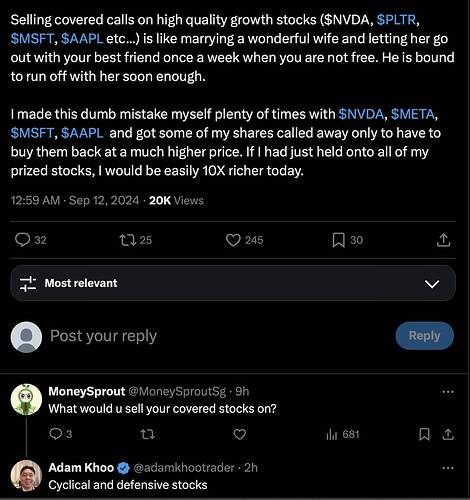

Wheeling is an art.

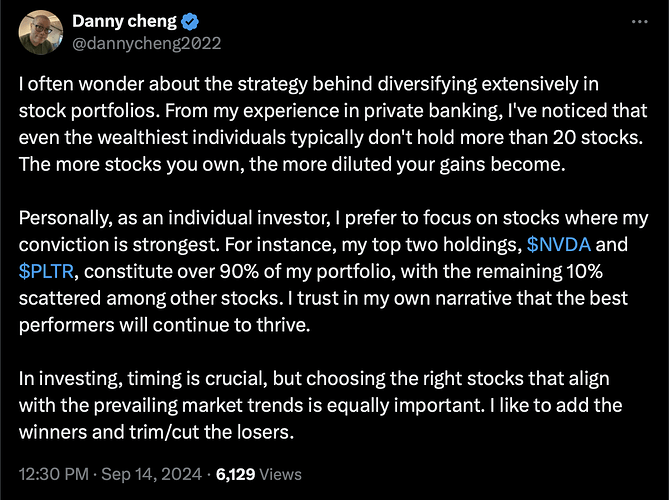

Good job. Concentrated portfolio of a few stocks yield the most return.

Good suggestion.

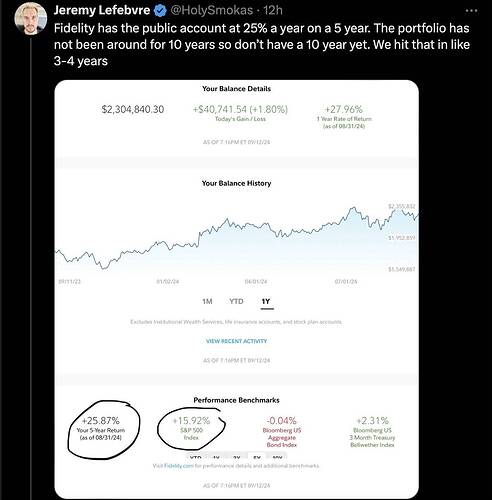

Concentrated portfolio or invest in S&P.

Still listening… wondering whether he would talk about his BABA investment. He cuts at a great loss.

Disclosure: Holding BABA calls equivalent to 1000 delta. Got in and out a few times, make $$$ despite BABA has been in multi-year decline. Some stocks should not be buy n hold ![]()

Note: Just before this, have 60 calls, sold 45 last week.

