RE is usually long-term. You can potentially score big with leverage in forex in a matter of days.

tell us what you did, or it didn’t happen.

I don’t trade forex much these days…not enough volatility. And I am not aggressive enough to opt for max leverage

That’s why I stay away from currency. Investment is never a matter of days. It’s usually years. Anything that’s done within a matter of days qualify as speculation only. As always, I’m an investor, not a speculator.

Forex is never an investment because nobody holds onto their positions for an extended period of time. People usually hold for days-weeks only.

Nothing beats stocks and real estate when it comes to building your net worth. Just ignore all these distractions and concentrate on your core.

I hold forex for decades. Holding tons of sing

Should have converted those into AAPL instead.

Don’t make cry. 100 folds more.

Yoda don’t turn into a grandpa. Buy more Austin rentals with your SGD.

Buy Fang, ant, and bat instead.

Apple: 932.8B (+13.3% !!)

Amazon: 767.1 (+0.6%)

Microsoft: 731.1 (-0.9%)

Google: 728.5 (+1.5%)

—> Gap: 217.3 (+1.5%)

Facebook: 511.2 (+1.6%)

Alibaba: 485.3 (+6.6% !)

Berkshire: 480.9 (-1.2%)

Tencent: 463.6 (-1.6%)

Apple and Alibaba rocketed up after earning. Not much change for the rest of the gang. Tencent is now dead last and continues to sink.

Today? $165.70 B difference.

$67.2B from $1T ![]()

Will Apple be the first 1T company?

That depends on WB and TC. If TC spent the buyback first, then no. If WB continues to buy AAPLs, most likely.

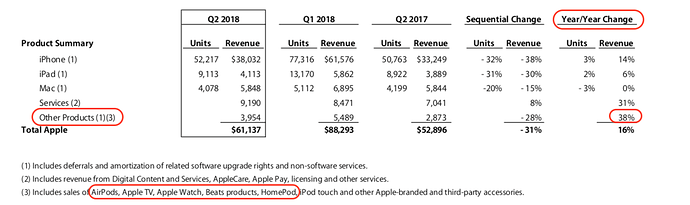

I still find little to like in Apple’s earning. iPhone units are going down but they are selling more expensive phones so rev is up. They are also milking their existing customers more in services. iCloud storage should have been free but they charge you an arm and a leg for it.

Call me biased but that looks like they are mortgaging their future. They better have some blockbuster products in pipeline.

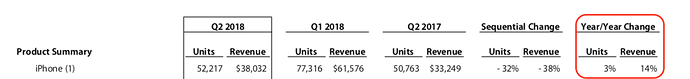

Both year over year unit sale and revenue have increased.

Apple doesn’t sell you like FB and Google to fund the iCloud. You get what you paid for.

Already here. AirPods, Apple Watch and HomePod. Revenue grows 38%.

Ok. iPhones units increased 3% yoy. That’s flat not decreasing. Yet.

You see things to like. I don’t see much. That’s fine. We invest in different names.

You want high growth. I merely treat AAPLs as passive income stream. Totally different goals. Usually that mean different stocks.