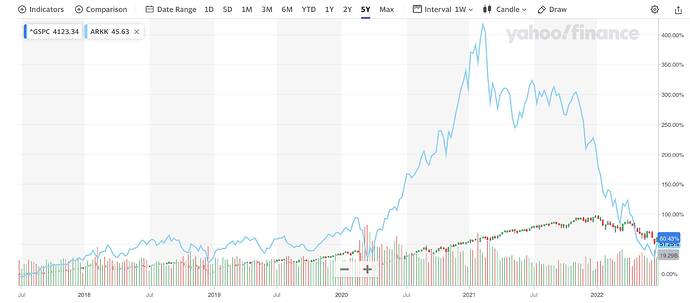

and S&P index.

Studies would claim that return of QQQ is better than S&P. This is true only for lumpsum investment at the start of the five years with no additional investment during the five years. However, a DCA approach which is appropriate for most W2 investors, return of S&P is higher than QQQ.

S&P vs ARKK using DCA, return of S&P is much higher than ARKK, not 9% higher.

My 2 cents : ARKK or any other including BRK holding wrong comparison(SPY) for retailers.

SPY can be compared with QQQ as index ETFs or VGT or AVUV as both spread the risk with more than 500 stocks.

These four are appx equal comparison, in fact risk with QQQ is higher as they hold around 100 stocks.

In this ,over a long term, AVUV ( still early 3 years run) better than VGT better than QQQ better than SPY for investor B&H Or DCA.

Even in correction cycle AVUV amazingly better YTD than other 3 ETFs, that is the benefit of small value caps.

He recommends holding:

Precious metals ![]() Still need to buy stocks.

Still need to buy stocks.

Apple like etf ![]() Prefer AAPL

Prefer AAPL ![]()

Cash ![]() No need to bother with consumer price index.

No need to bother with consumer price index.

Lessons sound good. There are few thousand companies, do you have the time to do DD and qualitative analysis of each business in depth? You need to have a quick way to filter the companies (to spend huge amount of time/effort to do DD) to a smaller number, say less than 10 companies. If you think you have this “quick way”, please tell us. Many of these lessons and advices sound good but not implementable. There are very few people with a stock portfolio that can return higher than DCA purchase of S&P over a period of 40+ years. Are you one of them? If not, just invest in S&P and spend your time enjoy life ![]()

For buy, hold and monitor investors, so long the stock is a secular compounder for 40+ years (20+ for millennials?), your approach doesn’t matter so long you buy. DCA purchase, BTD, buy whenever you have cash, buy using technicals/macros, buy…

How do identify a secular compounder? For a stock, many literature and pundits tell us how to do DD and how to determine the quality. Since time is limited, how to select a few (<10) companies from few thousand companies to do DD? With DD, hopefully narrowed to only ONE.

Possible steps?

a. Since we’re techies, choose tech stocks?

b. Choose based on CEOs e.g. founder-CEOs, well-known CEOs e.g. EM, CEOs from FANGMANT?

After DD ![]() my final choice is AAPL

my final choice is AAPL

@wuqijun choice is AAPL TSLA

Usually, each bull market is lead by different leaders. That means we should pick new investments each bull market. It’s exceptionally rare for a stock to be a leader in two different bull markets.

.

That’s the theory. How to tell the duration of the bull market? There are many disagreements when a bull market has started and ended. Let say the bull market has ended, when did it start? Mar 2020? Mar 2009? What I mean is hard to implement.

Say I use 20% decline from ATH as end of bull market, hence bull market has ended, we are waiting for the next bull market to start. Are there any newly listed tech companies? From existing listed tech companies, who are better than Elon Musk?

After determining the strategy of DCA purchase into S&P and buy/hold/monitor AAPL, I keep reviewing the strategy but couldn’t figure out a better strategy. I have a stock portfolio of high growth stocks for speculation/ keeping up with current development/ potential AAPL replacement.

20% decline is usually the end of the bull market. Which means we should be starting a new one soon. The odds are the biggest winners going forward won’t be the biggest winners from 2009-2022.

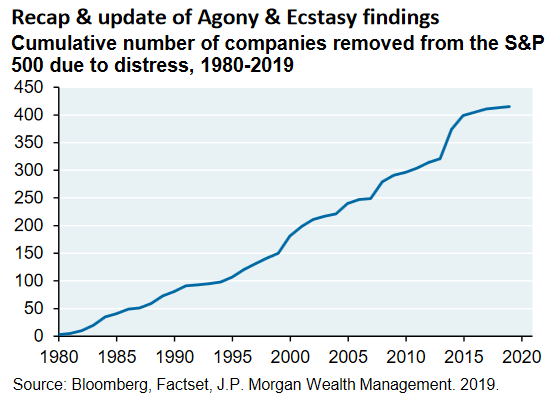

SPY is constantly being rebalanced and membership updated. Just look at this graph.

