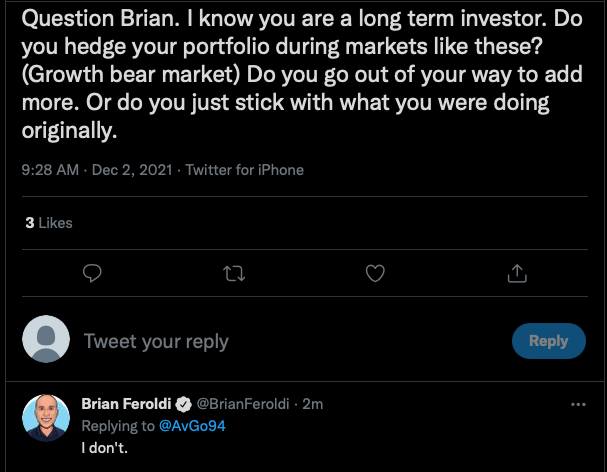

Investors don’t hedge.

Investors don’t hedge.

Joseph Carlson is a value investor, a small timer compare to @manch and many of the popular fin twitters.

He completely ignores crypto, TSLA, and all the popular hyper growth stocks.

It surprise me that there is still value investors around.

Is good to keep your 10x to 1000x bagger dream a reality check  by watching his views

by watching his views

Good observation. But not agreeing nor disagreeing with your opinion of growth will outperform or market over-react. IMHO, market is clearing traders (longs or shorts) and is a good time for investors to DCA purchasing into promising growth stocks. Why would all growth stocks perform well in a deflationary period (I believe is a layman’s view of a slow growing economy, not referring to a strengthening dollar)?

Bond market is saying, going forward is a slow growing economy with a strengthening dollar and a declining interest rate trend.

If the bond market is correct, the right investment is RE ![]() + FANGMANT

+ FANGMANT ![]() + growth stocks with good profitability.

+ growth stocks with good profitability.

@hanera I am searching your post a few days you wrote where to invest in different periods, and you wrote Real Estate is good for fighting inflation. Can you point to that ? or rewrite?

https://www.thefinancialphilosopher.com/2007/12/understanding-1.html

Short answer: Rent will keep up with inflation, albeit lag because of annual contract. However, not expecting inflation after 2-4 quarters, the reason for RE investment is:

a. Declining interest rates - Usually mean declining mortgage rates which mean increase affordability of RE so home buyers can buy higher priced houses;

b. Strengthening US dollar + consequence of a. - Overseas investors are attracted to invest in USA RE.

https://www.equitymultiple.com/blog/investing-strategy/effects-inflation-real-estate-investing

As of June 2020, the average holding period of shares was just 5.5 months . That’s a massive decrease from the late 1950s peak of 8 years .

wow

That jibes well with my earlier suggestion that creation of FED and detachment of Dollars from Gold Standards has only made market more volatile and price swings bigger. Guess who looses in the chaos and confusion? The common and poor people.

Shouldn’t we return to market drive interest rates constant currency supply.

Fed supposes to smooth the fluctuations but instead it amplifies them.

Exactly, how would you price stock market if you do not know what to price against ? How would you know what your dollar be worth in next few weeks and month (due to money printing)? Is dollar of 1970 same as dollar of 2020? The sooner we shut down the FED, calmer will be the currency, real estate, stock and debt market.

Investing in an index fund is sadly not going to get you to the 1%. How are you going to come up with $10M to invest to begin with? And even with $10M you are still not quite in the league.

You need to go all in in a concentrated position of some high risk asset. Win big or die trying…

Most people are not going for top 1%. $5M per adult is good enough. So no need to do anything after $10M. Just enjoy the free  , any amount above $10M

, any amount above $10M  The key message is do nothing and enjoy life.

The key message is do nothing and enjoy life.

Yes I suppose $5M is good enough

All cultures have something to say about wealth, mostly along the lines that fool and his money soon part.

It is true that money works for rich people, but only because the rich people know how to make money work for them.

Most people simply are too fearful to make good investment decisions. That’s actually quite foolish, because in trying to preserve what little they have they miss out on big gains.

For those who have $10M invested in S&P index in the beginning of this year, they are now in the top 1% club.

One tip that I remember well is from no one else but Jim Cramer.

There is a bull market somewhere.