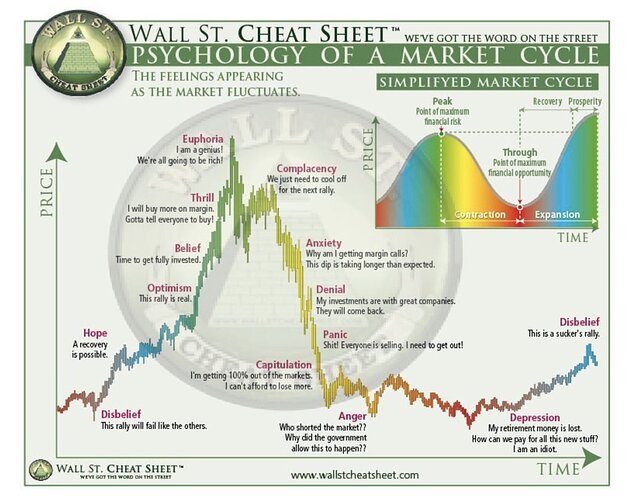

Thanks. Good reminder for understanding and managing risk. But isn’t the bigger risk is sometimes not taking a risk or not taking more risk( missing out on an opportunity).

You’re right. Both sayings are true, your judgement call as to which one applies ATM

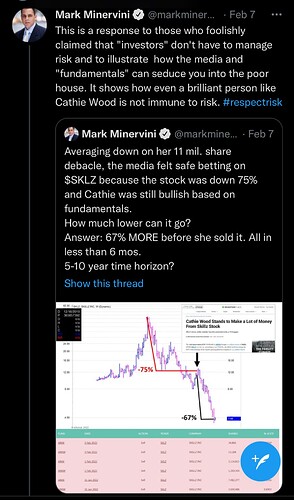

Mark is wrong about Cathie. She is a trader ![]() She tells us she has a five year timeframe but she trade daily.

She tells us she has a five year timeframe but she trade daily.

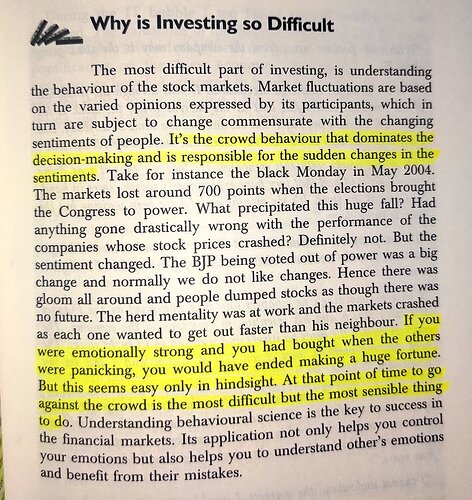

Is so well documented that many investors knew this. The billion dollar reason is we can only connect the dots looking backwards as to which one is an AAPL or AMZN. For example,

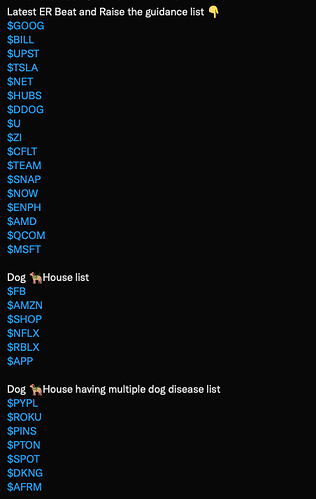

Which one of the following would be a 100x or even 1000x from today…

COIN RBLX U SHOP NET DDOG ABNB SNOW

Don’t know? No choice, spread out your capital. Btw, breakeven is one of them is 8x.

Own none of the dog house with multiple disease.

Own SHOP and RBLX in the dog house. Now I have to wonder whether I should sell them to add to the ER beat and raise guidance list.

Why do you have to base your decision on a single random ER?

.

This ER is important ![]() Just joking, I don’t invest base on financial performance. I bet on megatrend and CEO (if I can figure out enough about them).

Just joking, I don’t invest base on financial performance. I bet on megatrend and CEO (if I can figure out enough about them).

Roblox ceo not good?

Didn’t find out enough about him. So far, I like how he and other founders built up RBLX. I think is in the right direction. Just wondering about the monetization scheme. I am hoping they can find something like what Google found, Adsense… recalled Google is very user-friendly and popular but not very profitable until a VP comes out with Adsense.

