Brutally honest view of average traders…

IMHO, market is digesting the huge gain ytd, bull rally is intact. YMMV.

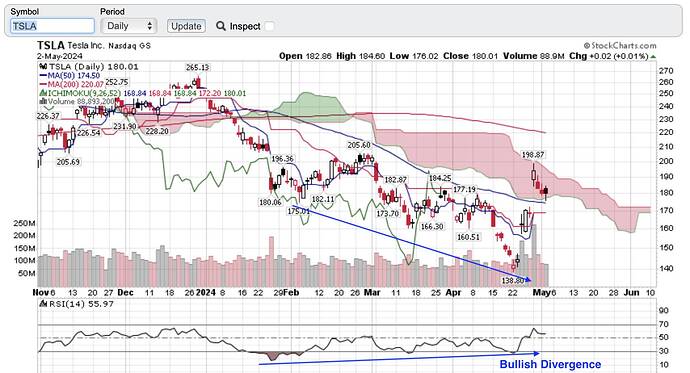

Bullish Divergence is one of the most reliable technical indicator… yet some traders dare to short a bullish divergence or these traders didn’t use TA? IMHO, even if you don’t believe in TA, you need to respect bullish/ bearish divergence.

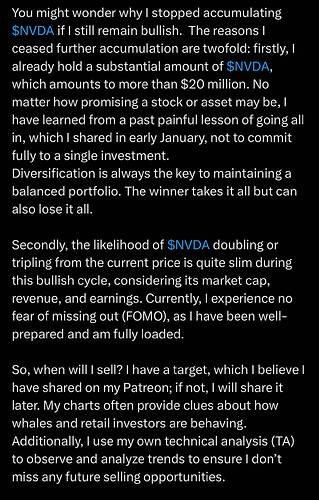

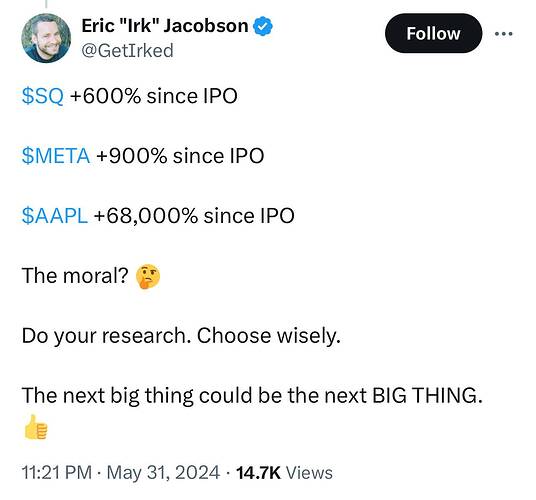

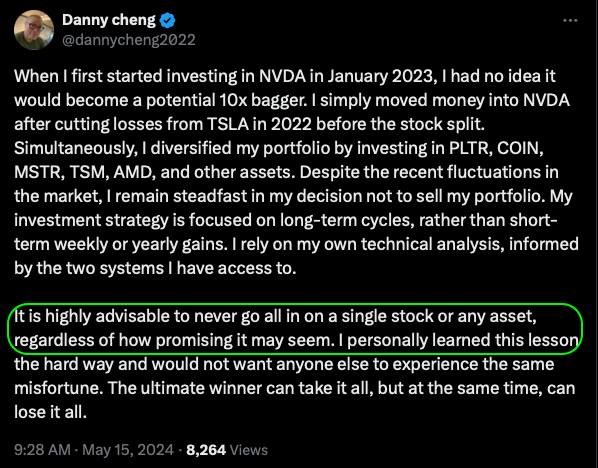

You’ve learnt the wrong lesson. Based on what you’ve shared, your timeframe is only a few years. There are exception to the rule. You can all-in if you fully understand the implication of certain change in fundamentals e.g.

Release of iTunes for windows for AAPL

Release of Model 3/Setup of Shanghai factory for TSLA

Release of GPU/CUDA for NVDA

Release of AWS for AMZN

Migration from desktop to mobile Facebook for META

Forward looking (to be proven): Release of AIP for PLTR

Conviction is critical in holding a stock long term.

For example, any buy n holder of AAPL since Dec 1996 underperforms S&P for 6 years…

However, if you hold till today… AAPL outperforms S&P by miles… CAGR appreciation of 30% for 27+ years.

…

First 40 mins is a debate between investor (Vitaly) and trader (Kris). Investor and trader can’t see eye2eye. AFAIK, easier to be a trader when your $ invested is small, need to transit to investor when the $ invested is large.

