I always laugh at these bull sitters. If someone has cracked the perfect formula to beat markets, why would they share their formula with the world so every copies it and it stops working, or why would they brag about it so one day they get shot or kidnapped. Its hilarious at best. These psycho, pathological crooks. Charlie Munger dresses down these quacks very well.

.

He didn’t share the details. Too broad for any one to copy.

Now and then, traders are able to crack the codes but usually work till the market changes the code. The good ones should be able to adapt accordingly.

Very few people have been able to consistently beat market, and they normally are Billionaires. In every Casino there is a winner everyday. That does not mean he or she is an expert investor gambler. They are simply the clown of the day.

Here is another Crook: https://www.investors.com/etfs-and-funds/etfs/cathie-wood-loses-money-on-every-stock-she-owns/

^^ She lost her investors so much money that she should be tried like SBF. Not much difference between the two. Ironically she is a woman and woke media still gives her some limelight. A man loser like her would have been crucified.

It is not cracking the codes, but getting some kind of clue where market leads. Many say algorithms, but they may have some kind of calculators to find the market inefficiency. It all depends on what we have in the logic.

Winning every trade is not possible, as we make errors and even algorithm has noises/errors, but consistently making growth is possible.

In my view, Chicken Genius spotted downfall ahead, shorted and then bought it. This definitely needs skillset, some code help without which it is impossible to beat against the market. If the algorithm is working, no one will sell it but use it forever.

.

Suma suma.

On the Greenlight platform, which caters to families, kids under 18 invested $13.4 million in 2022… The most popular buys, in order: Apple AAPL, Vanguard’s 500 Index Fund ETF VOO, Amazon AMZN, Tesla TSLA and Microsoft MSFT.

These same picks were mirrored at Stockpile, a similar platform that allows investing accounts for kids…The top picks for kids in 2022 were: Apple, Tesla, Amazon, Disney DIS and the same Vanguard S&P 500 index fund.

Gen Z kids are ![]() VOO and AAPL

VOO and AAPL ![]()

Securities Analysis 101.

DCA purchase (with DRIP) any S&P index fund/ ETF for 20+ years and has return beating 99% of investors.

See my PM ! I do not want to discuss this public as many haters are there !

I mostly post here asking for help, so let me, for once, also contribute something…

In the history of US stock market, there has been only one trader that I truly admire. This guy is a math genius and cracked the code to making money in stock market. Truly. Made more money than you can imagine! Very unique situation. In fact, I don’t know of a single other trader who has been successful consistently. There are investors like Buffett or Soros but no other successful algorithmic traders. Most hedge funds just do long-short balancing.

I’m going to reveal the name of this genius soon (big hint - it’s not me!) but let me first give the lessons I took from him. That guy is smarter than pretty much everyone living I know of, and I do know pretty smart (IQ and $$$$-wise) people. But, that’s not enough.The guy still needed tens of smartest people in the world to help him. He essentially created “AI machine learning for stock trade”, 30 years before the term “machine learning” existed. Even then, he ran out of “market capacity” and cannot take any new clients. He doesn’t speak much publicly. Over last 50 years, may be 5 interviews. His life has been sad lately, lost 2 sons in random accidents.

Obviously, I am talking about Jim Simons of Rentech, worth $25B. Watch A conversation with Jim Simons: Mathematics, Common Sense and Good Luck - YouTube and decide for yourself what it takes to be successful in trading.

Merry Christmas everyone!

Principles of Jim Simons

- Be guided by beauty e.g. AAPL is well organized and managed.

- Surround yourself with the smartest people. SJ’s idea. Unfortunately I’m not smart enough for them to work for me.

- Don’t run with the pack. Original thinking. I’m too dim so can’t do.

- Don’t give up easily. Easy to say, how do you know is not pushing towards the apex of a cone.

- Hope for good luck. Most important

So don’t do algorithmic trading… violate principle 3.

Principles are useless for most of us. Can’t do. Only principle 5 matters anyway. That’s what I believe in. Luck is the only thing that matter.

This is why I am not a stock trader. Luck matters most.

Investing in stocks is like playing checkers. Investing in RE is like playing chess. In RE investing you are the boss. You control the outcome. With stocks you place your bets and hope for the best.

You have no control no influence no insider information and often no clue. RE gives one an opportunity to control your own destiny. Be your own boss. Add sweat equity, pick your location.

Pick your tenants. Make your own mistakes or opportunities.