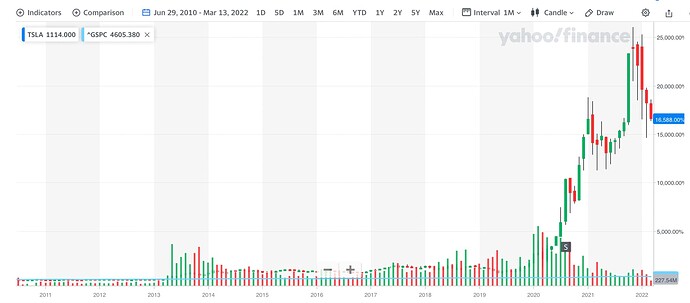

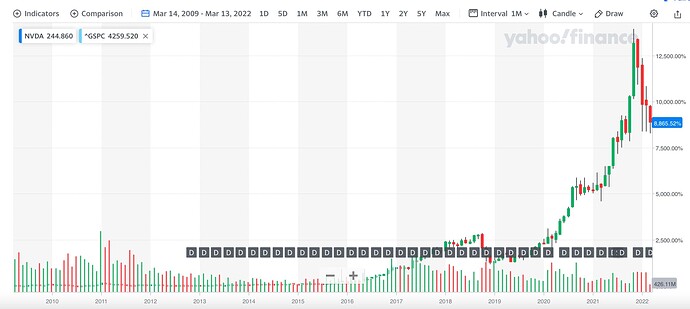

So long you are able to recognize that iPhone, AWS and streaming video are game changing. Shanghai gigafactory is game changing, 5 years from the construction is 2024, doubt you get 10x to 40x for the purchase in 2024 unless TSLA is worth $500 then, possible? The reason why you can get 10x to 40x for those three is because there are still many investors that don’t think they are game changing. TSLA is already a crowded stock, seriously doubt can get such a large gain. Ditto for NVDA.

“If you can’t stomach 50% declines in your investment, you will get the mediocre returns you deserve”

13 years of 29.2% only is considered legendary?

Holding one stock would do the trick.

Not as legendary as you sir

I think I need 15% a year for 10 years to match!

29.2% for 13 years is good but not great. To be great, should be at least 26% for 20 years, more than 30 years, godly.

Bot TSLA on Jun 29, 2010 IPO already beat the legendary Peter Lynch.

Bot NVDA 13 years ago also beat the legendary Peter Lynch.

Bot AAPL 13 years ago also beat the legendary Peter Lynch.

Ditto for AMZN.

29.2% for 13 years is good but not great. To be great, should be at least 26% for 20 years, more than 30 years, godly.

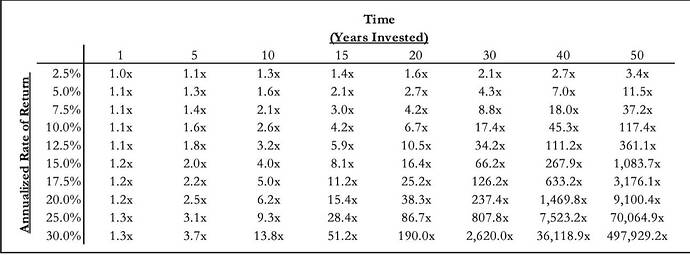

Nice chart for compounders.

Btw, since bottoming in Mar 2009, S&P compounded at 18% CAGR, about 13 years. At 18% from Mar 2009, S&P would be 1000 bagger in 2051 (42 years), 100 bagger in 2037 (28 years) and 10 bagger next year.

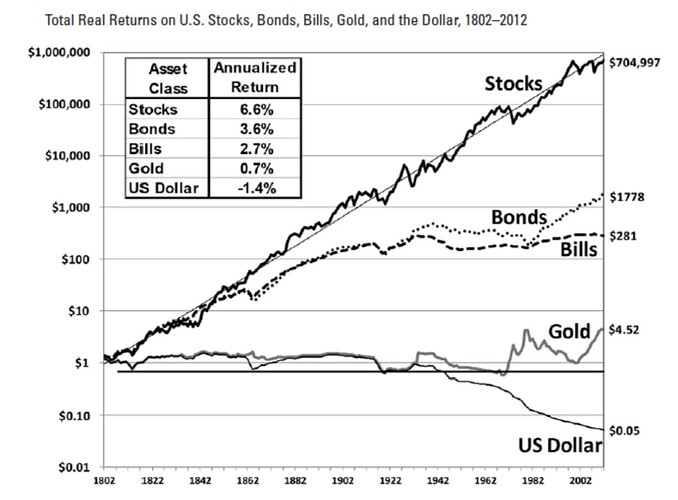

In investing, keep it simple, S&P index beats all financial assets. So no need to diversify into them.

Despite scarcity, return of gold is ![]() in the long run. Can we assume

in the long run. Can we assume ![]() for BTC?

for BTC?