In any 40 years period, DCA purchase any S&P index fund/ ETF trounces BTFD at major S&P bottom.

Historical return of S&P = 7-11% (with DRIP). In 40 years, worth is 65x.

It’s interesting there’s only 1 example of multiple down years in a row. That should mean to buy big now, because it’s very unlikely this will be a down year.

Yes go all in. Well May be you are already are all in if your words and actions match.

Just a word of caution. Any study based on S&P is only true for S&P. People always try to extend to individual stocks, in reality, most of the time is not applicable. Many studies show that DCA purchase of S&P beats nearly all forms of investment strategy over a period of 20+ years. 40+ years, confirm beat.

Each bull market usually has new leaders vs the prior one. The key is identifying leaders for each new bill market.

.

Come across this often but have not delved into what the statement means.

New leaders are not new companies, right?

Can be companies around for a long time, right?

Are leaders those start the bull market or those gain the most or those that make new ATH?

Start of Bull market is marked by S&P right?

I don’t think age of the company matters much. Dominoes pizza crushed it last bull market. They’ve been around decades. Leaders are the companies that make the biggest gains during the bull market. I’d define the bull market by S&P.

I would just buy the broad indices for now. If some individual stocks jump out as attractive that’s great as a side-bet, but the easiest play is to leverage into US and international indexes.

.

Do leaders need to be around at the start of bull market? Can they be listed a few years later in a 12 year long bull market?

It’d be interesting to look at that. My hunch says they are companies who’ve been around a bit, then they hit high growth during the bull market. Most companies don’t take off right after going public. It’s especially difficult now given the insane private valuations. I think of the recent bull markets as:

Pre-dotcom

Post-dotcom to Great Recession

Great Recession to Now

I’m not finding any articles that show who the big winners of each bull market were. It’s all stuff on picking winners for the next bull market. I’m sure there’s research out there on it though.

Both TSLA and META are listed after the Mar 2009 bottom.

Trading is gambling… hardly a business except of course for people making money off of traders

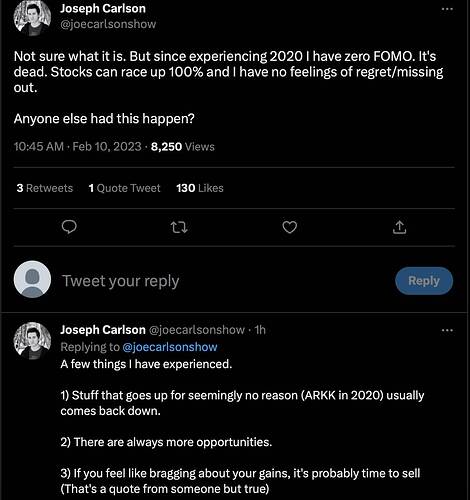

Carlos tells a story about why buy n hold and DCA purchasing is superior than Kris market timing. No puts. No hedging. Caveat: Has to be a fundamental good company with products many people use daily.