Best investment is your own home. After that it’s about risk tolerance and luck. At least with RE you can have some influence on the outcome. With stocks for most people it’s best to stick with an index fund DCA and just leave it in an IRA till retirement… best for the risk adverse.

Trading is for professionals and relies too much on luck for my taste.

For an algo to work, it needs to lead the pack not run with it. The gains are from buying assets before others start to buy them. It’s similar to Buffet’s buy when others are fearful.

With my temperament, I may not successfully continue here, this creates agitation, hate and jealous, skpetism and some times evil ideas.

On the whole, it is not helping me learn anything from here and decide to leave finally. I could have vanished silently like ptiemann, but people will be floating that this trader JIL lost money, not coming back and preech their wrong concept.

What I found is an innovation, a rare one. and will be successful in future - rest assured.

The reality is stated here, this is the key for success.

There is no one solution fits for all. You believe in luck and I beleive in my own luck but in different ways (may be entirely opposite way)

Well wisher,

Today is a special day and I decide to leave this blog on this day which will help me grow further.

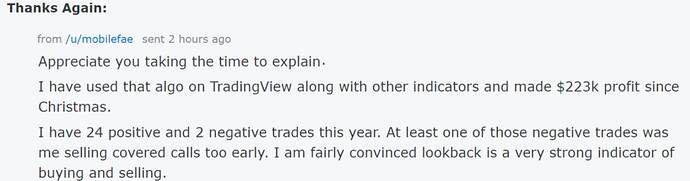

I started coding on Dec 26, 2017 very first time, found Market peak Jan 26, 2018 saved money, found bottom Feb 8, 2018. This is the time I was asked “Do you have crystal ball? Where is your crystall ball?” by few persons. I renamed my project as “CRYSTAL”.That was very primitive logic, however found again top Sep 29, 2018 saved all stocks to cash. Completely rewritten entire code base by Dec 25th, 2018 and found previous day was bottom after 19.8% drop. I bought heavily https://i.imgur.com/bZcjztM.png beliving my algorithm. I helped one unknown person during 2018 for testing my algorithm and see his response. He is the first one confirmed it is working. That person left reddit afterwards.

Later, I found peak in Dec 2019-Jan-2020 moved out to cash and found bottom 2022. All these were running good logic, but still lack accuracy.However, Nov-Dec 2021 was classic, found beyond doubt market peak and came out of market. The accuracy is almost 80% level. This recession cycle gave me enormous data points and experience how to move through stressful market recession and the accurancy is greatly improved to 90% or beyond.**I may not be like Jim Simon,he is too big and I am not even 0.01% of him, but I will be a successful trader on my own.**I need to get out of this blog so that I grow further. Thank you all and Good Luck to you all.

Please no upvote and do not respond (even through PM). This is once for all final decision as this is special day for me as this is the BirthDay/Confirmation day of My Algorithm.

We will miss you. I hope it wasn’t our resident troll that made you quit. I stay on here for entertainment only. I don’t take the jabs seriously. After all everyone is anonymous and therefore meaningless.

Jil, best luck to you! We all pursue our own path. Many years ago, I was doing algo-trading myself, consistently making small money every day but I couldn’t scale it and soon after lost interest.

May you make tons of money and tell story of this forum! Remember every large tree was a small seed once.

Curious. Why can’t scale?

I was exploiting price arbitrage between a few stocks and their option prices. These stocks were not the Fortune100 type companies, rather the small ones, because that’s where my simplistic algo could find the arbitrage. To make $1, I needed to trade $1000 of stocks. At some point, I started to move the stocks with my own trades (since those were small companies).

All algo traders hit this limit… Jim Simon cannot take new clients because as is, his hedge fund does like 20% of all NASDAQ trades.

Unlike others who find undervalued stocks ahead of market, I was always staying neutral. Purchase one security, sell the other. So, it was a near certainty that I would make money. Because of that, it’s even harder to scale this class of algorithms. I had a day job too and at some point just moved to other things…

.

True for both traders and investors, and for all stocks. Is why billionaires prefer buy n hold ![]() and borrow against their holdings for living expenses and new ventures. EM did that initially, couldn’t do recently because of high interest rate and expectation that TSLA would tumble so is more worthwhile to sell.

and borrow against their holdings for living expenses and new ventures. EM did that initially, couldn’t do recently because of high interest rate and expectation that TSLA would tumble so is more worthwhile to sell.