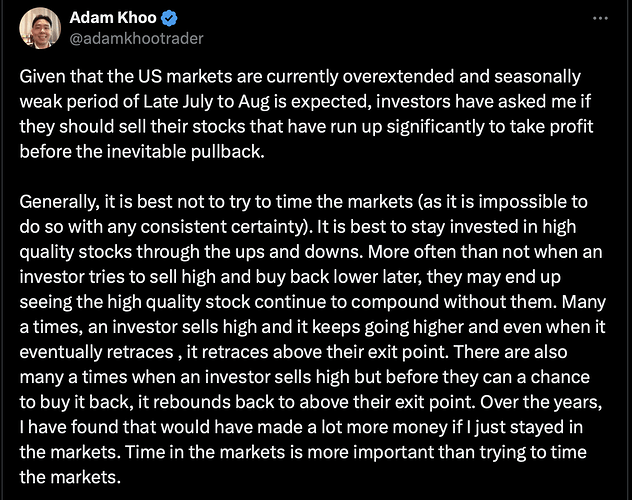

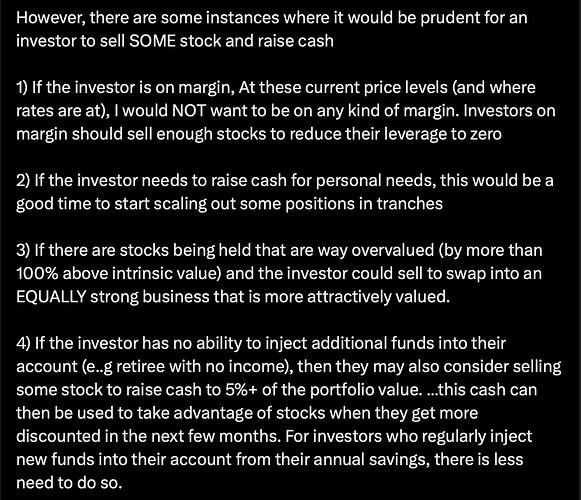

Trimming a solid LT investment is not a good idea. Is difficult to find a good LT investment. Should ride all the way.

Not everything taught in investment 101 are correct.

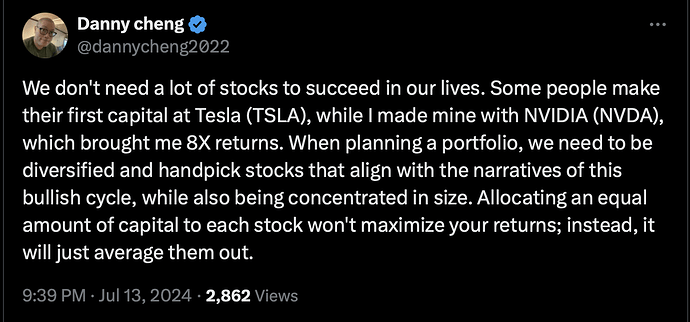

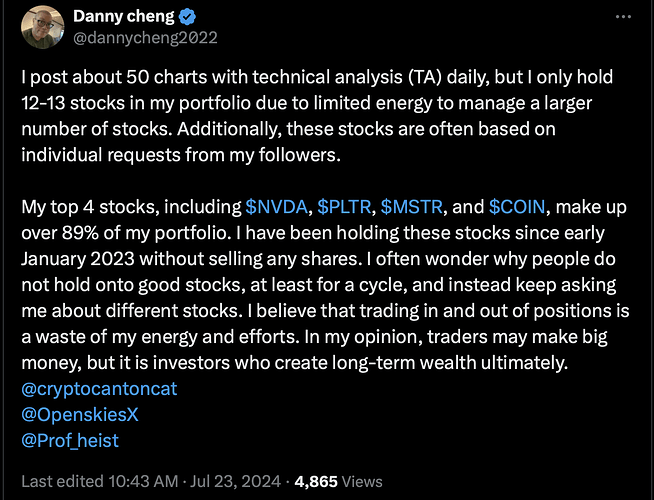

![]() This Hong Kong guy understands investing.

This Hong Kong guy understands investing.

intrinsic value:

NVDA $94-$120s.

AAPL $166

No PYPL, no SOFI and no U.

Disclosure: Didn’t adopt his approach since I already have my own approach that work. However, I think his approach is sound and apparently is beating S&P.

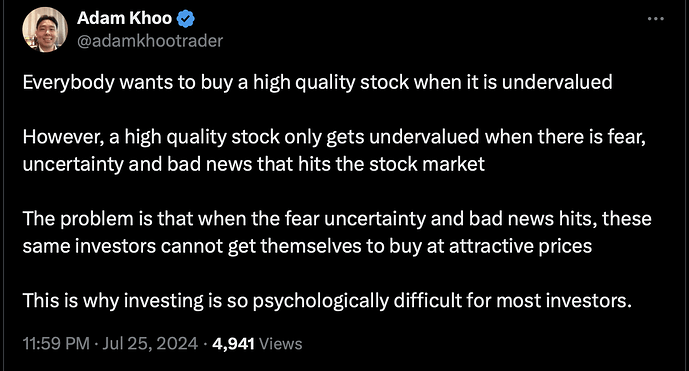

Not to mention losing 20% of accumulated gains to taxes every time you sell. Ouch. Even if you get the timing right.

Adam opines hedging is unnecessary. Same conclusion as me ![]()

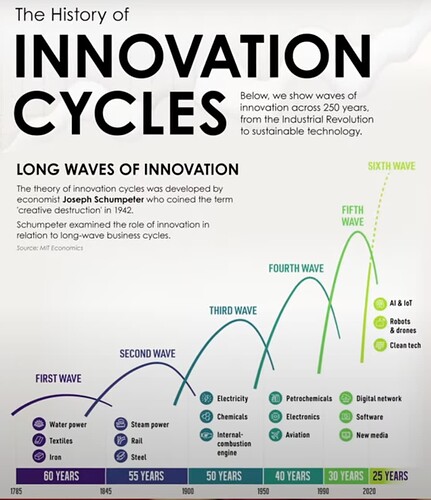

AI & IOT… plenty of good stocks.

Clean Tech … other than TSLA and ENPH, are there any good stocks?

Robotics and Drones… No good stocks.

Concentrated portfolio is the way to wealth growth. He holds popular stocks (AI and crypto) because of his ‘thematic’ approach. He drops TSLA ![]() though.

though.