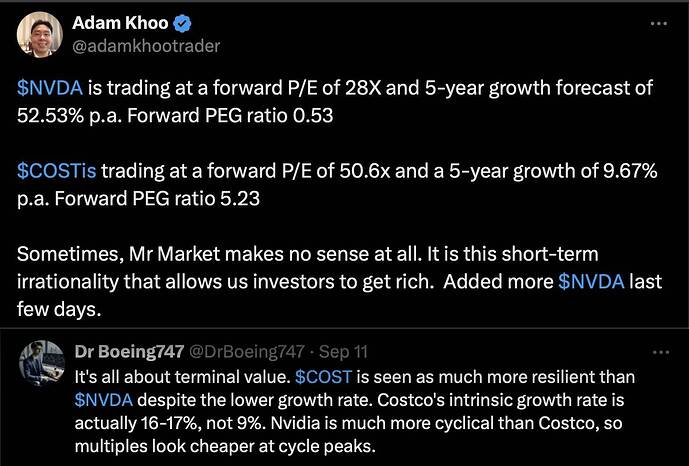

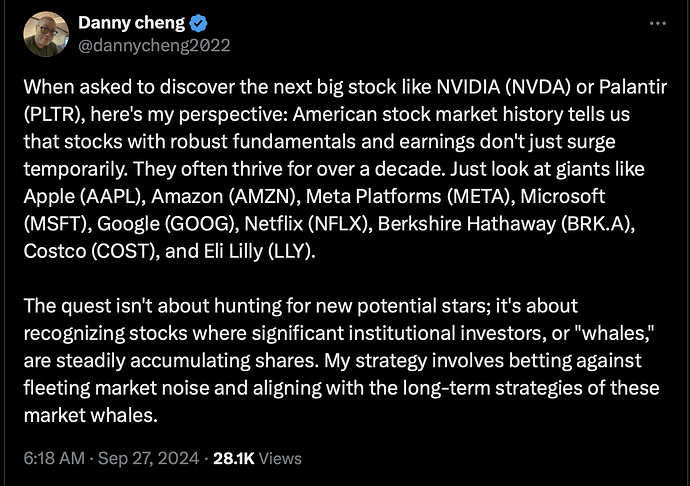

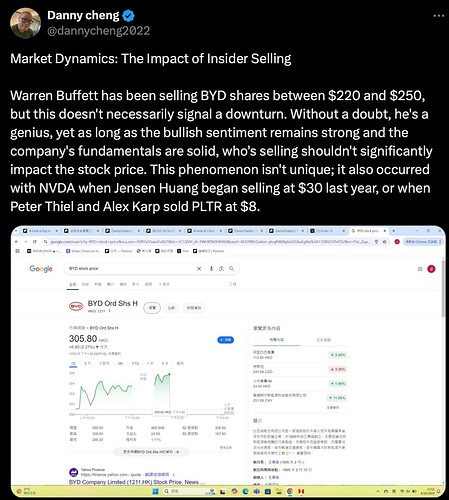

In addition to identifying whales accumulation, should recognizing the East Wind (catalyst/ trigger) for the accumulation e.g. AIP for PLTR, GPU then CUDA then Gen-AI for NVDA.

Currently, many stocks have this pattern.

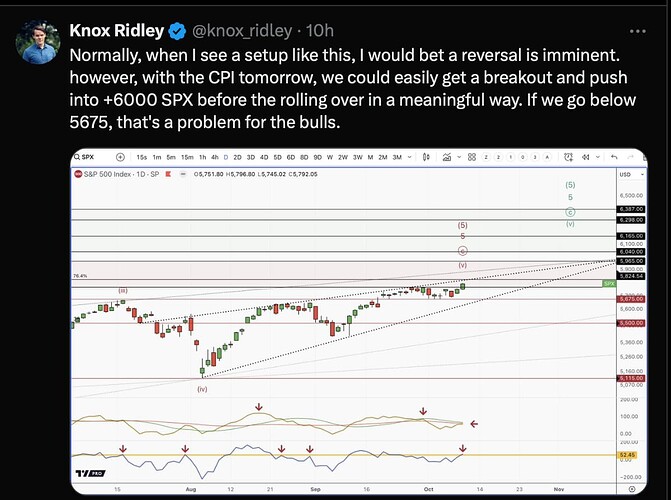

This type of pattern is either 12345 impulse (next wave is corrective) or nested 1-2-i-ii (next wave is a powerful wave iii of 3).

.

Agree with @manch that …

Having said that, not sure you are asking from a trader’s perspective or an investors’ perspective.

As a trader, there are many trading patreons, discords and websites available.

As an investor, the strategy is straight forward. Once you identify an investment quality stock (a stock that you’re confident would rise for more than 5+ years) e.g. NVDA, you shouldn’t trade for 5+ years. BTFD with new money (or proceeds from other less promising stocks in your portfolio). Stocks always correct so you would have the opportunity to BTFD. This year, NVDA offers three BTFD opportunities, dip to $75s, $90s and $100s. An alternative strategy is, ofc, DCA purchasing ![]()

Only investor perspective. I have NVDA with $75 avg. Wanted to see if new quality stocks can be added. Want to FIRE as soon as possible ![]()

So what net worth is your FIRE value?

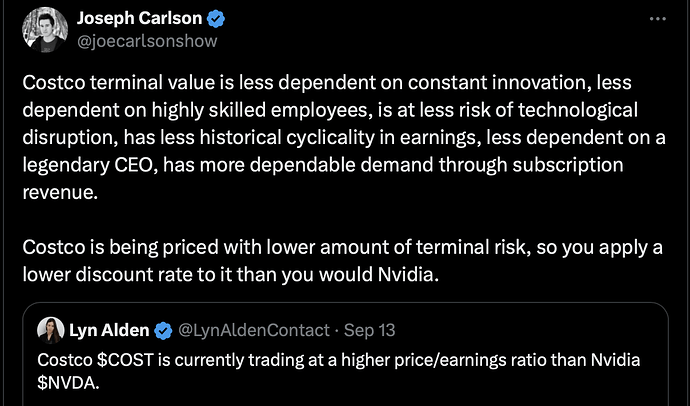

Hottest three stocks in social media. Nearly all investors posting on social media have these three stocks.