Looking at 30 years of history, over 80% of the companies in the index have changed. The index doesn’t go up over time, because a static set of 500 companies goes up. It goes up, because they are constantly removing the losers.

.

Is so hard to time the buying and selling of the chosen stocks, withstand the ridicule and remain convicted? to the chosen stock. Is much easier to just DCA purchase or BTD of S&P. Or once you have the chosen stock, why bother to sell unless there is a serious deterioration of fundamentals. The error of timing the buy/sell of the chosen stocks might not be worth selling the one in your hand.

The vast majority of stocks will eventually have a deterioration of fundamentals.

.

But we are not buying the vast majority. We want to buy the “few”. For this impending bull market, can you list out the possible five stocks that might be worthwhile to hold for 20-40 years or till the end of bull market?

I think end of bull market is more likely, because each bull market is lead by different factors. That’s why it’s so difficult to be a leader for 2 straight bull markets. Apple is the only PC company that successful made the transition to mobile devices to lead twice.

I’m working through making a list now. I want to wait until this next round of earnings to get a better view of who’s still growing post-covid.

Only very few stocks supersede SOXL or TQQQ from bearish bottom to bullish ATH !

It is very hard to find the winner from individual stocks unless fundamentals analysis + proper DCF is made.

Otherwise, every guess is like head & tail throw !!

It’s hard enough to pick a leader in one bull market. To be able to do so consistently would be almost impossible.

Good news is you don’t have to do that. One good pick is enough. Last bull market I saw my TSLA investment grew more than 30x (from $500k to $15M). Now all I need to do is just to stick with TSLA from here on. I don’t need TSLA to grow another 30x because of my hefty starting value this time around. A mere 5x to 10x is good enough with this next cycle. And the cycle after that, I need even less. Maybe a mere 2x will do.

.

15 x 10 x 2 = $30M ![]()

Moreover, you don’t need it but many new TSLA investors need them. Check YouTube and Twitters, many are talking about 10x to 100x.

Anyhoo, 20x = $15T, very hard unless Fed will QS in the future, no guarantee.

I didn’t do that for AAPL. I doubt @wuqijun did that for TSLA. What is needed is intuition ![]() and plenty of luck

and plenty of luck ![]()

![]()

I believe many investors that use FA + DCF have sold AAPL from Oct 2018 to early 2019, and didn’t buy back.

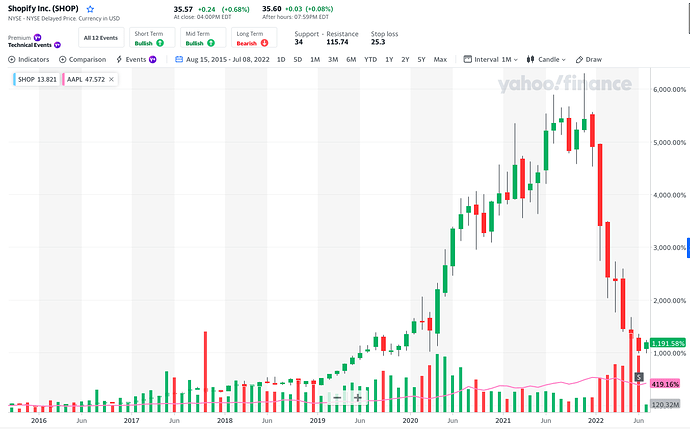

AAPL vs SHOP

At which point, using FA+DCF, would an AAPL investor decides to switch from AAPL to SHOP? When would he sell SHOP using FA+DCF (not don’t fight the Fed principle, those who use Fed would have sold in Nov/Dec).

Price of SHOP vs AAPL from IPO of SHOP on May 15, 2015

Have you bot on IPO and held, 3x return over AAPL

Have you DCA purchase SHOP, return would be less than AAPL using similar DCA approach.

.

![]()

![]()

![]()

I presume is a list of stocks that fulfills the following…

I have SHOP, SQ and TOST. Hopefully they are in your list ![]() SHOP was one of the leader in the previous bull run. Still can run?

SHOP was one of the leader in the previous bull run. Still can run?

Many restaurants are using robots, didn’t check the brand of the robots, will try to check. I do know, most of them use SQ and TOST.