Many investors think software companies have the best business model yet… AAPL is the highest market cap and the two potential challengers are NVDA and TSLA. What gives? Some people twisted the reasoning that those are also software companies… please give a better reason.

Software has very high margins, and the SaaS model is very sticky. It has more stability. AAPL is a software company. Do you think they’d have the same product prices if the hardware ran Android and Windows? TSLA is getting a premium valuation, because people value it as a software company.

.

Millennials bought into EM’s dream and strongly felt that TSLA would be the biggest company in the world soon, so is a must own till the millennials change their minds. There is a challenger ![]() PLTR, Alex Karp is copying EM’s approach in promoting the company. There is no need to do any DD or valuation, blindly follow the crowd is

PLTR, Alex Karp is copying EM’s approach in promoting the company. There is no need to do any DD or valuation, blindly follow the crowd is ![]()

Sound good. That’s what many thought during Dotcom, all in to sure-to-win stocks…

SUN CSCO INTC YHOO!

SUN YHOO! no longer around.

Outcome of recency biased is not always good. Happen to be correct, think you’re a genius and did a sound DD.

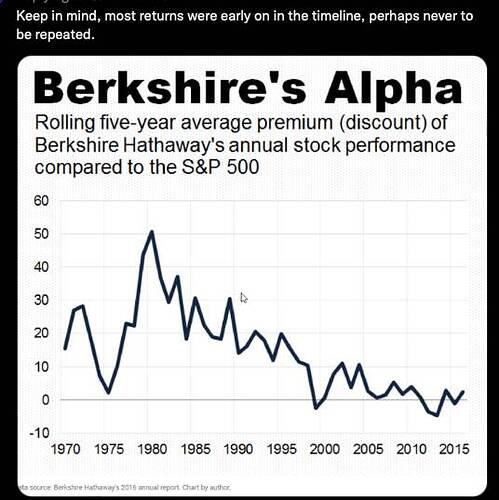

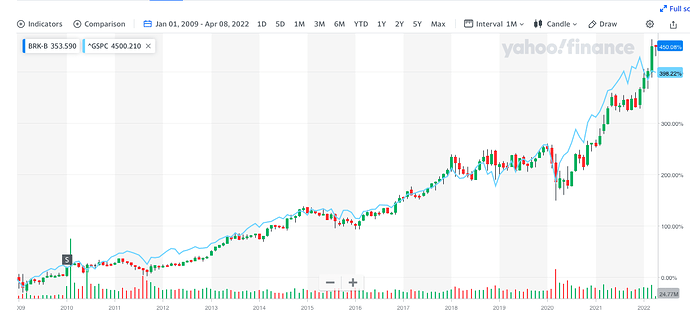

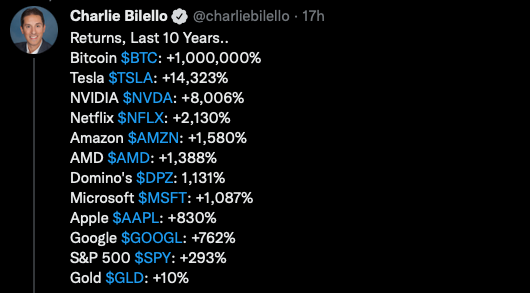

Please tell me return for the next 10 years from today,.

Domino’s looks so out of place.

It’s powering all the engineers from these companies.

Yes I can attest that Dominos is the power behind these keyboard slaves, specifically in the developing world.

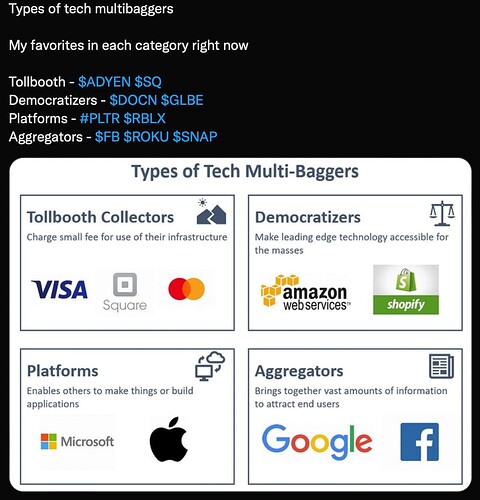

With the crash of high growth software companies, investors realize asset light companies have tons of competition. How can you achieve sustained high profits and cash flow if you have to spend so much money for SBC and R&D to stay ahead. Some have to spend tons on customer acquisitions.

That’s why high gross margins are important. Also, revenue should grow faster than R&D expenses. If not, then it doesn’t seem scalable.

