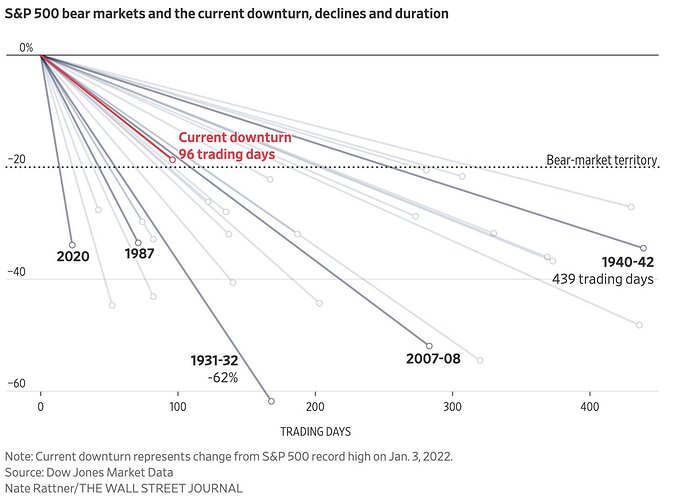

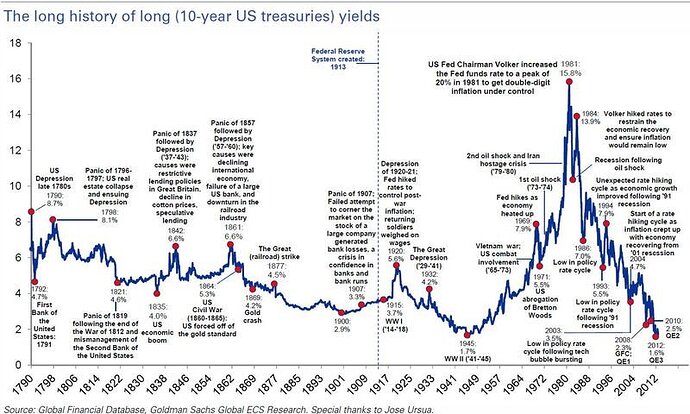

I was talking about generational bear market in sync with Panda last year. Am I a year too early?

Haven’t looked at the EW for a long time.

I heard about this generational bear market from some other author on SA too. I’ll try to find the article.

Extension of a fifth wave is unpredictable. It can keep extending for a long long time. For a cycle degree i.e. multi-year fifth wave, it means can be a few years to many decades.

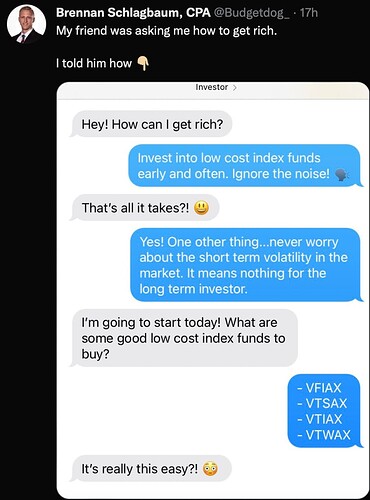

COST ![]() Won’t buy at today’s price but won’t sell.

Won’t buy at today’s price but won’t sell.

COST >> AMZN, @manch, right?

If I can get in COST, I won’t buy from AMZN, HD, TGT, HMART

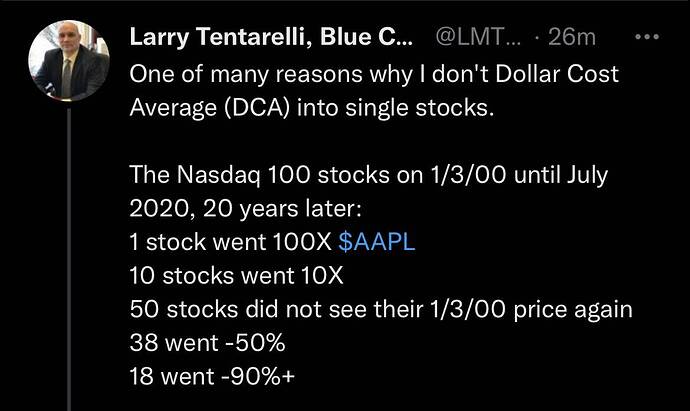

That is, if you are still holding cloud stocks, you probably won’t make any money ever unless one of them is of AAPL quality.

For investors (not traders),

Leadership and corporate culture.

Tips for investors,

Companies listed are relatively new compare to AAPL and MSFT. I want to find the next AAPL MSFT💰

"Apple earnings were juiced by stimulus,

Amazon was greatly helped by lockdowns, and

Nvidia had to settle with the SEC for not properly disclosing how much of their business was tied to crypto mining.

Google is the best buy on this list, they might see an ad slowdown, but they’re such a cash cow that they’ve got the best long-term chances for solid growth.

Meta is cheap too but has more problems.

Microsoft is a great company but the multiple still serves to cap your upside.

And Costco, Amazon, and PepsiCo are all likely to see inflation pressures."

Logan Kane article is too shallow. You can’t base investment decisions on projected P/E only.

His comments on mega caps are opinions/ assertions with no supporting evidence.

Averaging into QQQ over 12 months is a viable investment approach.

Again I am crossing my lane!

Warren buffet team bought 15% of PARA ( old Viacom cbs) at $26.44 lowest on May 12 , almost 75% of its peak price !

He dropped completely VZ

He bought Citi getting rid of WFC

He is again looking for 4+% dividend buying at deep low day ( at least now )!

Another great investor.

Walter Schloss

Wow, it’s been a long-time since I saw someone reference book value.

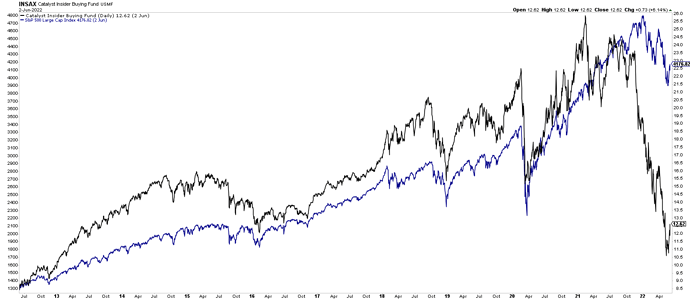

S&P 500: 11% over 40 years = 65x

Growth Portfolio: 20% over 38 years, loss 75% over 2 years = 64x which is less than 11% over 40 years

S&P > Growth Portfolio