I have only believe in RE. Can be as Primary, vacation or rental. Can be improved.

He have invested the proceeds and made $3M ![]()

Smart!

Zillow Home Value Index comparison as of today

Mountain View: $1,980,865, 10.5% 1-year change

Sunnyvale: $1,937,805, 15.9% 1-year change

Los Gatos: $2,431,241, 19.3% 1-year change

Cupertino: $2,648,706, 19.7% 1-year change

Saratoga: $3,458,707, 21.5% 1-year change

Palo Alto : $3,488,610, 13.7% 1-year change

Los Altos: $3,867,679, 18.9% 1-year change

Los Altos Hills: $5,084,630, 14.1% 1-year change

Can you folks predict where we go from here?

Not consistent with your list. Typo? PA or MV?

This is based on Zillow. You are right in this list least loved is MV. However, what i have noticed though is that Los Altos and some parts of Mountain View closer to Los Altos are hotter than some parts of Saratoga… Like the following:

https://www.redfin.com/CA/Saratoga/20400-Williams-Ave-95070/home/1791029

https://www.redfin.com/CA/Saratoga/19801-Braemar-Dr-95070/home/1231140

Los Altos…

Big lot + Big house = BIGG price

Great for SB9 lot subdivision.

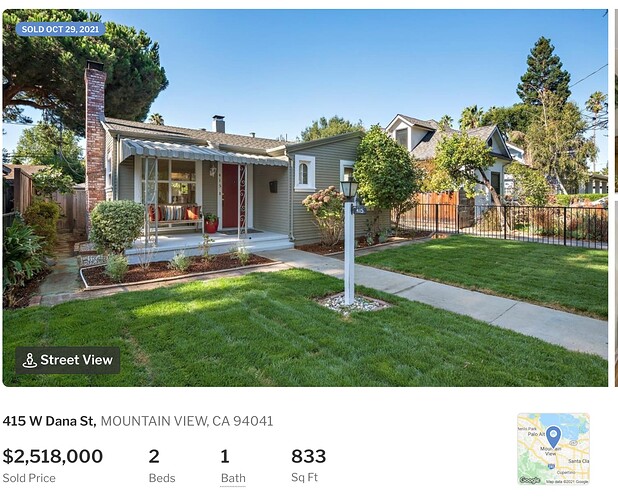

Mountain View prices going nuts …

Why you care? You stopped buying properties since 2016

I hope to one day get back on my horse again…

You’re gonna be priced out. The rent increases of your SF properties can’t keep up with price appreciation in RBA.

$3M is 50 bitcoins. Can definitely afford one when it costs only one coin in 5 years.

@manch are you saying that the same house which costs 50 Bitcoins today can be bought for only 1 Bitcoin in 5 years. That would imply that a typical Bay Area house would lose 98% of its value in the next 5 years. That does not sound right to me…

I think manch is saying even though a typical bay area house will increase in value from $3M today to $30M in 5 years, a single bitcoin will also rise in its value to the same $30M amount.

The market is going even more crazy …as soon as it open up in January the same madness is expected to start

This is absurdly hilarious ![]()

![]()

![]()

![]()

![]()

![]()

The typical RBA house that costs $3M today is likely to be valued at ~ $4M in 5 years time - that’s a 33% increase or about 6% annually which is consistent with long term appreciation.

It will NOT be worth $30M in 5 years.

Neither will 1 BTC be worth $30M in 5 years. It will not be worth $5M or $1M, or even $500k in 5 years.

If lucky, 1 BTC may be worth $200-250k in 5 years.

The real question is what will the dollar be worth in 5 years? Inflation is eating away the value of the dollar and driving people into nutty investment vehicles. At least RE is tangible. The rest is virtual crap.