So many people talk about generational wealth…

Generational wealth is achieved when you’ve accumulated enough investments to pay for your families living expenses in perpetuity without touching the principal .

FIRE before GW ![]()

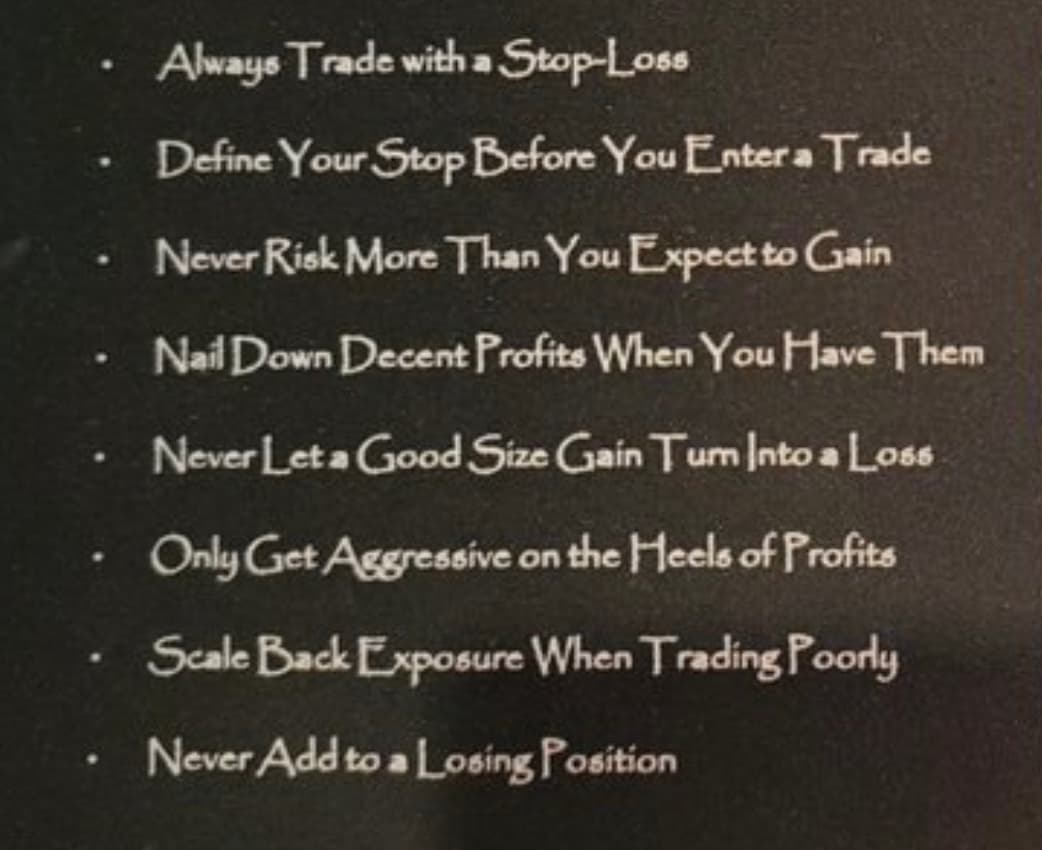

Common mistake: Found a good idea but uninvested in it.

Assumption: Highly convicted that is a good idea when new and not an after the fact then know.

That is, from a multi-decade perspective, no need to do any TA and FA. People, people, people.

I remember a study done that over a decade companies on the best places to work list out-perform the overall market. The gap wasn’t very big though. The companies on the list change every year, so the portfolio would need updated every year.

I hope that I can show one myth today. Many believe News/Media drive the market, but it is false.

Today morning Nasdaq went down 1.03%, then news splashed this (I bought more QQQ/TQQQ when it dipped more than 1% today).

End of the day, Nasdaq will likely recover end up near positive (or real positive) and close, leaving NFLX as is dropped. The upside reversals started for earning season and likely recover until all BIG megacap results are out.

This is a proof that News/Media does not drive market.

What is happening is “News/Media Picks interesting news, very convincing to viewers for the actions of market”

The real fact is news/media does not know why market is going up or down

There may be impact of NFLX on Nasdaq, but that is limited to market cap weight ratio only

Please no question and answers, if you do not like it or do not believe it, ignore it.

[edit] Sorry for confusion: Situation changing, sold all QQQ/TQQQ as FED is likely increasing the rate 0.5 leading to 3.25% rate hike this year.

Market may not fly high with higher borrowing pressure.

In addition, Mortgage rates for 30 year is moved to 6.75% which is too high. Not a good sign to hold QQQ/TQQQ.

No more updates, sorry for confusion.